Consumer

Evolution

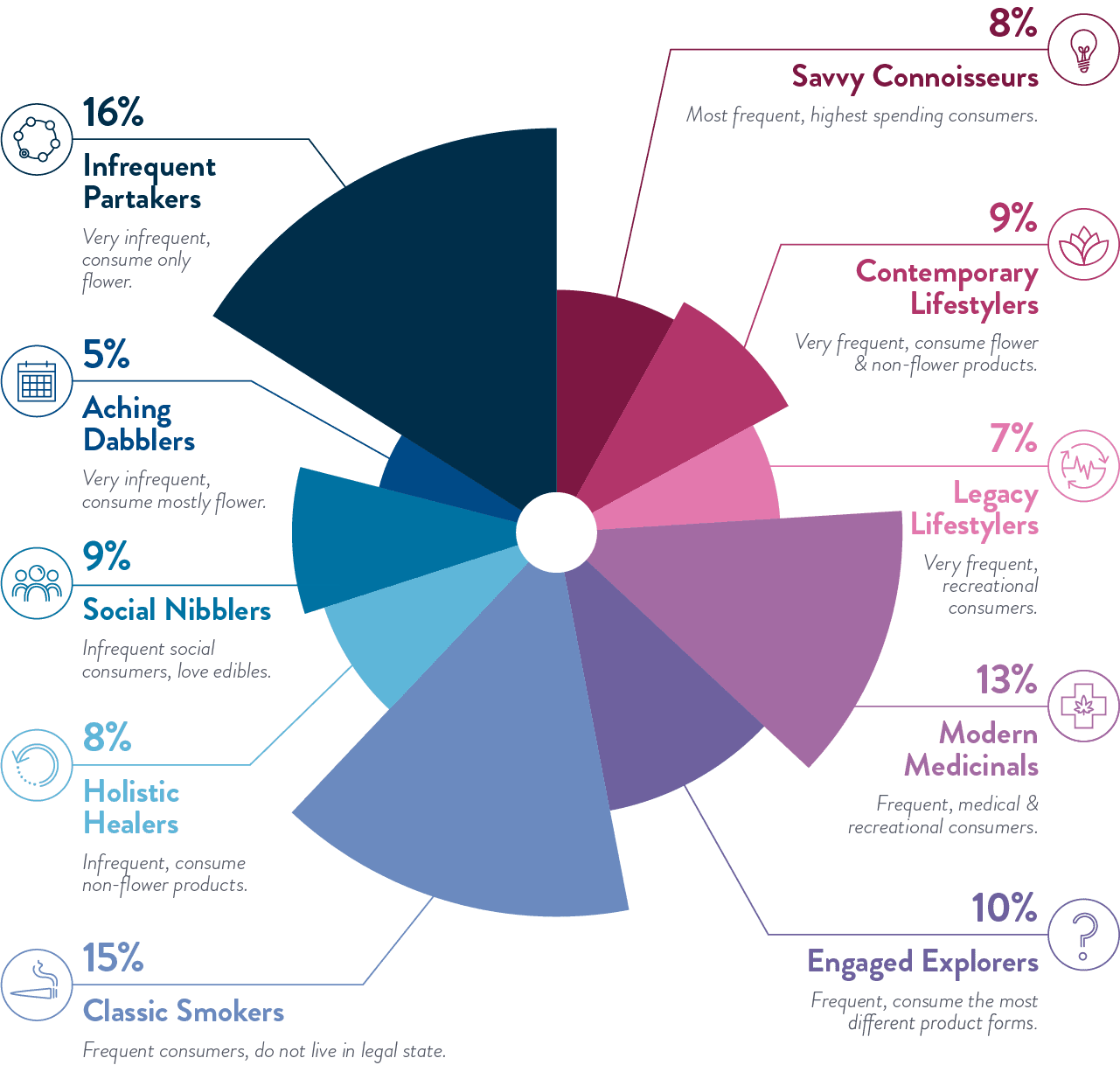

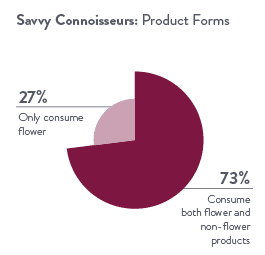

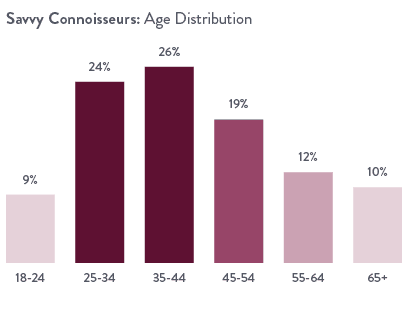

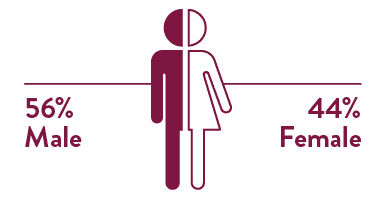

Every Archetype includes a wide range of ages, genders, education levels, and living situations. Archetypes are defined by their cannabis-related behaviors, preferences, and regulatory contexts.

ARCHETYPE SNAPSHOT:

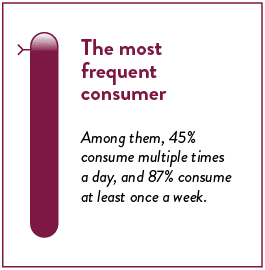

SAVVY CONNOISSEUR

Chris is a 34-year-old, small-business owner in Portland. After rapidly advancing in his career, he opened his own high-end design firm. Between the demands of career and young kids at home, Chris likes to use cannabis throughout the day – often in the morning, during breaks while working, and after the kids have gone to bed. He primarily uses cannabis for medical purposes because it both provides relief from nagging pain and helps manage his stress levels.

Watch THE CANNACLIP

DOWNLOAD THE REPORT

INDUSTRY BRIEFING

Acknowledging The Consumer

CANNABIS CONSUMER DEMOGRAPHICS

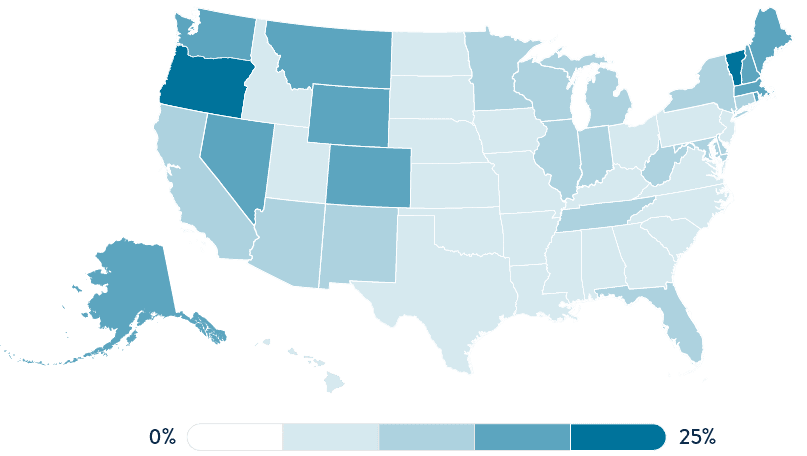

In September 2020, New Frontier Data designed and conducted an online survey of 4,601 cannabis consumers to assess attitudes, perceptions, and consumption across legal and unregulated markets in the United States. Survey themes included: cannabis use, purchasing behavior and decision influencers, product preferences and expenditures, beliefs about cannabis, and other consumption behaviors.

Reasons for Cannabis Use

Age Distribution of Cannabis Consumers

Cannabis Consumers Across Markets

thank you to our sponsors