The Normalization of Cannabis: Product and Sourcing Choices

More than Half of U.S. Adults Have Consumed or are Interested in Trying Cannabis

May 2, 2023

What are you holding?

May 30, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

Running errands for groceries, pet food, toiletries, and other goods is an ingrained part of daily life. We may choose stores because they are convenient for us, because we like the product selection, or because we know the staff can answer our questions. Purchasing cannabis used to be an act of availability, not of convenience. Consumers were often at the mercy of the seller when it came to product availability, price and points of access. With cannabis legalization for adult use now the law in 22 states and 74% of the total U.S. population living in a state with adult-use or medical access, the normalization of cannabis for many Americans has resulted in a shift in terms of overall sourcing and what drives consumers to specific dispensaries.

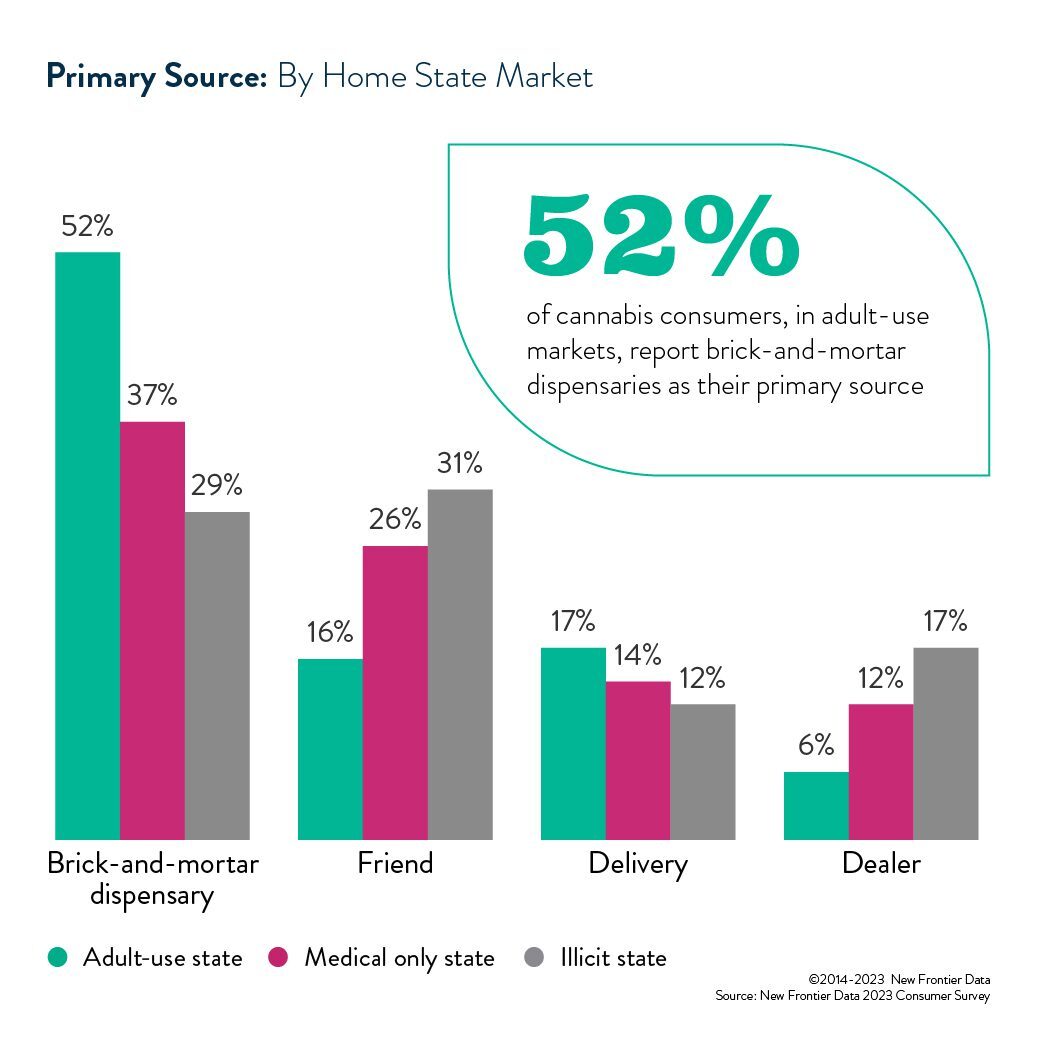

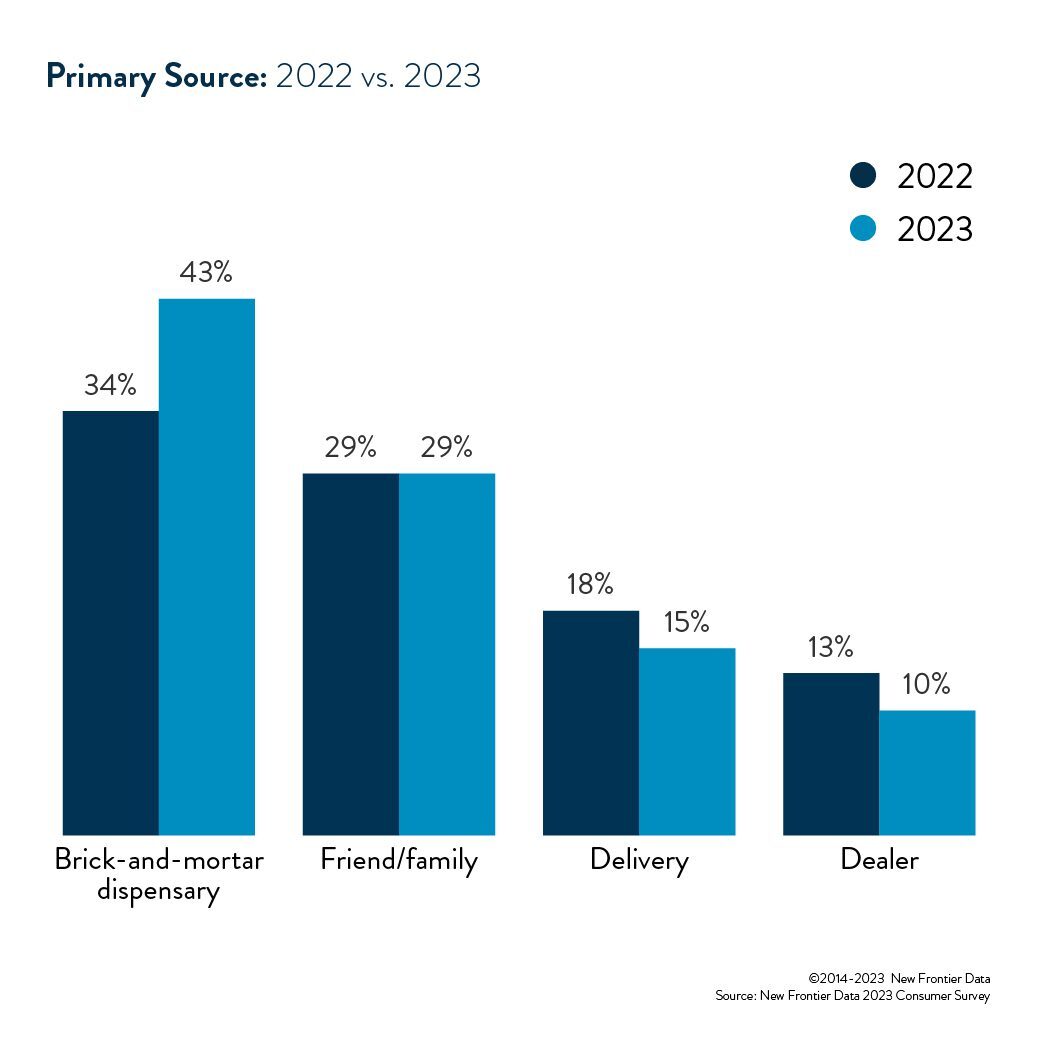

According to the 2023 Consumer Survey published by New Frontier Data, 43% of current consumers say that a brick-and-mortar dispensary is their primary source of cannabis, compared to 34% in 2022. Ten percent of current consumers say that their primary source is a dealer, down from 13% in 2022. As expected, this is a starker difference in states with adult-use access where 52% of current consumers say their primary source is a brick-and-mortar dispensary and only 6% say their primary source is a dealer. Interestingly, 29% of current consumers in illicit markets say that their primary source is also a brick-and-mortar dispensary compared to 17% who say they use dealers. This means that, even in illicit markets, consumers are travelling across state lines to obtain cannabis from a regulated source, as 42% of consumers say they have sourced cannabis from out of state.

It is not just cannabis sourcing that is beginning to mimic traditional commerce, the reasons that consumers give for choosing a particular source are also meeting the mainstream. The top reasons consumers give for choosing a particular brick-and-mortar dispensary are product quality, product selection, price, knowledgeable staff, and convenient location. These are the top reasons people choose grocery stores (location, price, product selection, product quality, and friendly and knowledgeable staff).

One remnant of prohibition that comes out in the sourcing data is the reason that consumers give for choosing the same businesses over and over again, which is familiarity. This was cited by 58% of consumers as the reason they keep coming back to the same store. Almost 20 years ago, I conducted a study of medical cannabis patients and asked this question about their go-to medical cannabis dispensary. Familiarity was also the top reason given. During prohibition, acquiring cannabis was a process with rules. What you could say, what you couldn’t, how to properly pay and contact your dealer, all with the risk of arrest. Knowing exactly what the rules were and what was expected of you was a part of the process. In some ways, that anxiety has held on into legalization for many consumers, who, even though they are purchasing in a legal market, may still feel a sense of doing something wrong and needing to adhere to specific protocols. As the legal market matures, I expect that familiarity will become less important and that the other reasons given for loyalty (convenient location, knowledgeable staff, and product selection) will become more important to consumers.

In many ways and in many places, cannabis has become another errand to take care of on the way home from work. The number of consumers sourcing from brick-and-mortar dispensaries will continue to rise as more legal markets come online, and even those in illicit markets will have greater access to legal stores. Like other areas of commerce, location, product selection, and staff will drive dispensary business, and consumers will relax into this new reality of cannabis as a consumer-packaged good.