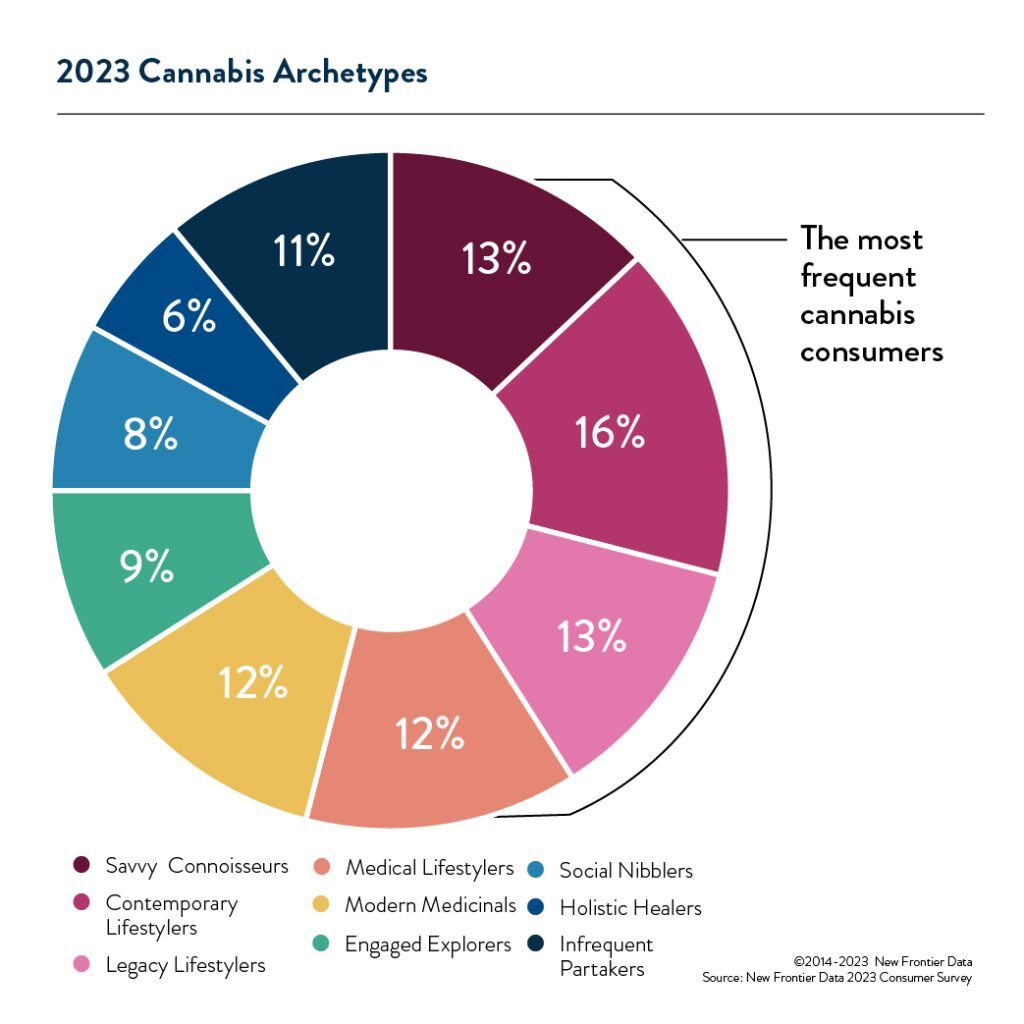

2023 Archetypes: High-Frequency Consumers

New Frontier Data and Treez Unite Cannabis Dispensary Point of Sale and Local and State Market Data to Create a New Revenue-Generating Engine for Treez Dispensary Clients

June 15, 2023

2023 Archetypes: Medium-Frequency Consumers

July 11, 2023By Dr. Molly McCann, Senior Director of Consumer Insights at New Frontier Data

In this first of three installments on New Frontier Data’s 2023 archetypes, we’ll be introducing the most frequently-consuming cannabis user types.

Our upcoming report, Cannabis Consumers in America 2023 Part 2: Exploring the Archetypes, describes New Frontier Data’s nine cannabis consumer archetypes, updated with our 2023 consumer survey data (for an overview of the survey findings, check out Cannabis Consumers in America Part 1: An overview of consumers today.

Savvy Connoisseurs (13% of consumers)

These extreme consumers typically use cannabis multiple times per day, for a wide variety of both medical and recreational reasons. They consume many different forms of cannabis—both smokable and non-smokable. Though most live in states where their access to cannabis is legal, Savvy Connoisseurs source cannabis both from regulated channels (legal dispensaries, delivery services) and informal sources (friends, illicit dealers). They are the highest spenders and most frequent purchasers, with two-thirds shopping for cannabis at least once a week. This archetype is the youngest on average, and the most likely to be a source of cannabis for friends and family.

Contemporary Lifestylers (16% of consumers)

These frequent consumers primarily use cannabis recreationally to unwind. They generally prefer smokable cannabis products, but many also use non-smokable products on occasion. All Contemporary Lifestylers live in states where their cannabis use is legal (either in adult-use states or as registered patients in medical-only states), and they use primarily regulated sources for cannabis, typically a dispensary. Contemporary Lifestylers acquire cannabis frequently, and are moderate-to-high spenders.

Medical Lifestylers (12% of consumers)

Like the Contemporary Lifestylers, the Medical Lifestylers are frequent cannabis consumers who most often use smokable cannabis but may occasionally use other edibles or other non-smokable forms. Unlike the Contemporary Lifestylers, the Medical Lifestylers use cannabis for medical reasons—such as managing pain or treating a medical condition. They generally source cannabis from legal dispensaries and delivery services. The Medical Lifestylers are the second-highest spending archetype after the Savvy Connoisseurs.

Legacy Lifestylers (13% of consumers)

Like the other Lifestyler archetypes, the Legacy Lifestylers are frequent consumers who primarily smoke their cannabis. Like the Contemporary Lifestylers, the Legacy Lifestylers are generally recreational consumers who use cannabis to unwind. But unlike their cousins in legal cannabis markets, Legacy Lifestylers are all illicit consumers—they either live in states where cannabis remains completely illegal, or they live in medical-only states but are not registered patients and so do not have access to legal dispensaries. Accordingly, they source primarily from friends and illicit dealers. Legacy Lifestylers acquire cannabis about as often and spend only slightly less than per purchase their legal counterparts, the Contemporary Lifestylers, albeit outside of the regulated context.

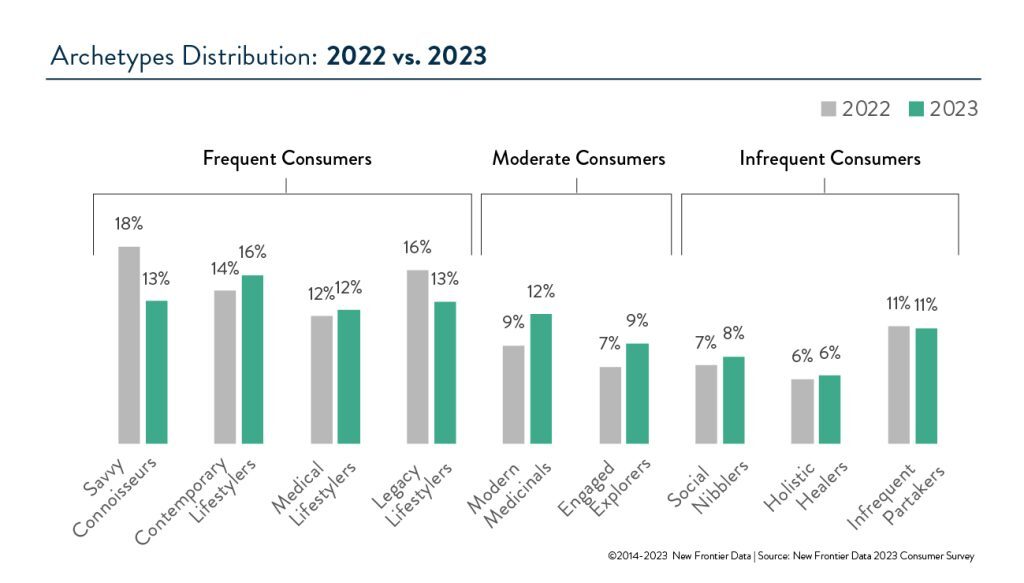

While each archetype has remained similar in the characteristics outlined above since last year; the important development has been the change in the distribution of consumers across the nine archetypes since last year, reflecting the evolution of consumer preferences as well as recent cannabis policy developments:

Fewer Illicit Consumers

One notable change since last year is the decrease in the size of the Legacy Lifestyler archetype—who made up 16% of consumers in 2022, down to 13% in 2023. The Legacy Lifestylers are the archetype most inhibited by their states’ cannabis laws. With several states—including populous markets like New York and New Jersey—expanding legal access to cannabis between our 2022 and 2023 surveys, millions more consumers find themselves in a new archetype, even if their use behaviors and motivations have not changed.

In the near term, as more legal markets come online, Legacy Lifestylers will morph into Contemporary and Medical Lifestylers, depending on whether their consumption goals are medical or recreational. In the longer term, those consumers may find that after exposure to a broader range of product forms in a legal market, they actually prefer non-combustible options, and could evolve into one of the archetypes that prefers non-flower products, either the Savvy Connoisseurs if they add non-smokable products on top of smoking, or the Engaged Explorers or Modern Medicinals if they replace much or all of their smoking with non-combustible products.

Connoisseurs Settling In

The Savvy Connoisseur is the other archetype that has shrunk in relative size since last year—from 18% to 13% of all consumers. Part of this shrinking is a result of new, less-frequent consumers becoming a larger part of the consumer space. It could also reflect a return to the new normal after further easing of pandemic restrictions—many consumers may have found themselves with more work and social obligations in early 2023 relative to early 2022 and scaled back the frequency and circumstances of their use.

The reduction in the number of Savvy Connoisseurs from 2022 to 2023 may also be reflective of consumers in newly legal markets settling into their own consumption habits. Rather than feel the need to try a variety of new products, they have figured out what they like and are creating a routine. They also may find less of a need to educate their friends about new products or procure products for their social circles as cannabis becomes more mainstream and the general public becomes more knowledgeable.

You can read more details about the consumer archetypes in the report, to be released next month.

To reach these consumers effectively with the right message, please contact our B2C division– NXTeck

NXTeck, Delivering targeted, tailored, and scalable digital campaigns in the cannabis industry is no small task. NXTeck’s cannabis consumer ‘audiences’, ‘analytics and ‘attribution’ reporting give you the power to identify, target and reach this lucrative audience with the only solution informed by location, point-of-sale, social science and the industry’s largest cannabis and CBD consumer audience dataset. To get in touch please email sales@nullnxteck.com