States’ Legal Cannabis Markets See Strong Growth Amid COVID-19 Disruptions

The Legal Cannabis Industry’s Opportunities to Cultivate Social Equity

July 12, 2020

Brand Preferences Among U.S. CBD Consumers

July 27, 2020By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

One unanticipated effect of the COVID-19 pandemic has been the growth acceleration of legal cannabis markets (and erosion of illicit markets) in those states which have activated both medical and adult-use sales. In 2019, the total combined illicit market for cannabis in the United States was an estimated $64 billion, which through the growth of currently legal markets is projected to shrink some $4 billion by 2022.

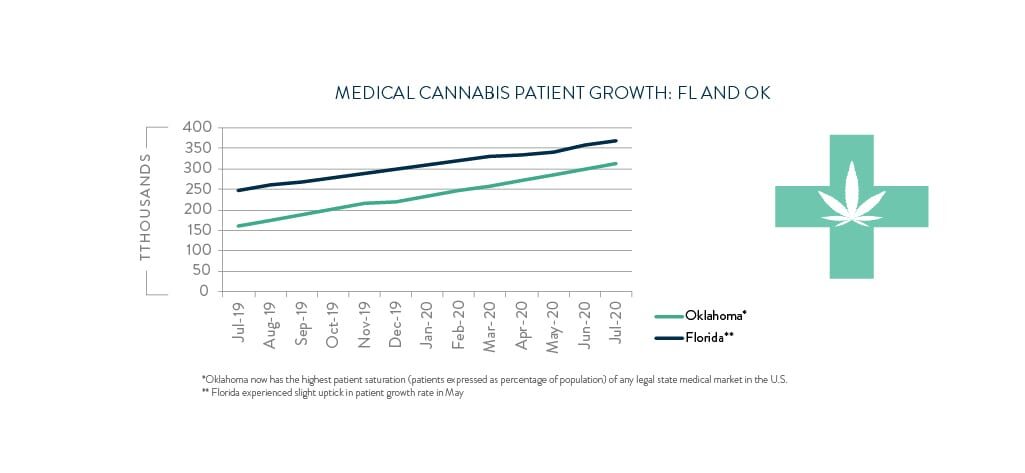

Through higher sales and increased patient participation in medical-only markets, the second quarter of 2020 saw surging patient counts in medical markets – particularly in those having 1) lower barriers to entry (i.e., less restrictive qualification requirements), and 2) more accessible markets (i.e., greater density among dispensaries).

High-Performing Medical Markets

Both Florida and Oklahoma were seeing very strong patient participation rates before the pandemic took hold, and continued those trends despite sheltering-in-place orders effected in April and May, respectively. That the registrations would continue apace (and in the case of Florida, increase) amid the dramatic contraction of broader social and economic activity underscores the strong demand for cannabis in those markets.

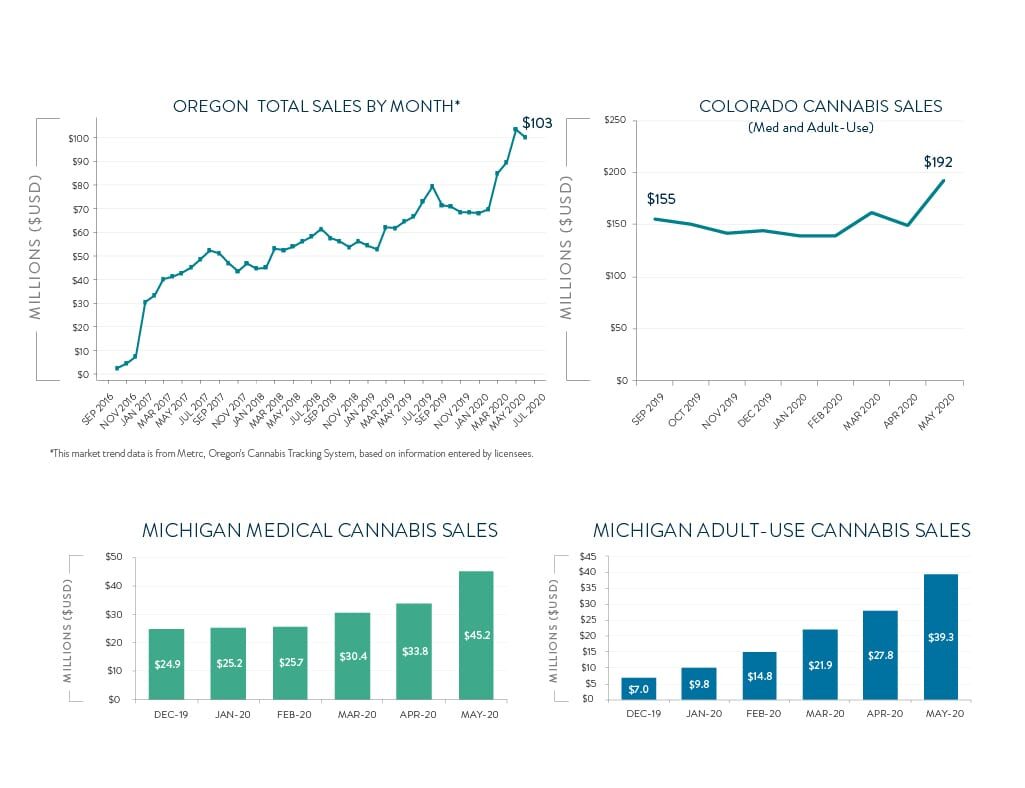

State Data Showing Increase in Sales

While many major adult-use markets (e.g., California) have delayed release of tax data pertaining to cannabis sales in Q2 during the height of the pandemic, sales numbers released out of Oregon and Colorado (the two most mature legal cannabis markets in the U.S.) and also Michigan show marked boosts between March and May.

Oregon saw record-setting sales in March, April, and May (the latter seeing the state generate $100 million in cannabis sales for the single-highest monthly total since the program’s launch). For its part, Colorado (with the country’s most mature adult-use market) saw record sales in May, which neared $200 million for the first time in its program’s history.

Medical sales in Michigan (previously flat between December 2019-February) saw a 48% increase in monthly sales between March-May. Adult-use sales in the state, which saw a strong growth trajectory since before the pandemic, received an additional boost in demand through April and May.

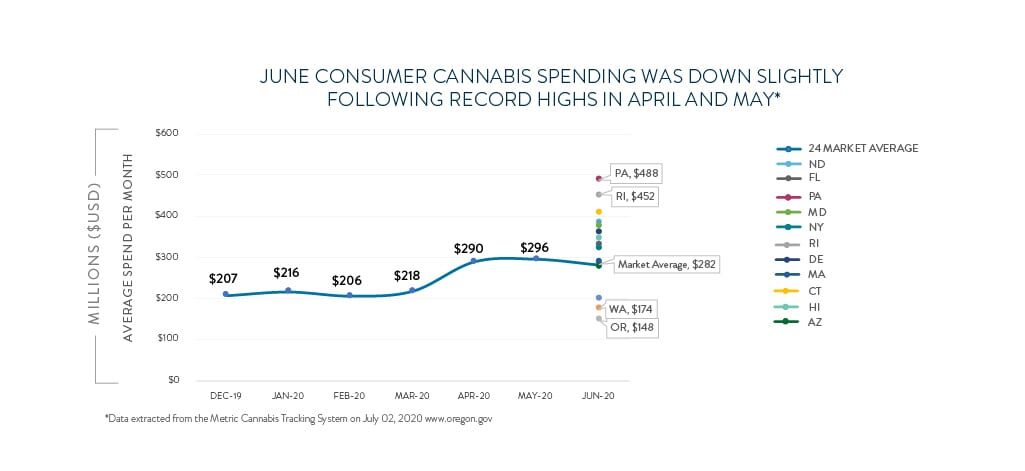

Analyzing retail data from 24 legal cannabis markets, New Frontier Data found that average consumer monthly spending rose to record highs in April and May, reaching $290 and $296, respectively. June sales across those markets was down slightly (with consumer monthly spending at $282), but still significantly higher than the corresponding average of $213 spent during the first three months of the year.