Seven Variables to Determine Success in Legal Cannabis Cultivation

27.7 Million Pounds of Legal U.S. Cannabis to be Cultivated in 2030; 20 Million Pounds More Than 2020

September 7, 2022

Dr. Amanda Reiman Named Chief Knowledge Officer at New Frontier Data

September 13, 2022By John Kagia, Chief Knowledge Officer, New Frontier Data

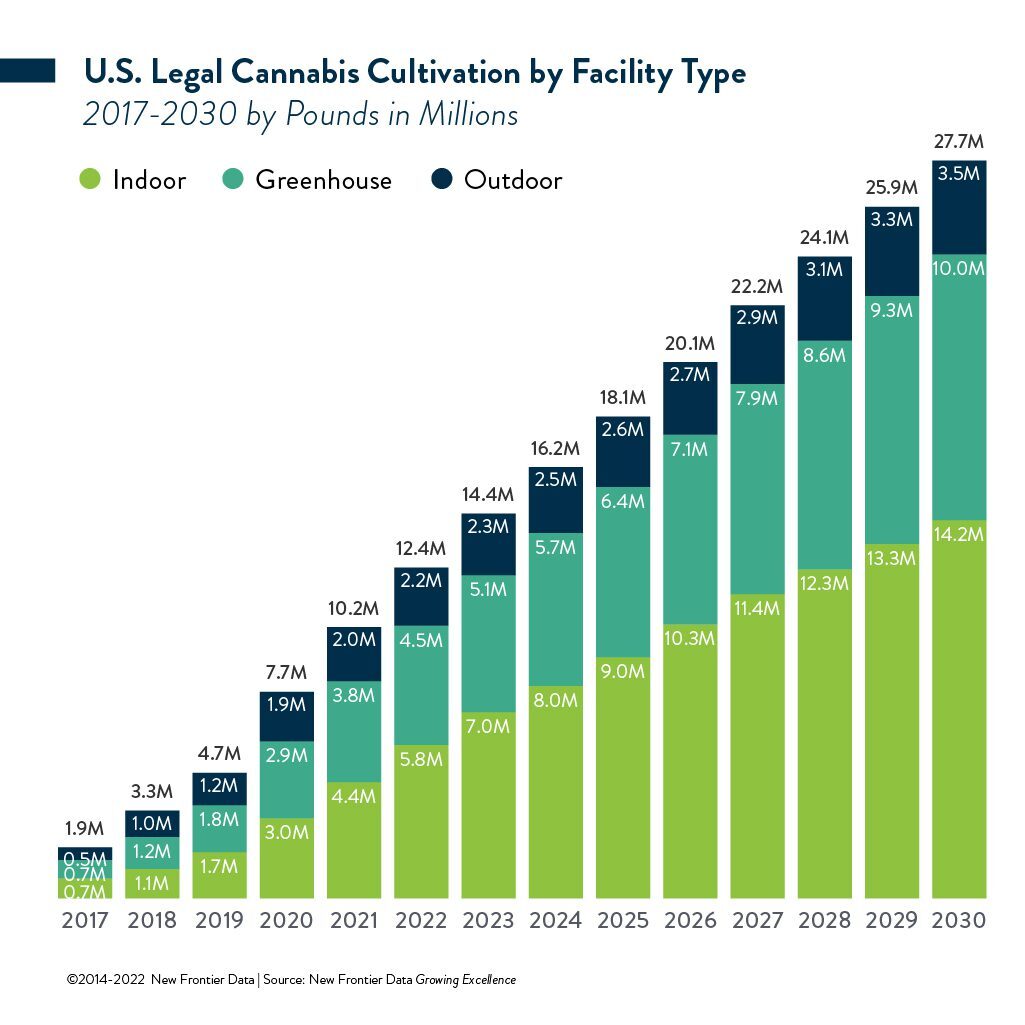

Legal cannabis production in the United States is poised to grow dramatically with the launch of newly legal markets in the East Coast and Midwest. Between 2022 and 2030, programs starting in Florida, New York, New Jersey, and Virginia will collectively account for one-quarter of the legal cannabis produced in the country, underscoring the scale of opportunity emerging in those states. Nationwide, legal cannabis demand is poised to explode, growing from a projected $31 billion in sales this year to $73 billion worth in 2030.

As the activation of new markets in the legal cannabis industry transitions eastward from West Coast markets, several factors will impact how cannabis is grown. Such shifts are already forcing cannabis growers to rethink how to cultivate their plants.

Cannabis growers will need to address the same issue threatening to disrupt the wine industry and other agriculture-based enterprises: new weather patterns brought on by climate change. Different climatic conditions will favor controlled environments over outdoor cultivation, given either the length and depth of winters in the North or summer humidity in the South.

Strained, aging electrical systems will make energy efficiency an even greater priority for growers reliant on the grid. Odor control will be imperative for producers in the country’s most densely populated regions, and cost competitiveness will be critical for legal markets competing against those states’ sophisticated and highly efficient illicit markets.

Shorter growing cycles will precipitate a need for growers to get their plants from seed to sale before increasing risks of early freezes, fires, or floods. Conversely, some cannabis strains will prove themselves better suited for locales where they did typically grow.

In anticipation of a nearly 39% increase in harvested cannabis from 20 million pounds in 2020, to 27.7 million pounds in 2030, New Frontier Data (in partnership with Surna Cultivation Technologies) is offering a free report, Growing Excellence: Seven Ways to Optimize Cannabis Cultivation in Newly Legal Markets, examining the fundamental variables which producers must consider as they determine whether to build or upgrade facilities to serve the newly expanding markets.

By basing their strategic plans around the seven key factors identified and detailed in the report, operators can capitalize on the massive market opportunity coming to bear.

LOCATION

Location significantly influences tradeoffs between indoor and greenhouse facilities.

AUTOMATION

Automation is changing the game, but also increases the imperative for having the right people managing the system.

BUILD OR BUY?

Whether to build or buy depends on at least four key variables about a facility’s performance.

DEMAND FOR VALUE-ADDS

As demand for value-added products surges, production will increasingly split between cultivation for smokable flower and for extraction.

RESOURCE EFFICIENCY

Resource efficiency is an increasingly important competitive differentiator.

CLIMATE CHANGE

Climate change will have increasingly consequential impacts on cultivation environments.

FUTURE PLANNING

Plan for where the market is going, not where it currently is. Federal legalization and reforms could drastically minimize the carbon impact of the burgeoning industry nationwide. Sun-grown, greenhouse, or warehouse-cultivated cannabis from the West Coast could supply consumer demand from coast to coast, much in the way that California farmers supply 90% of U.S. demand for strawberries and tomatoes. Meanwhile, geographical differences may spur interest in differentiated craft and regionally produced products.

Opportunities which market growth presents will not be uniformly distributed, as the most efficient and differentiated producers will be positioned to lead the space. Costs will be a key determinant of future success, and increasingly crowded markets will compress wholesale prices and drive competition for shelf space in a fragmenting product landscape. Still, such changes represent immense opportunity for those growers who are able to minimize their production costs (especially for labor, energy, and water) while differentiating themselves whether based on cost, quality, or the novelty of their genetics.

While producers in new markets may enjoy a period of high margins and low competition, the most successful operators will be those who plan for where the market is headed, not where it already sits.