What to Do About Water? Getting the Cannabis Industry Out in Front for Wise Usage

Proficiency Testing Is Vital for Public Confidence, Political Acceptance

February 16, 2021

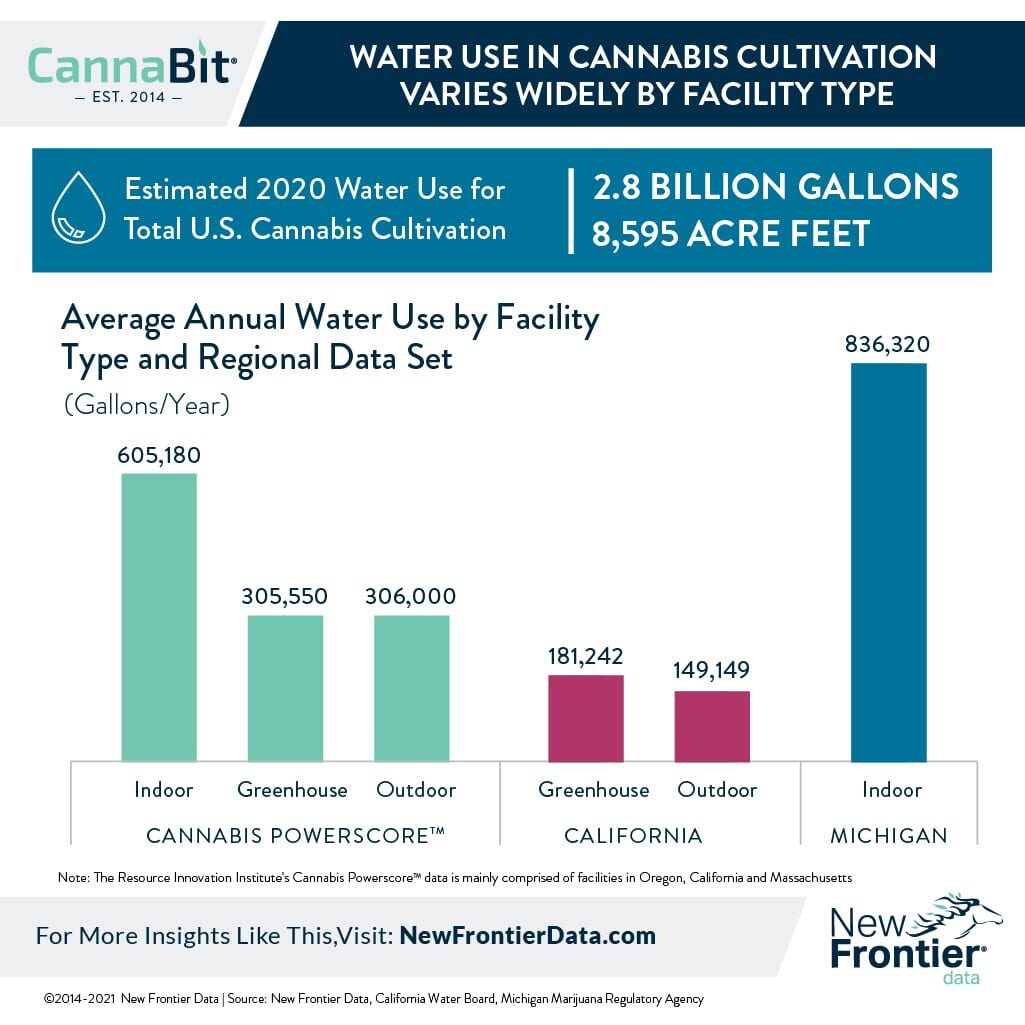

U.S. Legal Cannabis Water Use to Almost Double by 2025

February 24, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

Historically, environmental conditions in the Western United States has been conductive to outdoor cannabis cultivation. Under changing climate conditions, however, several of those are now facing some of the most acute drought conditions in the country. Arizona, California, Colorado, Nevada, New Mexico, and Oregon (which collectively account for 71% of the nation’s total cannabis supply, both legal and illicit) in particular are being exceptionally afflicted, according to the National Oceanic and Atmospheric Administration (NOAA)’s Drought Monitor.

To help research and address the problem and the increasing potential threat, the nonprofit Resource Innovation Institute (RII) last April formed the Water Working Group of experts from multiple fields, banding together to better understand and address water use in cannabis cultivation, and how respective geographies and cultivation methods impact usage rates. The group’s policy experts include cultivators, researchers, utility officials, and regulators. Along with partners New Frontier Data and the Berkeley Cannabis Research Center, the Water Working Group is publishing a Cannabis Water Report, a document that will establish a scientific understanding of how, and how much, water is used for cannabis cultivation.

“We live in an era of climate change where droughts are increasingly common,” explains Derek Smith, RII’s executive director. “A significant portion of cannabis cultivation is located in Western states, which will continue to be affected by water scarcity. It has never been more important to understand how our industry can improve efficiency.”

Indeed, the premium to be placed on systemic efficiency becomes ever more important as the nation’s legalized cannabis markets expand. Including the latest five states which mandated programs in the November elections, New Frontier Data expects the overall legal U.S. cannabis industry to grow at a compound annual growth rate of 21% through 2025, to reach $41.5 billion. That figure represents more than 3x the $13.2 billion legal market of 2019.

New Frontier Data estimates that while legal production of cannabis represented nearly a quarter of the 2020 total U.S. market (including illicit sales), that share should increase to reach 35% of the market by 2025. Conversely, the nation’s illicit market is expected to see sales decline from $66 billion in 2019 to $64 billion in 2025.

During that same period, researchers expect total water use in the legal cannabis market to increase by 86%. Though some critics and opponents have seized upon water use as a policy issue, the regulated, legalized cannabis industry In California generally uses significantly less water than do some of the Golden State’s other major agricultural crops (e.g., cotton, tomatoes, wheat, and corn). That noted, it is a virtual given that the trend toward longer, more acute droughts will be sustained well into the future, which lends more urgency to the Water Working Group’s efforts and messaging.

To wit, cultivators are being advised to design, build, and operate their operations appropriately to address the changing climate conditions, assuming:

- Longer, hotter, and drier summer growing seasons;

- Revised restrictions on water access, water discharge volumes, and minimum effluent quality standards/monitoring as groundwater sources become more scarce;

- Evolving building standards to increase energy efficiency, reduce waste, and preserve indoor and outdoor air quality via mechanisms like California’s Title 24, the state’s triennially updated Building Energy Efficiency Standards (which have implications for HVAC, humidity control, and other environmental management systems impacting water use in grow environments);

- More expensive municipally supplied water;

- Increased cooling demand for indoor and greenhouse growers to offset higher loads; and

- Higher operational expenses for temperature control and water management systems.

As the report’s authors note, as the U.S. cannabis industry matures, water use efficiency will necessarily become more important, as it likewise will for other agricultural crops. Pressures to use water efficiently will mount, and include the reduction of input and energy costs, protection of the environment, addressing evolving regulatory standards, and ultimately being responsible stewards of both the nation’s industry and its ecology.

For more comprehensive insights and to download the Cannabis Water Report or other value-added industry intelligence in New Frontier Data analyst reports, please visit our reports webpage.