California Consumers’ Spending Up

February 25, 2018Cannabis Jobs, Growth, and Tax Revenue After the Trump Tax Reform

March 4, 2018

- As more revenue is generated in the legal cannabis, there will be more jobs created, and more business and payroll taxes generated for the federal government.

- Roughly 200,000 jobs exist in today’s legal cannabis market (i.e., growers, processors, wholesalers and retailers), not including ancillary businesses.

- By 2025, projections anticipate 630,000 industry-specific jobs

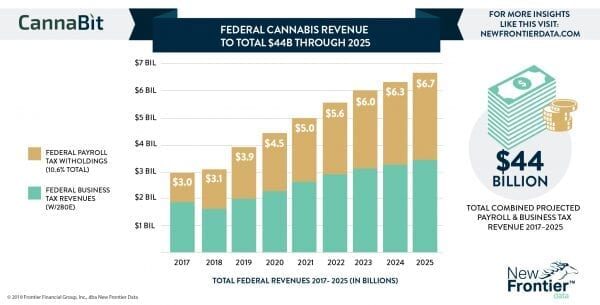

- Total estimated revenue at the federal level (payroll taxes plus roughly equivalent business taxes) is $2.9 billion for 2017, $3.1 billion in 2018, and reaching $6.7 billion by 2025. Taxes factor in higher effective 280e tax rates for cannabis businesses.

- Total estimated federal revenues between 2017 and 2025 are in the cumulative range of $44 billion: While many assumptions supply that total, the data reflects New Frontier Data’s refreshed 2018 forecast and the impacts of the Trump tax cuts.