Uh-Oregon: A Cautionary Reminder About Rushing Out West

February 4, 2018New Frontier Data Acquires Hemp Business Journal

February 7, 2018

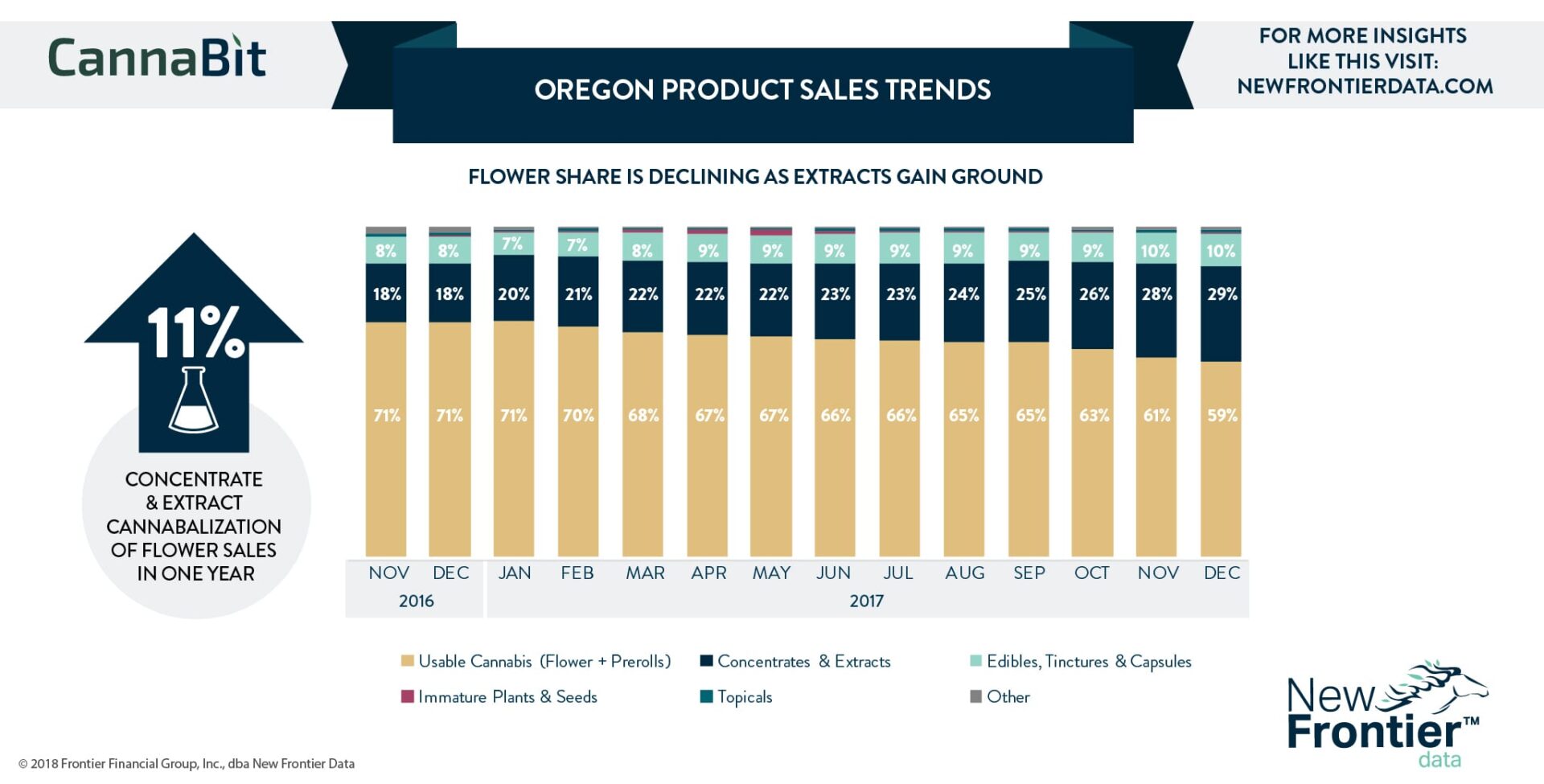

- Oregon’s cannabis sales trends reflect a significant relative decline in demand for flower and pre-rolls, whereas concentrates/extracts have seen strong growth.

- From December 2016 to December 2017, market share for flowers dropped from 71% to 59% (minus 12%).

- During the same year-to-year period, demand for concentrates and extracts rose from 18% to 29% (plus 11%).

- Meanwhile, demand for other products, including tinctures, capsules, immature plants and seeds, and topicals remained flat.