What are you holding?

The Normalization of Cannabis: Product and Sourcing Choices

May 16, 2023

Cannabis Prohibition Still Plays an Outsized Role in the Evolution of the Cannabis Industry

May 31, 2023By Noah Tomares, Senior Research Analyst, New Frontier Data

A consumer walks into a dispensary, browses for a few minutes, picks out an eighth of their favorite strain and a pack of edibles. They pay in cash and continue on with their day. For brands jostling for prominence in a crowded marketplace, it might seem as though the battle is over until this consumer needs to acquire more cannabis. However, the question of why and how this consumer enjoys their cannabis is a quintessential key to long-term success.

Fewer than half of consumers report having access to any forms of cannabis other than flower, prerolls, and edibles, even in adult-use states. While we expect use of other forms to gradually increase in popularity as legal markets expand and dispensaries diversify their product offerings, understanding how consumers enjoy their cannabis they have currently available can provide greater insight into how they may feel about adopting new product forms. Cannabis gear can vary widely in terms of cost and ease of use, which may end up impacting which product forms are chosen by casual consumers as well as aficionados.

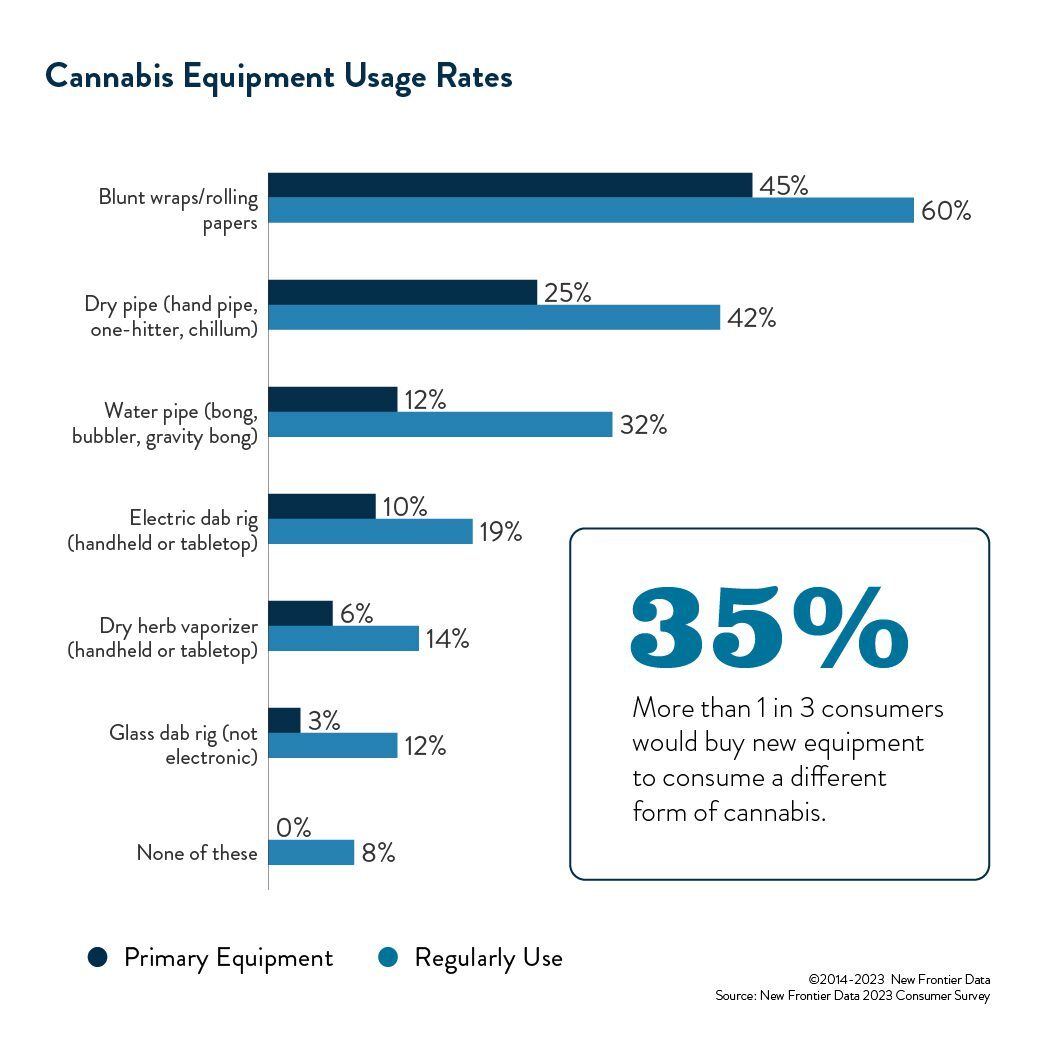

Generally speaking, consumers are more likely to have experience with flexible and affordable equipment. According to the 2023 Consumer Survey from New Frontier Data, among consumers who have used combustible cannabis products, the most common tool utilized were blunt wraps/rolling papers (60%), followed by dry pipes (42%) and water pipes (32%). Consumers were less likely to say they had previously used dry herb vaporizers (14%) and electronic (19%) or glass dab rigs (12%).

Choice of equipment did not vary extensively by market type, but demographics do appear to play a role. Men were moderately more likely than women to claim they had used all product forms, especially water pipes (37% vs 28%) and blunt wraps/rolling papers (63% vs 56%). This makes sense given that women are more likely than men to report using non-flower products exclusively (29% vs 15%).

Younger consumers under the age of 35, who tend to consume a wider variety of product forms and consume more frequently, were more likely to report utilizing a wider variety of equipment. The one exception to this is dry pipes. Nearly half (47%) of consumers over the age of 35 said they had utilized a dry pipe in the past compared to one in three (34%) in the youngest cohort. This could be a holdover from prohibition where dry pipes were a staple of consumption.

Consumers mostly purchased their reusable equipment from headshops/brick & mortar specialty stores (42%) or from a dispensary (27%). Only one in seven ordered their equipment online (14%) or acquired it through a friend/family member (13%). Whether due to concerns about online transactions or lack of awareness, the market for cannabis equipment currently appears to be largely localized.

When it comes to purchasing new equipment, nearly two-thirds of consumers say they would buy something new if their current equipment broke (62%). More than a third of consumers also said they would also consider new equipment in order to consume a different form of cannabis (35%) or if a healthier option became available (33%).

For some time, we have known that the cannabis industry is not one-size-fits-all. Demographically, cannabis consumers are diverse. Users are spread across age groups, genders, economic brackets, and political affiliations. Likewise, reasons for cannabis use remain highly diverse and personalized. As the market has matured, consumers have become far more intentional with their use, including the tools they choose for consumption.

Most cannabis consumers (56%) now utilize both flower & non-flower products. Among consumers who do consume more than one form of cannabis, they primarily choose different forms of cannabis to engage in different activities (45%), create different moods (37%), or at different times of day (29%).

Brands and retailers aiming to identify a specific target consumer type and cater to their specialized needs must be keenly aware not only of the reasons why a consumer chooses a specific product or product form but how they plan to consume that product. Beyond the desired effect of a product, companies will have to consider the scenario in which their target consumers might be using it. Awareness of the synergies between product, method of consumption, and gear needed can help engender consumer loyalty and boost a brand’s profile in its market.