Trends Worth Celebrating as Q3-’22 Begins

83% of U.S. Cannabis Consumers Use Flower Even as Exclusive Flower Use Declines

June 30, 2022

For Cannabis Consumers, Inflation is No Obstacle

July 12, 2022by Noah Tomares, Senior Research Analyst, New Frontier Data

Arrival of the annual American midsummer holiday seems as good a time as any to take a breath and see how cannabis sales trends have been shaping up. Last year, for instance, July 4 weekend sales of flower spiked by 8% compared to the previous weekend, while sales of pre-rolls swelled by nearly 11%.

What do those data points suggest? While loose flower accounts for most flower purchases, the packaged convenience of pre-rolls offers greater flexibility at a social event or in an outdoor setting such as a Fourth of July barbecue.

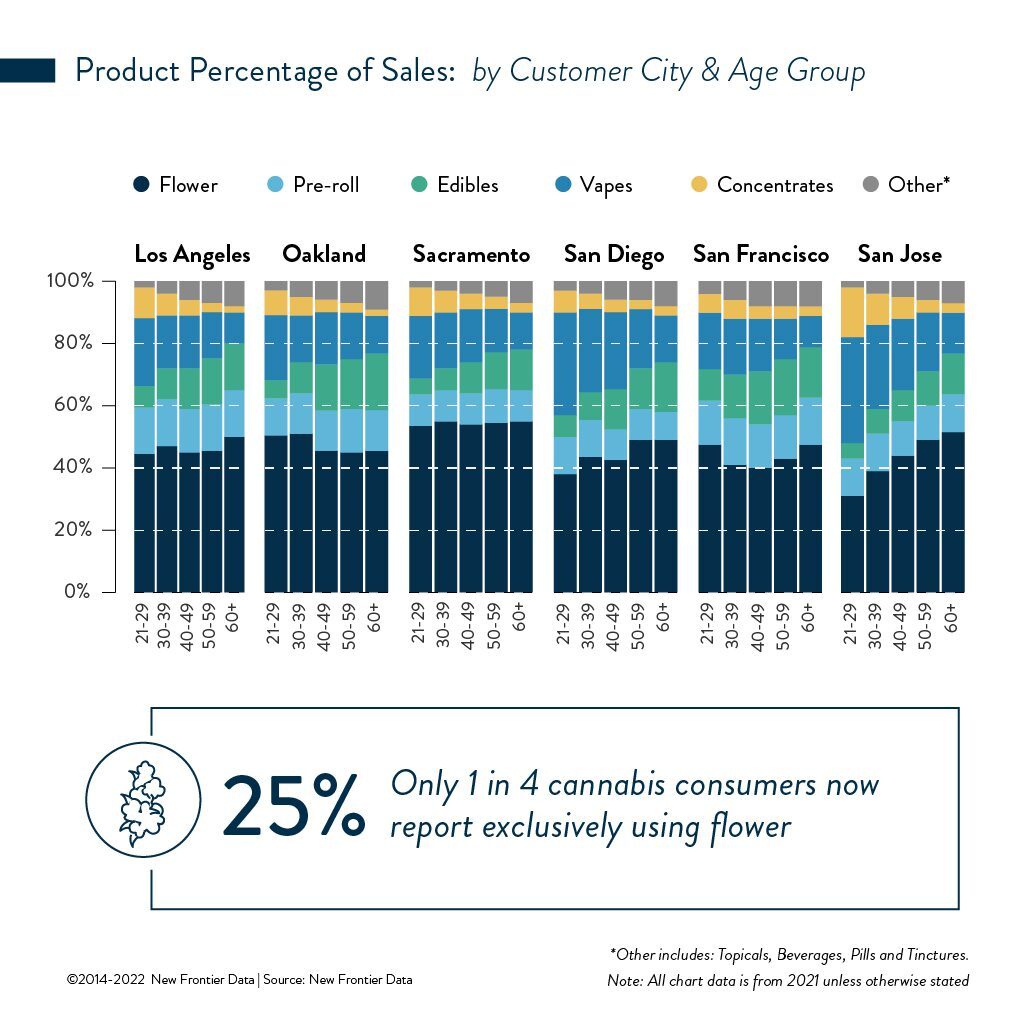

As the legal cannabis industry grows and evolves, and new product forms become widely available, more than half (57%) of consumers now report using both flower and non-flower products.

Flower Remains King

However, even in the fast-growing and highly dynamic marketplace, flower remains king. Last year, it accounted for 44% of total cannabis sales (50% if counting pre-rolls). A reported 83% of cannabis consumers have used flower, nearly two-thirds (64%) have purchased flower, and more than 3 in 10 (31%) have purchased a pre-roll.

Closely examining a large, maturing market such as California’s can offer compelling insights into how flower sales are trending. The Golden State legalized medical cannabis in 1996 and recreational use in 2016. Combined legal sales there totaled nearly $5.9 billion in 2021 and are projected to reach $9.25B by 2030, according to the Market Data Dashboard in Equio, New Frontier Data’s cannabis business intelligence platform.

When considering California’s legal flower sales last year, sales of flower over a weekly basis were relatively consistent, with Fridays and Saturdays regularly registering the most flower transactions, accounting for 17% and 15% of weekly totals, respectively. Mondays and Tuesdays represented the lowest proportions of sales, with each representing 13% of average weekly transactions.

Context Matters

Across the year, holidays saw the biggest sales spikes, as Independence Day, Thanksgiving, and Christmas Eve each registered significant boosts for total flower sales and pre-roll transactions. While brands already take ample advantage of the hype surrounding April 20 (4/20), producers who can plan promotions around other holidays can find new opportunities to connect with consumers.

Men consistently purchase more flower (both dried flower and pre-rolls) than do women. However, representing a proportion of total flower purchases, women have been more likely than men to purchase pre-rolls. Likewise, younger cohorts are likelier than older consumers to purchase pre-rolls.

Despite younger consumers’ higher propensity to purchase pre-rolls, older consumers (i.e., those age 55+) were more likely to report joints as being are their most frequent, favored way to consume cannabis. For their part, younger consumers were more likely to choose blunts (though overall, blunts were among the least-popular ways to smoke flower). There are several explanations for that differentiation: One likely factor is the wide range of products to which the youngest consumer cohort has been exposed. Older consumers may have formed consumption habits when pre-rolls were less readily available, and therefore seem more likely to roll their own joints.

The differences may also be contextual: For younger, less experienced consumers less adept at rolling their own joints, pre-rolls offer convenient alternatives in increasingly diverse sizes and potency options. Additionally, pre-rolls facilitate consumption in social settings, boosting their popularity with younger consumers. Compared to older consumers, younger consumers were reportedly more likely (by 39% to 27%, respectively) to consume cannabis while socializing at someone’s house, or (by 23% to 12%) at a bar, club, or restaurant. Identifying consumers’ unique purchasing and usage patterns is critical for brands and retailers looking to connect with consumer groups in a meaningful way.

Pre-rolls are also proving to be a compelling revenue stream for retailers. The top brand of pre-rolls sold in California during 2021 was the generic, in-house brand. More than 6 in 10 (61%) of consumers cited price as either a “very” or “extremely” important factor when making a purchasing decision, and in-house products are often more aggressively priced than branded products, being often used in giveaways or promotions.

The Power of Flower

That noted, the broadening availability of value-added products and fragmentation of use makes it especially important for flower brands to understand how consumers make purchasing decisions, identify for which applications their flower products are best suited, and align their marketing and brand-positioning to reflect the applications and intentions which best align with their target audiences’ intended uses.

For more information about the dynamics and broader trends influencing the growth of the cannabis industry, check out New Frontier Data’s latest report: The Power of Flower.