STUDY: Self-Reporting Cannabis Consumers Help Inform Markets

Dr. Amanda Reiman Named Chief Knowledge Officer at New Frontier Data

September 13, 2022

Women Report Less Success Reaching Their Goals with Cannabis Products

September 20, 2022By Amanda Reiman, Chief Knowledge Officer, and J.J. McCoy, Senior Managing Editor, New Frontier Data

Legal cannabis in the United States represents a booming yet inchoate industry projected to be worth $57.4 billion by 2030. Yet, for all of the opportunities which exist as this fall’s midterm elections could see fully half of the 50 states soon having adopted adult-use or medical markets, there are also an ever-changing array of obstacles raised by constantly changing regulations. It’s a veritable bullfight for investors, businesses, and even consumers to keep up with the constant flow of potential challenges.

That said, understanding purchasing behaviors – particularly by identifying product and experience preferences – is fundamentally important for any successful consumer packaged goods (CPG) business. In that regard, a cannabis company is no different than Coca-Cola, Starbucks, or Budweiser.

By understanding consumer desires and behaviors – and applying those insights across the entire consumer purchase journey from discovery to purchase – cannabis product manufacturers and retailers can fully capitalize on the possibilities.

Toward those ends, New Frontier Data, in partnership with cannabis discovery company Jointly, is releasing Cannabis Consumers in America: (Part II) The Purposeful Consumer, the second report in a three-part series about U.S. consumers and their intentions, preferences and behaviors.

Since Jointly launched its consumer data platform in 2020, some 80,000 cannabis consumers have rated and recorded their individual experiences. Included to date are more than 206,000 documented experiences detailing goals, products, doses, product effectiveness, and flavor/aroma ratings. They include 140,000 experiences noting the time of day, duration since a previous session, the presence or absence of exercise, hours of sleep, hydration, fullness of stomach, and side effects.

An overarching theme in the data reinforces how cannabis consumption is intentional and purposeful. Regardless of a consumer’s age, gender, or desired experience, today’s cannabis consumers are seeking specific effects – whether for relaxation, pain management, or to enhance a social experience. Those intentions determine the consumers’ product preferences and purchasing habits in pursuit of those effects and experiences, and from a marketing perspective help create a fundamentally meaningful connection between them and their chosen brands.

The data from for the latest report draws from 120,000 documented instances including setting, any personal company, product type consumed, and desired outcome. The perceived quality/effectiveness of a consumer’s experience was defined both by the product and dose they chose, and by creating conditions for a positive experience.

Among some distinct consumption trends, findings included:

- Relaxation and relief of everyday stress are the most popular aims reported across all consumers.

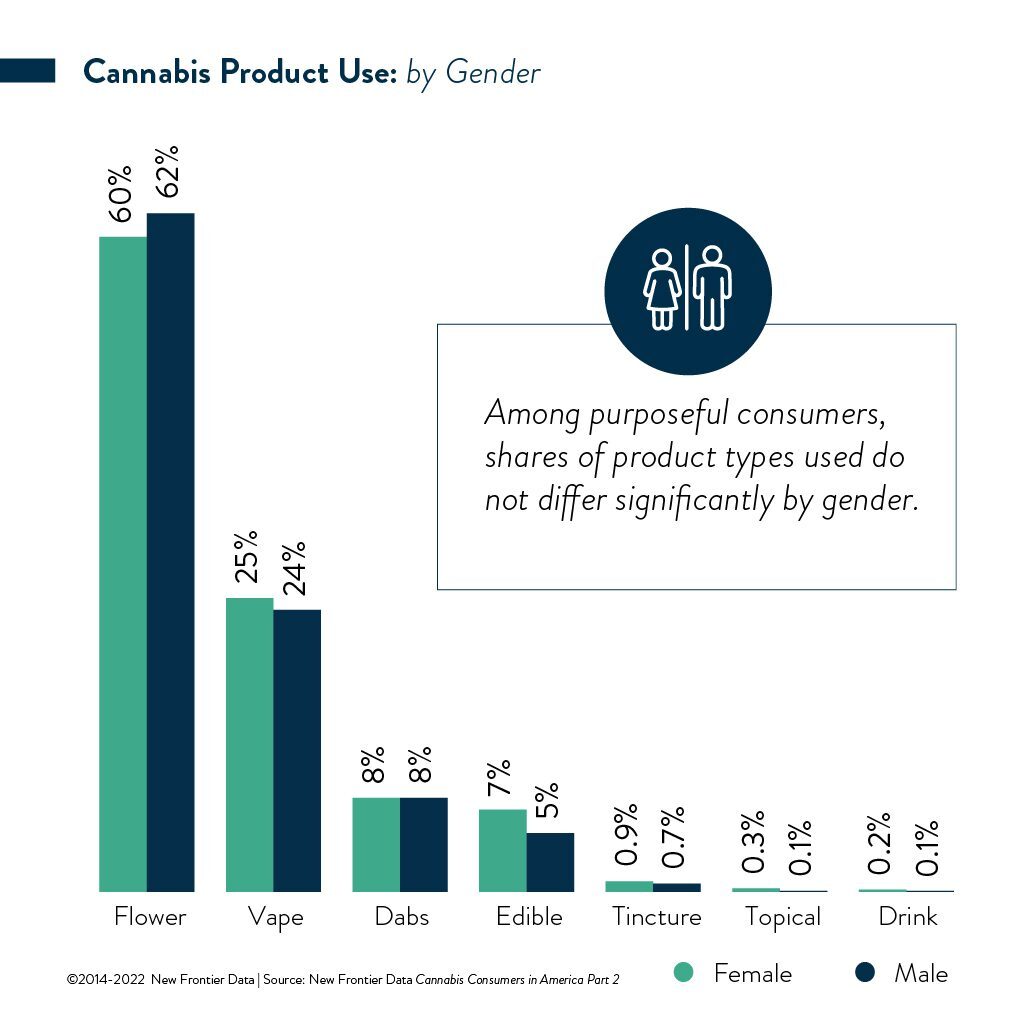

- Shares of product types used do not differ significantly by gender: Slightly more males (62%) than females (60%) preferred flower, while slightly more females (7%) than males (5%) favored edibles.

- Vapes and dabs were reportedly more popular among younger than older consumers; conversely, edibles and tinctures were more often chosen by older consumers.

- Across a wide range of consumption goals, cannabis drinks, edibles, and tinctures reportedly performed better than did inhalable products.

- For 8 among the 11 most popular reasons for people to consume cannabis, males (at statistically significant rates) reported having better success than did females in achieving their goals with the plant.

- Female consumers reported a higher incidence of side effects (e.g., dry mouth, appetite stimulation, and red eye) than did males.

- Consumers over age 42 reported less success at achieving their consumption goals across a wide range of purposes (though they saw roughly equal success in aiding sleep and stress relief).

Unsurprisingly, side effects were reported more commonly with THC-rich products than CBD-rich products, and were more pronounced among those having not consumed recently as opposed to frequent consumers. Formal study would be needed to determine whether frequent consumers establish tolerances to side effects, or more simply tailor their uses through experience to mitigate or avoid them.

Other caveats exist among the findings: While self-reporting women describe themselves as more susceptible to side effects from cannabis, it is an open question whether that is due to specific biological differences, or socially shaped inclinations for being more aware or willing to admit them. For their part, younger consumers’ reportedly increased frequency of experiencing side effects may be related to their respective tendencies for consuming higher doses than older age groups.

Understanding how intentional consumption is reflected through consumers’ purchasing choices helps producers, brands and retailers identify which products are most effective toward fulfilling their consumers’ goals.

For engaged discussion about the report, its findings, and implications for businesses, a webinar – Intentional Cannabis Consumption – featuring experts from both New Frontier Data and Jointly along with Sara Payan, public education officer for the Apothecarium in San Francisco, is slated for Sept. 29 at 3 p.m. EDT: Register to participate.

Meanwhile, click here to download a complimentary copy of the report. Interested in accessing Part I of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.