Legal Cannabis and the Three State Governors

Shaking the Crystal Ball for the Legal Cannabis Industry in 2021

January 11, 2021

One More Time: New York Governor Makes Third Try to Adopt Adult-Use Cannabis

January 25, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

Despite results from last November’s U.S. elections being overwhelmingly positive for the legal cannabis industry, early 2021 bureaucratic challenges encountered in three different states may fairly draw comparison to the story of “Goldilocks and the Three Bears”, per prevailing regulatory conditions respectively too hot, too cold, and just right.

Too hot: South Dakota

Last fall, typically conservative South Dakota bucked tradition at the ballot box by becoming the first state in the nation to simultaneously legalize cannabis for both medical and adult use.

Yet, despite an adult-use ballot initiative which was approved by more than a 54% margin last November and validated by the secretary of state, South Dakota’s Republican Governor Kristi Noem has doubled down on her long-established opposition. Noem last week issued an executive order indicating that she is behind efforts to overturn the voter-approved recreational cannabis legalization by couching her stance as her duty to defend the state’s constitution.

In her executive order, the governor claims that the popular initiative “violated the procedures set forth in the South Dakota Constitution.” Specifically, the suit claims that the ballot measure improperly addressed more than one subject, and thus needs to be placed on the ballot through a state convention.

Conversely, in a Jan. 8 filing, two assistant state attorneys general defending the voter’s will describe the governor’s efforts as “nothing more than contestants trying to avenge their loss at the ballot box, instead of accepting that democracy happened.”

Circuit Judge Christina Klinger is due to hear arguments on Jan. 27 in Pierre.

Too cold: New Jersey

Over two months after New Jersey voters overwhelmingly approved a constitutional amendment to legalize a regulated, adult-use cannabis market in the Garden State, Gov. Phil Murphy, Democratic lawmakers, and administration officials got derailed by a policy dispute.

On Jan. 8, concerns about unnecessarily harsh penalties on minors charged with possession of the drug led the initiative’s lead sponsors to pull their names from a compromise bill, and plan to hold firm. Conversely, Murphy’s assistants say he will not sign anything other than a so-called “clean-up” bill which outlines penalties for both underage possession of illicit-market marijuana or wrongly obtained cannabis products sold through the legal marketplace.

The clean-up bill was been expected to get full votes in both houses of the New Jersey Legislature, but instead the legislation got pulled from the agendas in both chambers. In a Jan. 11 news conference, Murphy expressed his optimism for an agreement, but admitted that substantive negotiations remained to be worked out over an unspecified timeline.

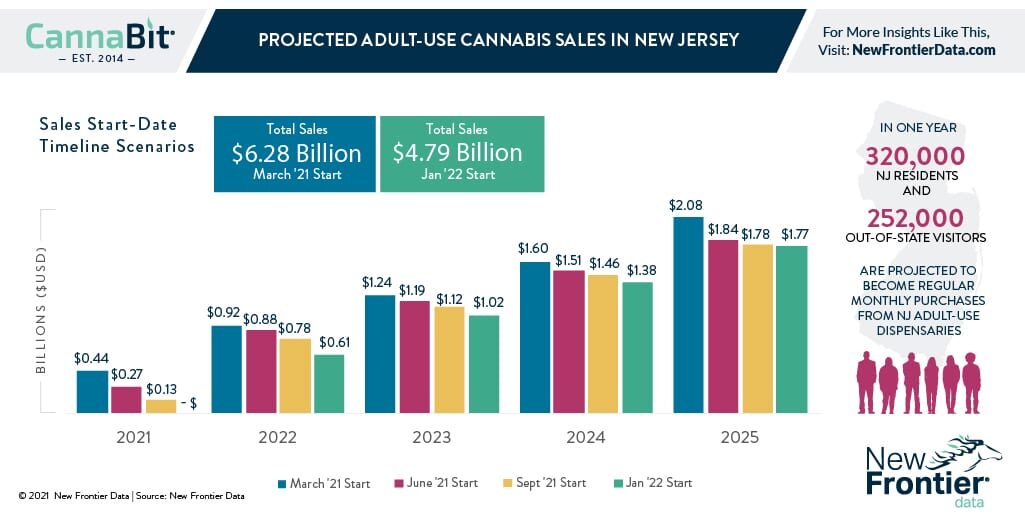

Until the legislation is passed, cannabis remains technically illegal to use in a state which approved it by 67% of voters last November. No specific regulatory process has been finalized, leaving some involved thinking that it could take anywhere from six months to a year before the legal market opens in stores. Meanwhile, what is expected to become the second-largest state adult-use market (behind California) will be stalled for generating any revenue.

Just right: New York

While its neighbor straightens up that business, New York expects its newfound Democratic supermajority to finally provide the push that Governor Andrew Cuomo failed to gather in two previous attempts to legalize recreational cannabis.

Emboldened by his party’s ability to override any Republican attempt at veto, on Jan. 6 Cuomo announced his proposal to legalize cannabis and create an equitable adult-use cannabis program which he asserted will “generate much-needed revenue while allowing us to support those that have been most harmed by decades of failed cannabis prohibition.”

The plan would establish a new regulatory Office of Cannabis Management to oversee both the proposed adult-use program and the state’s preexisting medical cannabis program. If approved later in 2021, adults over age 21 could purchase cannabis through state-approved dispensaries, with expectations for the Empire State to start reaping an estimated $300 million in annual tax revenue.