Sinking Into a CBD Skincare Market Projected Worth $7.6 Billion by 2029

Beauty May Be Skin Deep, But CBD Skincare Market Looks to Grow 8x by 2029

November 29, 2022

Normalization Turning from Holiday Specials to Business as Usual

December 6, 2022Skincare represents a $136 billion global industry, with a $17.6 billion (nearly 13%) share of that coming from the United States. The global CBD skincare market was worth an estimated $953 million in 2021, with projected growth of nearly 8x reaching toward $7.6 billion by 2029. THC topicals — which currently are subject to more difficult regulatory processes than is CBD — are projected to reach a $420 million market by 2030, nearly tripling their 2021 value of $153 million.

Fundamental questions arise when comparing differences between cannabis consumers and nonconsumers regarding their skincare behaviors and spending habits. While it may be hypothesized that those already consuming cannabis may be likelier to try a CBD or other cannabinoid-based, skincare product, are there other factors (e.g., gender, age, or skincare purchasing behaviors) to inform predictions about demand for cannabinoid-based beauty products?

Made in partnership with San Francisco-based Purissima, Inc., New Frontier Data’s latest report, Cannabis and Beauty: Opportunities in the CBD Skincare Market uses data from the 2022 New Frontier Data Consumer Survey to dive deeply into consumers’ quantifiable knowledge and use of CBD skincare products, the routines, spending habits, and preferred products of consumers vs. nonconsumers, and the demographics detailing those most interested in such products.

Among key findings in the report:

Cannabis consumers are more aware and engaged with the skincare space. Cannabis consumers are more likely to report having a skincare regimen, buying new products, and spending more for skincare than are nonconsumers. That contrast extends to cannabis consumers’ being more likely to act as early adopters, and to spend money for new products.

Consumers and nonconsumers prefer the same products and use skincare for the same reasons. Since cannabis consumers and nonconsumers reported choosing the same top-three products (i.e., moisturizer, cleanser, and lip balm) and top-three reasons for doing so (i.e., dryness, anti-aging, and fine lines and wrinkles), there may be ways to better leverage those customers’ comparable desires to treat the same skin-related issues, and use the same types of products.

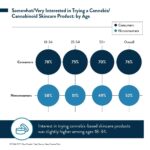

Interest in CBD skincare is higher among men, and younger age groups. That men among both the consumer and nonconsumer groups were slightly more likely to show interest in CBD for skincare suggests that young, male cannabis consumers may represent a ripe target demographic for aggressive brands.

Medical consumers may be a better target than recreational consumers. The non-intoxicating nature of cannabinoid-based, skincare ingredients may appeal to medical consumers whose primary goal is consistent symptom relief.

Register to join us for a free webinar on Dec. 1, hosted by Rob Evans, cofounder and Chief Business & Strategy Officer at Purissima, Inc., and Karen Raghavan, VP of Brand Development. They and New Frontier Data’s Chief Knowledge Officer Dr. Amanda Reiman, Ph.D., MSW, will discuss highlights of the report and their implications for the market. Download a complimentary copy of the report.

About Purissima

Purissima Inc. is revolutionizing the way companies source and use plant-based ingredients through the development and production of commercially viable, microalgae biotechnology. Purissima’s mission is to provide the world access to high-quality, pure, safe, and sustainable ingredients for products to improve the quality of life for millions. Purissima has sustainably and effectively biosynthesized 70+ natural ingredients, including those rare or hard to access, at a fraction of the cost and without adverse environmental, varietal, or supply-chain impact. The brand’s patented and proprietary biotechnology advances critical plant-derived health + wellness solutions while preserving Earth’s biodiversity and natural resources. For more information please visit www.Purissima.bio.

Media Contact:

Anna MacLellan | Autumn Communications

Purissima@nullautumncommunications.com

About New Frontier Data

New Frontier Data is the premier data, analytics, and technology firm specializing in the global cannabis industry, delivering solutions that enable investors, operators, advertisers, brands, researchers, and policymakers to assess, understand, engage, and transact with the cannabis industry and its consumers.

Our mission is to inform policy and commercial activity for the global legal cannabis industry. We maintain a neutral position on the merits of cannabis legalization through comprehensive and transparent data analysis and projections that shape industry trends and dynamics while driving demand and opportunities. Founded in 2014, New Frontier Data is headquartered in Washington, D.C. with a presence in Europe, Latin America, and Africa. For more information about New Frontier Data, please visit us at https//www.NewFrontierData.com.

Media Contact:

Emily Watkins

New Frontier Data

+1 844-420-3882 ext. 3