Value-Added Products Command More Brand Loyalty

Clear-Eyed Objectives Determine Success for Legal Cannabis Policy

August 30, 2022

27.7 Million Pounds of Legal U.S. Cannabis to be Cultivated in 2030; 20 Million Pounds More Than 2020

September 7, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

The cannabis industry is nearing the end of a one-size-fits-all era where brands could be indiscriminate about whom they target with the products they offer. With consumers becoming far more intentional about their consumption, and their primary drivers for use becoming more diverse, it is increasingly important for brands to invest in understanding both who their consumer is and why they consume.

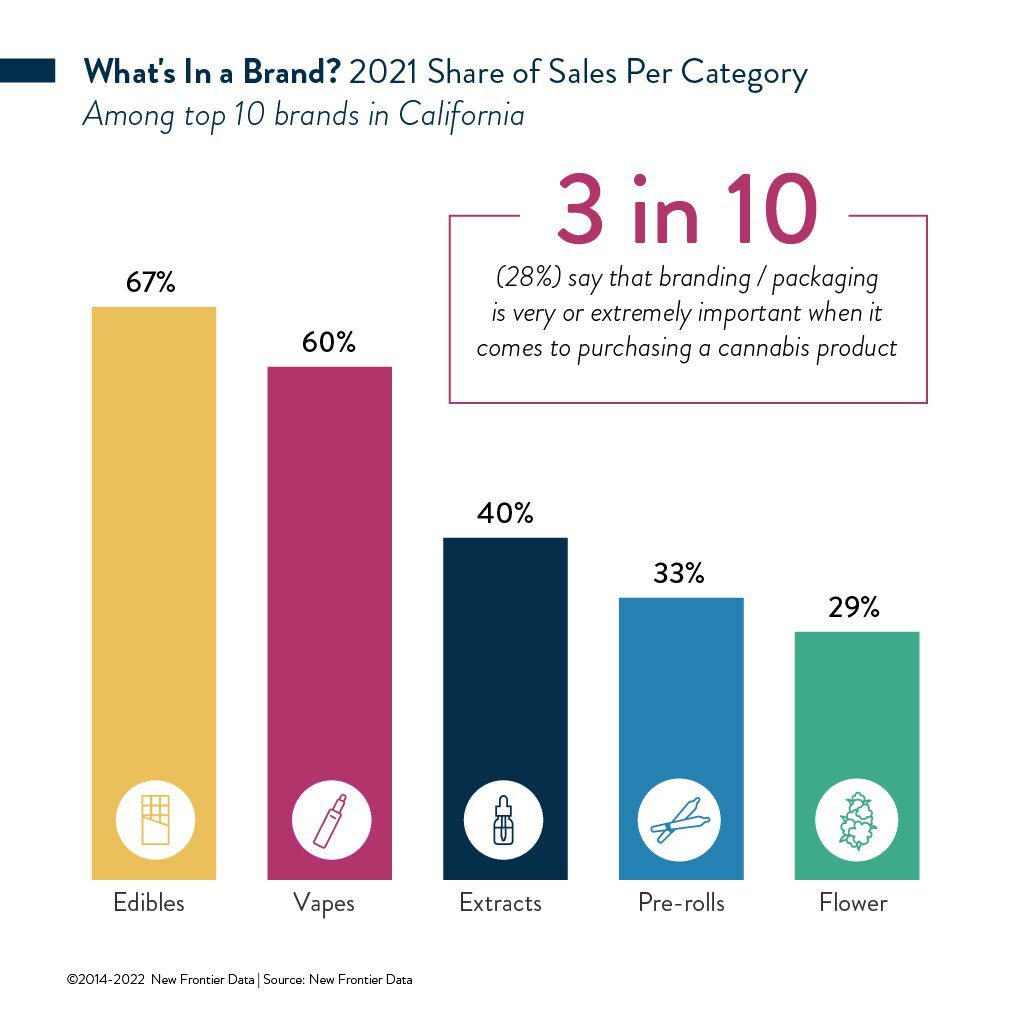

When it comes to purchasing cannabis products, branding is far from the most significant factor that consumers consider. Fewer than 3 in 10 (28%) report that branding/packaging is very or extremely important when it comes to purchasing cannabis. A product’s potency level (78%), its effect (63%), and price (61%) play larger roles.

More than half (51%) of current consumers express being eager to try new products when they learn about them. That suggests a positive environment for brands’ launching new products, even in crowded spaces, as there remains a large cross-section of consumers interested in trying the latest thing. For a deeper dive about U.S. cannabis consumers, consider New Frontier Data’s report: Cannabis Consumers in America: Dynamics Shaping Normalization in 2022.

Concerns Beyond Brand

Together, those tendencies suggest that brand loyalty remains generally low. However, value-added products do appear to command a greater degree of brand loyalty than do flower products.

Flower remains the most common and most popular way to consume cannabis. Nearly 2 in 3 (64%) of current consumers who use flower report sometimes or always seeking out flower from brands/companies. Male consumers are more likely than female consumers to sometimes or always seek out flower from specific brands (71% vs. 53%). However, in California, the top 10 brands selling flower products accounted for only 29% of the units sold in 2021. The top pre-roll brands accounted for 33% of sales. During the same period, the top 10 brands supplying value-added products such as edibles (67%) and vapes (60%) accounted for a much higher proportion of the total units sold. More specific information about which products are resonating with consumers is available in Equio’s Retail Suite.

There are several explanations for product-specific brand concentration. While consumers may have some sense of how to visually distinguish between high- or low-quality flower, there is far less to be gleaned by comparing the look of two vapes or packages of gummies.

Effect Is Most Important

At the same time, more than half (51%) of consumers say that the most useful information about a cannabis product is the effect which the product will have. While strain can be a powerful tool for brands and producers alike, the specific mix of cannabinoids and various terpenes found in cannabis can drastically affect each user’s experience. That may be why fewer than 1 in 5 (17%) among consumers cite a strain’s name as being the most useful information. For a closer look at all things flower, check out The Power of Flower: Purchasing & Consumption Trends in the U.S. Cannabis Market.

Value-added products purport to have the same proportion of various ingredients in each package, and may lend consumers greater confidence that they will enjoy the same experience the next time they purchase a product.

What’s Next?

As the industry grows in scale and specialization, different brands with resonant products aimed at well-defined target segments are far likelier to secure effective competitive market positions over the long term than are brands which try to serve the broadest possible base without tailoring to individual subgroups’ needs. At the same time, while value-added producers may enjoy greater brand loyalty, new entrants to the market must be keenly aware of potential challenges they may face engaging consumers who have already found their favored niche.

Learn how to leverage the timely, in-depth marketplace data and expanded dispensary insights available within the Retail Suite.