2023 Archetypes: Medium-Frequency Consumers

2023 Archetypes: High-Frequency Consumers

June 27, 2023

2023 Archetypes: Low-Frequency Consumers

July 25, 2023By Dr. Molly McCann, Senior Director of Consumer Insights at New Frontier Data

This is the second of three installments on New Frontier Data’s 2023 archetypes. In this blog, we’ll be introducing the medium-frequency cannabis consumers. Read about the high-frequency consumers

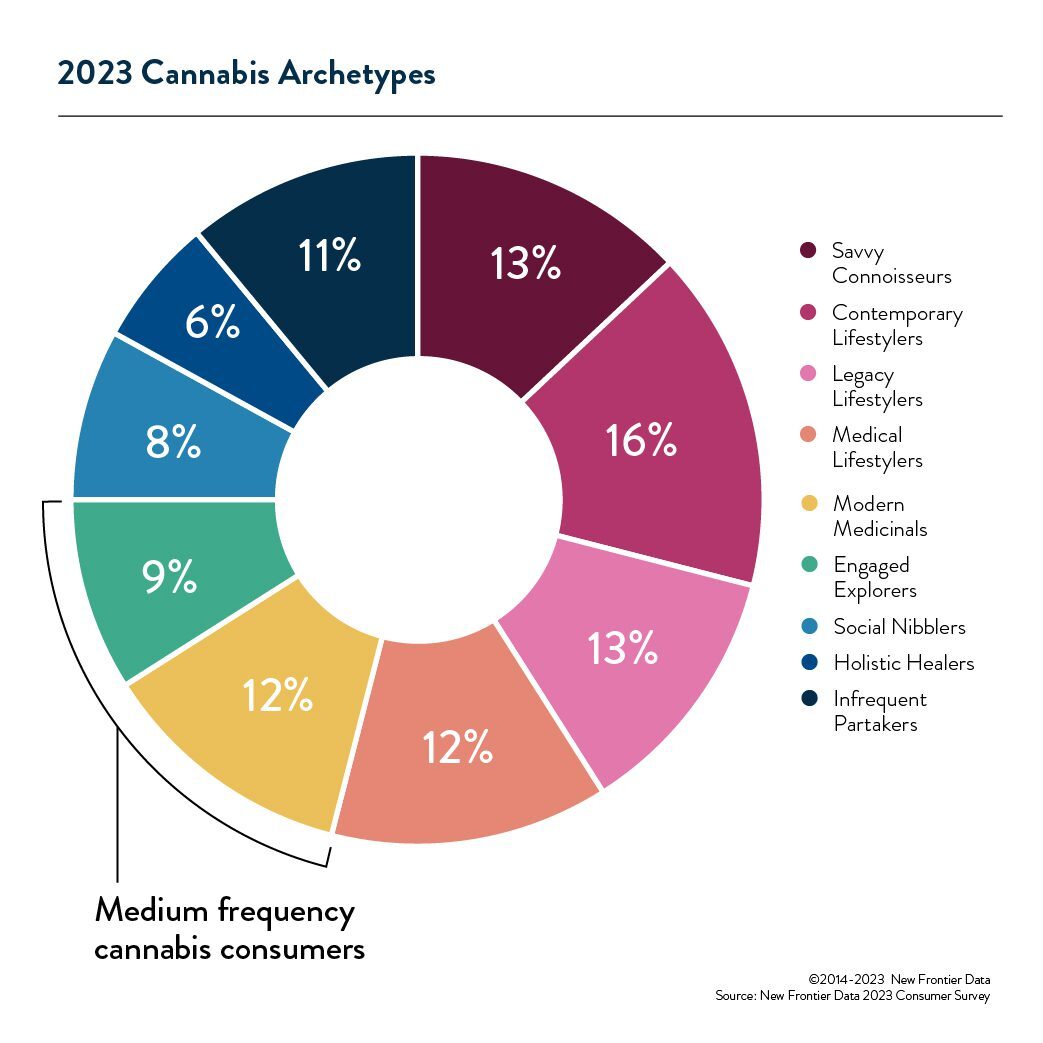

Our upcoming report—Cannabis Consumers in America 2023 – Part 2: Exploring the Archetypes—describes New Frontier Data’s nine cannabis consumer archetypes, updated with our 2023 consumer survey data (for analysis about consumers in general, check out Cannabis Consumers in America Part 1: An overview of consumers today.

While many brands are focused on wooing the heaviest-using consumers, moderate consumers have unique attributes that make them attractive to companies developing novel and wellness-based delivery methods. They are also very loyal to regulated sources and are on the higher end of the spectrum when it comes to spending. Here is a bit more about these interesting groups of consumers.

Modern Medicinals (12% of consumers)

These consumers primarily use cannabis medically to manage pain or a medical condition, though many of them also use it recreationally and to promote general wellness. Most Modern Medicinals use exclusively non-smokable forms of cannabis: from edibles and vapes to tinctures and topicals.

While Modern Medicinals exist in all market types, a majority acquire cannabis from regulated dispensaries and delivery services, which tend to be more reliable sources for nonflower products. Modern Medicinals are the most likely archetype to pay for all of the cannabis they consume (80% vs. 59% of consumers on average), meaning they purchase their own products and rarely consume cannabis that is being shared socially. They even spend more per purchase than the more frequently using Contemporary Lifestylers and Legacy Lifestylers.

Engaged Explorers (9% of consumers)

Most of these consumers describe their cannabis use as exclusively recreational, generally to relax and relieve stress. Engaged Explorers most often use non-flower forms, notably vapes, and edibles, though many also smoke cannabis on occasion.

Nearly all Engaged Explorers live in adult-use markets, where they enjoy relatively convenient access to a wide range of products. As a result, dispensaries are the leading source for the archetype. They are mid-range spenders, most spending between $20 and $99 per purchase (weekly to monthly).

Moderate Consumers Are a Growing Segment

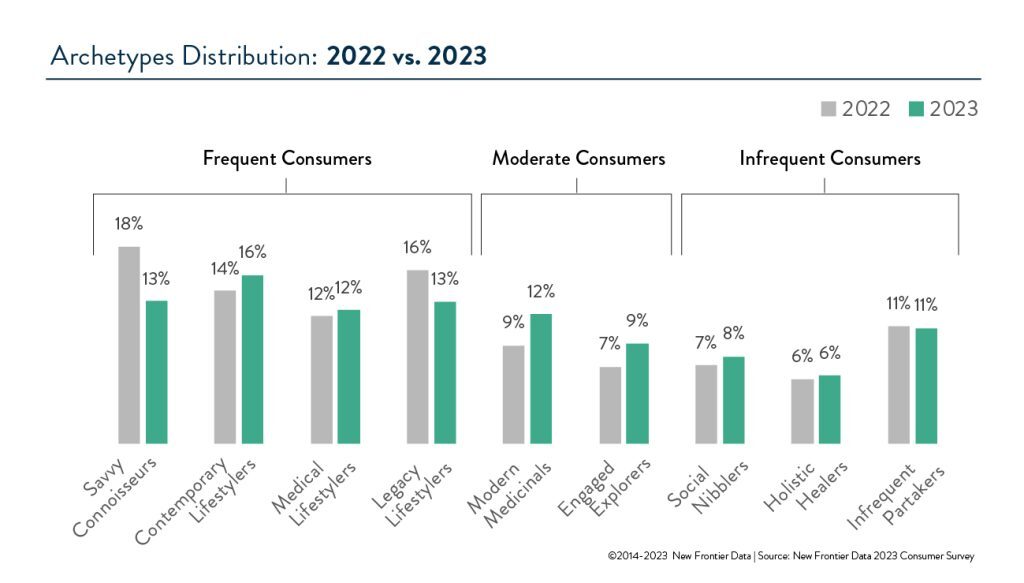

The Modern Medicinals and the Engaged Explorers are the two archetypes that have grown the most since last year. As legalization expands across the U.S., cannabis is becoming more readily accessible in dispensaries and more present in everyday life. This has led to more casual consumers joining the market. While they use less frequently than the four archetypes discussed in the last blog installment, these moderate consumers participate primarily in the legal market.

Moderate Consumers Are the Most Reliable Retail Shoppers

Modern Medicinals and Engaged Explorers are the two archetypes most likely to source primarily from cannabis retailers (dispensaries and delivery services), as opposed to informal sources like friends, family, or illicit dealers. 81% of Modern Medicinals and 82% of Engaged Explorers source primarily from businesses, compared to just 55% of consumers on average. In both cases, these archetypes’ reliance on regulated sources is related to their preference for value-added product forms; regulated outlets generally offer notably higher quality and a wider selection of non-flower products. Furthermore, because they are not hyper-frequent users, Modern Medicinals and Engaged Explorers are not as cost-sensitive as the multiple-times-per-day users, who sometimes source from the unregulated market to spend less.

In our final segment, we will explore the infrequent using archetypes, which cover many of the new and returning consumers.