Want to grow the industry? Start local

Necessity vs. Nicety: Adult-use and medical patient spending during tough economic times

January 10, 2023

New state markets could inject an additional $18 billion annually into U.S. legal cannabis market by 2030

February 21, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

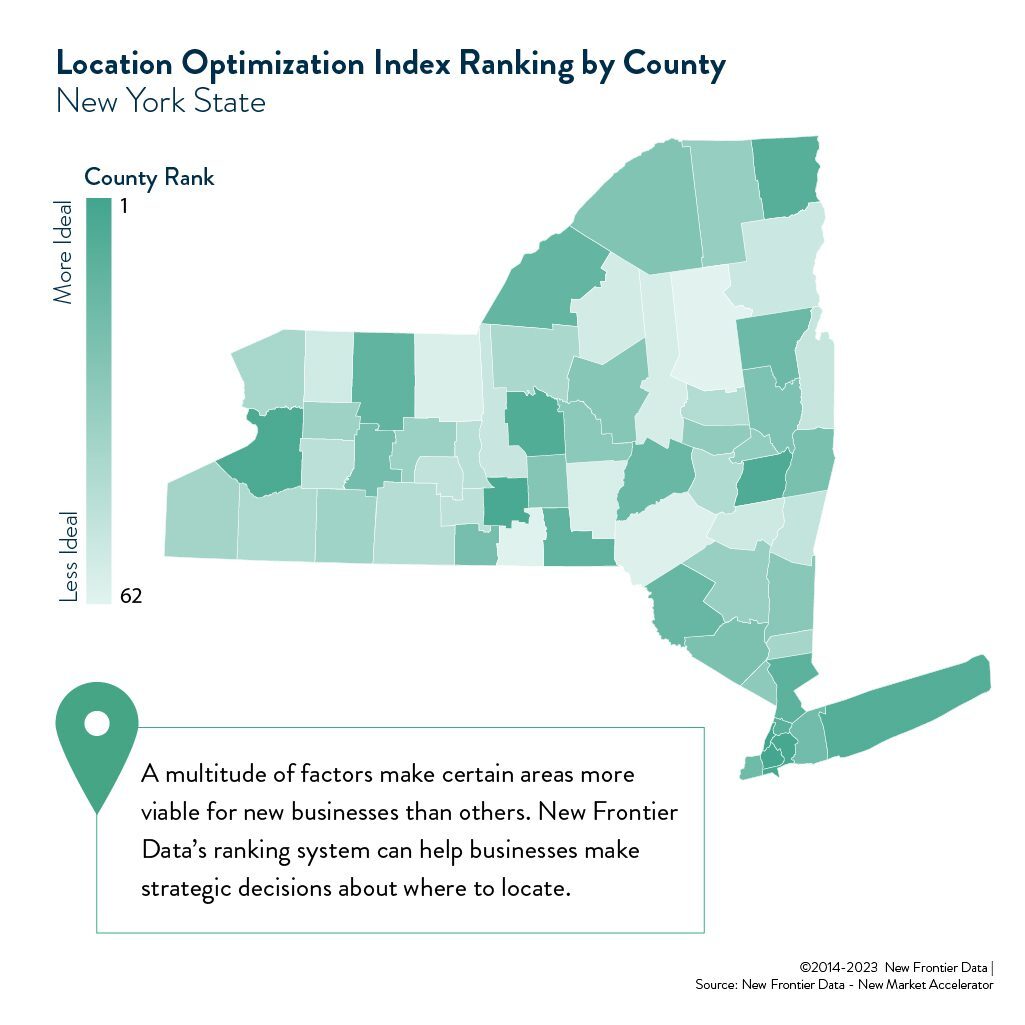

Think globally, act locally is a perfect sentiment for the burgeoning cannabis industry. Even as additional states join the adult use party, opt-out policies allow localities to continue the prohibition of regulated sales and other commercial cannabis activities. This means that optimizing your businesses’ locations becomes about more than finding a state with legal access. Indeed, states that allow for opting out see fewer licensed dispensaries per consumer than states that do not. And while finding opt-in localities can be tedious (about half of the municipalities in New York have opted out for dispensaries and even more for consumption centers), there are other layers to consider. Zoning restrictions, local taxes, and the willingness of the community to embrace cannabis businesses can all impact success, even in opt-in locations.

Zoning is a common way for jurisdictions that have opted in to make finding a suitable location difficult. NIMBYism, concerns about cannabis businesses being in the public eye or in highly trafficked areas of town often pushes them into industrial areas, inconvenient for consumers. Additionally, rules about distance from schools, churches and other sensitive areas may be set by the state but can be enhanced at the local level. Twelve years ago, I was tasked with trying to find a new location for a dispensary I was working for in California. After including the required distance from schools and parks, there was not one appropriate location in the entire city. And this was a city considered to be very “cannabis-friendly”. This is why it is imperative that businesses scout potential locations according to local zoning policies to make sure they are not setting themselves up for a fight with the community.

The community still has incredible power to influence the outcome of cannabis business applications. It is recommended that businesses do their homework and learn more about the community they wish to enter before spending a lot of time and money on an application and business plan. Having a better understanding of the values of the community, their fears around commercial cannabis activity as well as the level of support will assist in making decisions not only about the viability of the location, but the strategy for becoming an asset and not a burden.

Local taxes should also be considered. In legal markets, there are state taxes, but localities pass taxes as well and these can vary. Some have no tax in the hopes of courting cannabis businesses, and others set tax rates high, increasing the barrier to entry. Local tax rates should be taken into consideration when deciding where to locate a business.

Legalizing adult-use cannabis at the state level is the first step toward creating a viable industry. However, the real work for businesses comes next, deciding where in the state to locate. Local zoning and taxes along with community buy-in should all be considered when choosing a location. New Frontier Data has developed a location optimization tool for the state of New York to help businesses identify the most suitable locations and provide information on the addressable market as well as other factors at the local level that might impact success. For more information on this tool, talk with one of our experts.

What other markets would you like to see?