U.S. Mid-Year Report: Legal Industry Projected to Top $6 Billion in Quarterly Sales for Q2-2021

Who Is Driving CBD Consumption? Four Groups Define Sales

June 7, 2021

Hyper-Competitive Retail Cannabis Market Fuels Demand for Next-Generation Business Intelligence

June 14, 2021By Kacey Morrissey, Senior Director of Industry Analytics, New Frontier Data

How leaders in Washington, D.C., will decide some key market governance issues remains far from clear at the start of the summer, but decisions made in the halls of Congress, the White House, and in state capitals nationwide during the second half of 2021 will impact the trajectory of the industry for years to come.

What is better known is that while the COVID-19 pandemic generally brought previous trends of productivity among many industries to screeching halts in 2020, the legal cannabis industry experienced unprecedented growth. During the unprecedented period of shutdowns and spikes in consumer demand, operators were forced to adapt, commonly developing their online ordering platforms and offering delivery and curbside pickup options. Increased focus by industry operators on developing technology and operational logistics to meet 2020 demand will continue to pay off in the coming years, as such types of operational developments and emphasis on increased ease of consumer access ultimately improve incentives for legal market participation by consumers patronizing the illicit market.

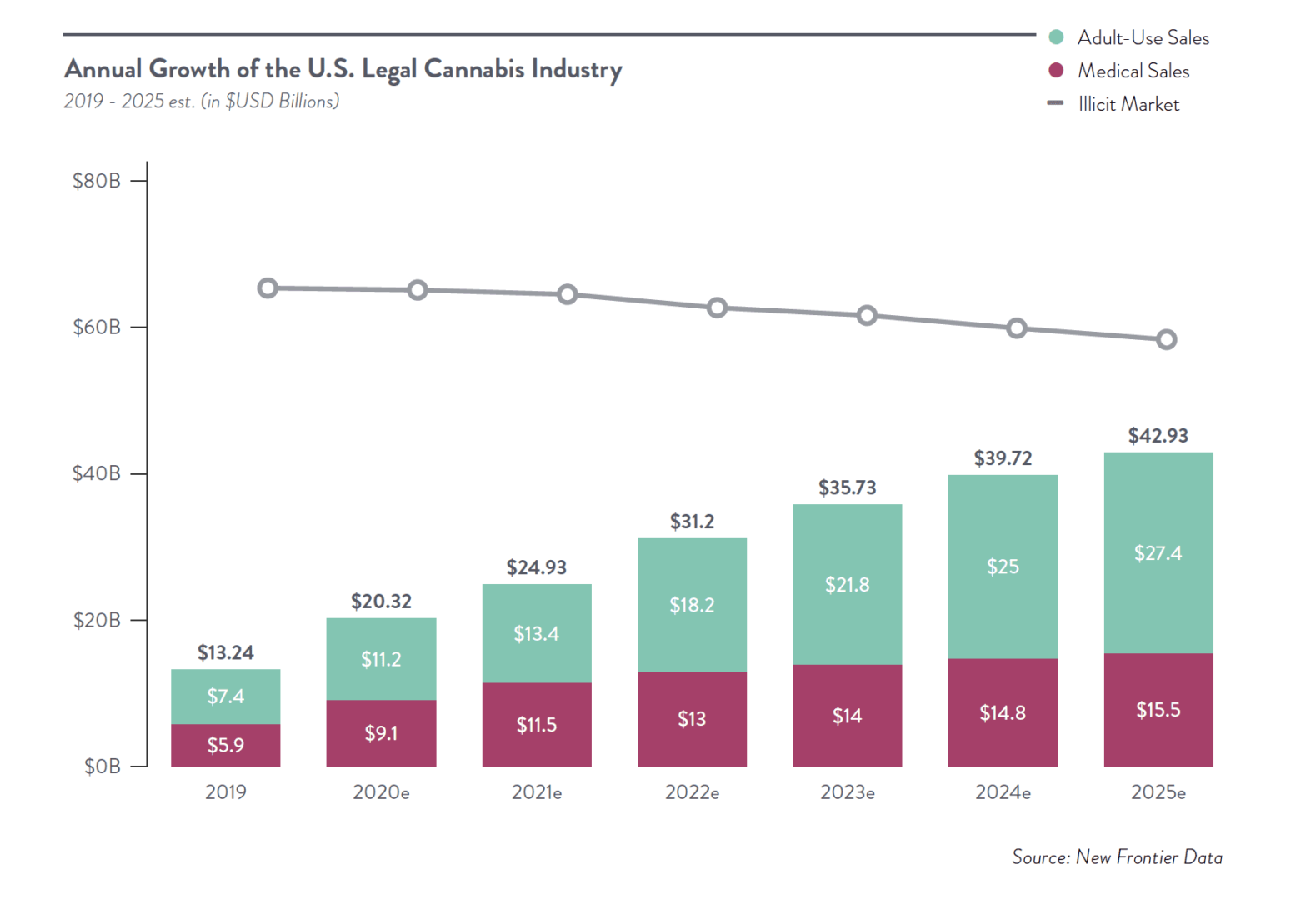

What New Frontier Data expects going forward into the near term is for those companies’ and state markets’ 2020 evolution to keep translating into improved prospects for illicit market cannibalization by 2025. As adult-use markets continue to outperform expectations, they will further affirm deeply entrenched consumer demand, while expanding state legalization will add political pressure for federal action on cannabis reform.

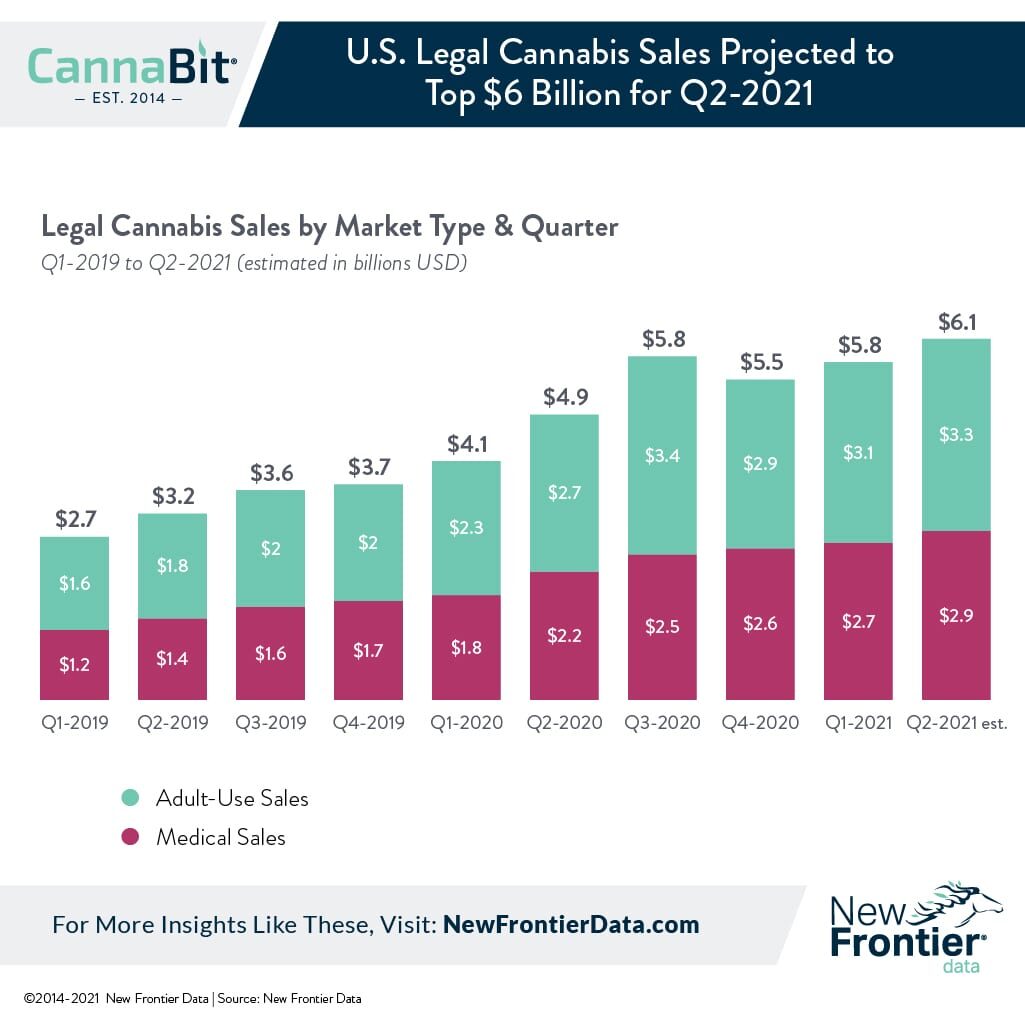

Analysis by New Frontier Data projects legal cannabis sales to increase by approximately 4.4% from the first to second quarters of 2021. Quarterly sales across legal medical and adult-use states reached an all-time high of $5.84 billion in Q1-2021, with sales for Q2-2021 projected to surpass $6 billion.

In calendar year 2020, total combined sales of cannabis across legal medical and adult-use state markets crossed the $20 billion threshold. With 10 newly legalized state markets expected to activate sales in the next two years, total annual legal sales nationwide are projected to grow at a compound annual growth rate (CAGR) of 16% over the next five years, reaching $43 billion by 2025.

Expanding Legalization Hastens the Erosion of the Illicit Market

Despite strong performances seen in legal state markets (e.g., $20.3 billion in combined state legal sales for 2020), the illicit market continues to serve most of the national demand, with an estimated $66 billion spent on cannabis across illicit sources in the U.S. in 2020.

Even with continued growth in the number of cannabis consumers nationally, both legal medical and adult-use markets will increasingly erode the demand met by illicit sources.

In 2020, an estimate 24% of U.S. cannabis sales were believed legal; by 2025, 42%1 of total annual U.S. cannabis demand will be met by legal purchases in regulated marketplaces.

Medical Market Legalization Fuels Overall Industry Growth

With 38 legal medical state markets (plus the District of Columbia [D.C.]), the total number of medical cannabis patients nationwide has surpassed 4 million (as of April 30), and is projected to increase as newly legal medical markets become operational.

In those states where cannabis has been legalized for medical use (with no assumptions for any new state markets by 2025), New Frontier Data projects that there will be a combined 5.4 million registered medical cannabis patients in the U.S. by 2025, representing nearly 2% of the entire U.S. population.

A FREE copy of the U.S. Market Update will be available for download this Wednesday, June 16.