Who Is Driving CBD Consumption? Four Groups Define Sales

Social Connections Keenly Influence CBD Consumers’ Behavior

June 1, 2021

U.S. Mid-Year Report: Legal Industry Projected to Top $6 Billion in Quarterly Sales for Q2-2021

June 14, 2021By Molly McCann, Ed.D., Director of Industry Analytics, New Frontier Data

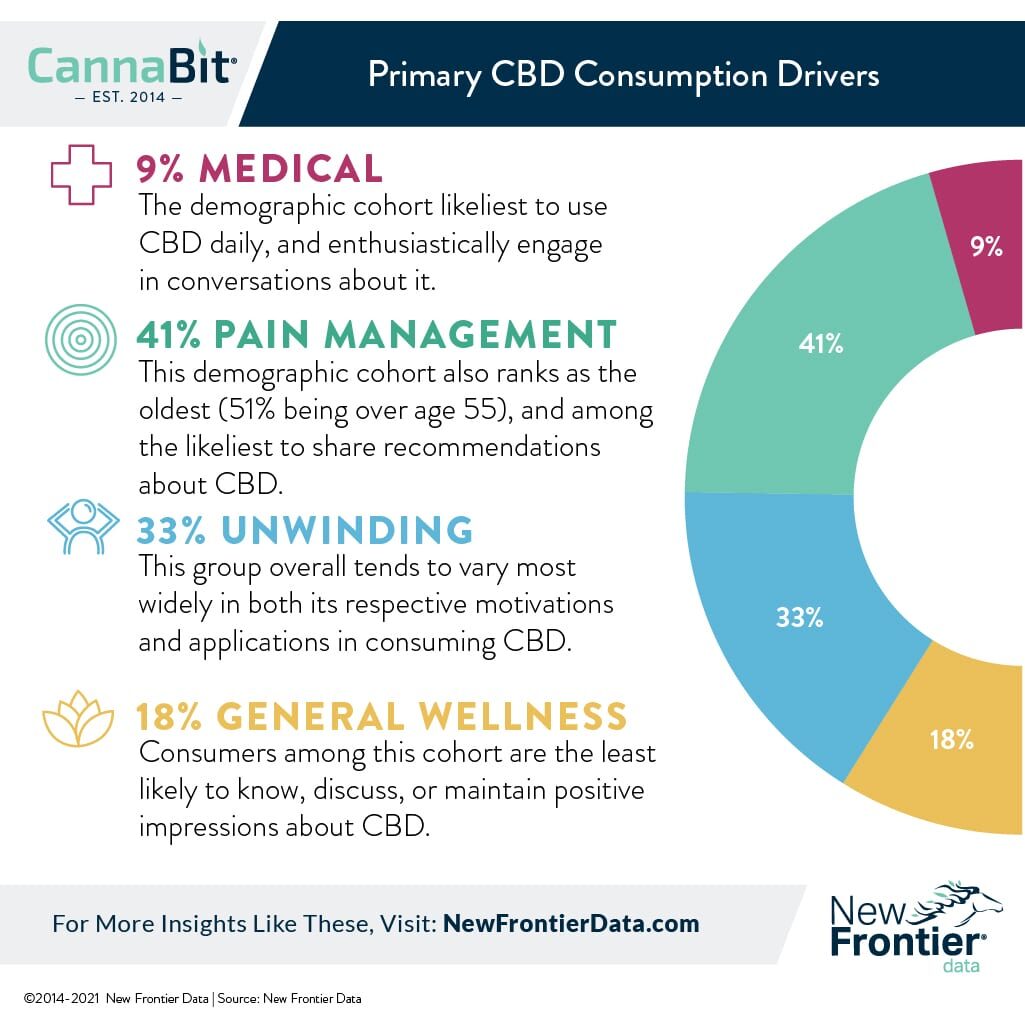

CBD has been touted for a variety of wellness and therapeutic applications — whether from aches and pains, to relaxation, to treating acute medical conditions. Accordingly, consumers’ reasons vary for their use of it. In a survey of U.S. CBD users, New Frontier Data found that consumers differ profoundly about their primary motivations for using it. A new report provides analysis of four key demographic cohorts driving consumption, and summarizes key market differences defining use behaviors and preferences for each.

Medical Consumers

The majority (70%) of medical consumers use CBD to treat a specific medical condition, with the remaining 30% using it to manage gastrointestinal issues, mitigate negative effects from other medications, or as a less expensive alternative to other medications.

Though they account for but 9% of the total market share among CBD consumers overall, those driven by medical motivations consume the most frequently of the four groups, with nearly 2 in 5 (38%) using CBD at least daily, and 3 in 5 using it at least weekly. Nearly half (45%) name tincture as their preferred form, and they are the group most likely to prefer capsules (14%). Medical consumers vary widely in age, and more than a third (35%) purchase primarily from online sources.

Pain Management Consumers

Consumers who use CBD to manage pain are the largest group — representing 41% of CBD consumers.

Pain consumers skew older than average — a majority (51%) are 55 years or older — and though they consume less frequently than do medical consumers, nearly half (44%) use it at least weekly. As for all groups, tincture is the pain consumer’s most broadly preferred form (40%), and the group is by far the likeliest to prefer topicals (29%). Most pain consumers primarily source CBD either online (28%), or from a personal connection (26%).

Unwinding Consumers

One-third (33%) of consumers use CBD primarily for unwinding, an umbrella term encompassing anxiety reduction, stress relief, and relaxation. Just as the largest cohort (i.e., pain consumers) skews older, the unwinding consumer skews younger, with a majority (51%) of the group being under age 35. Unwinding consumers use CBD the least frequently of the four groups, with less than a third (31%) doing so at least weekly. The infrequency of their use may be related to sourcing — they mark the only group citing personal connections (31%) as their leading primary sources of CBD. Unwinding consumers have a broader range of preferred forms of CBD than do either medical or pain consumers, with 24% preferring a CBD-infused food or beverage, and 21% preferring either to vape or smoke CBD.

General Wellness Consumers

Those consumers in the fourth cohort use CBD for all other reasons encompassing pursuit of general wellness, e.g., increasing overall wellness, falling asleep or improving quality of sleep, improving mood or fitness training, and being more energized, among other reasons. General wellness consumers account for nearly 1 in 5 (18%) of CBD users, and vary widely in their ages.

General wellness consumers’ leading primary source for CBD is found online (33%), and while they are among the less frequent consumers (i.e., 40% using CBD weekly), they have the widest variety of preferred product forms. Just under one-third (32%) prefer tincture, one-quarter (25%) prefer infused food or drink, and 17% primarily vape or smoke CBD.

You can read more about consumers’ differing behaviors and experiences by age and other variables in New Frontier Data’s report, U.S. CBD Report Series, Vol. 3: Consumption Drivers.