As Pandemic and Politics Rage, Cannabis Industry Is Still Booming

Cannabis Spending Still on the Rise

November 15, 2020

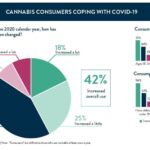

Cannabis Consumers Coping With COVID-19

November 22, 2020By Noah Tomares, Research Analyst, New Frontier Data

While issues surrounding the fiercely contested U.S. presidential election have garnered most of the media’s attention in the past few weeks, the specter of COVID-19 continues to dominate life and the economy in the nation. The pandemic’s resurgence this fall has resulted in ever-increasing numbers of daily new cases, hospitalizations, and deaths.

While outgoing President Trump has made repeated claims that the coronavirus would simply disappear in the wake of the election, it has not vanished. President-elect Biden has already adopted a more aggressive approach, having organized a coronavirus advisory board while imploring Americans to wear protective face coverings.

Given the national spike in cases, it seems possible that the U.S. may follow some European nations into effecting a second range of lockdowns. For the cannabis industry, which recently expanded to include five new states, another lockdown would represent the latest in a long string of market disruptions.

In several ways, the legal cannabis industry was better prepared for COVID-19 than were many other market sectors. Given cannabis’s federally prohibited status, operators nationwide were already used to working in cash-constrained environments. Demand for cannabis is often localized, meaning that supply chain disruptions tend to be less prevalent or impactful than among other industries. Consumption of cannabis also conforms well to social distancing, as even preceding the pandemic more than half of consumers (65%) reported always or primarily consuming cannabis alone.

Ironically, in some measures the advent of the pandemic has proven to be a boon for the cannabis industry. Several states declared cannabis as essential business, granting the industry new legitimacy, while allowing it to remain open for business. Safety measures paved the way for curbside pickup, and delivery services, and other innovative adaptations. In states with established legal markets, health concerns presumedly drove some consumers toward the legal market, and away from illicit—if indeed often cheaper—alternatives.

It has been documented that consumers stockpiled cannabis in preparation for the pandemic’s impacts on lifestyle and habits. Before the first lockdown, consumers both in Europe and the U.S. feared that access would be limited in the coming months.

Since lockdowns began, average monthly spending on cannabis has spiked. Colorado consumers spent, on average, $60 more on cannabis (+43%) in April 2020 than they had in March 2020. In Las Vegas, average spending increased by $74 (+32%) over the same period. In Massachusetts, where it was initially announced that only medical cannabis facilities would be allowed to remain open during lockdown, average sales spiked by $105 (+48%).

As consumers again prepare for more potential lockdowns, average expenditures on cannabis are again rising. In Colorado, consumer spending grew by 25% from August to September, and jumped another 38% from September to October. Likewise, Massachusetts saw spikes of 16% and 34%, respectively, over the last two months. In Las Vegas, where canna-tourism is a major driver of activity, spending increased by 11% and then 12% in the same months.

Nationally, consumers have favored traditional flower products over alternatives (i.e., vapes and edibles) during the pandemic. Last month, those products made up majorities of sales in Colorado (53%), Las Vegas (67%), and Massachusetts (56%), respectively.

While Las Vegas has increased flower products’ share of the market during the pandemic (+6% from April – October 2020), Massachusetts and Colorado have seen flower sales drop (by 3% and 6%, apiece) through the same period. It remains to be seen whether those trends will be maintained during pending lockdowns.

The incoming Biden administration will face myriad crises as it is ushered in on Jan. 20, 2021. They will be confronted by each a deadly pandemic, economic decline, and challenges both international and domestic.

Among the innumerable pressing tasks vying for the President-elect’s attention will be the direction of a national cannabis policy and related social reform.

A majority of Americans now live in legalized markets, with a corresponding majority of Congress now representing those individual and business interests. While a new if divided Congress addresses broader policy changes — including the MORE Act — cannabis is more popular than ever, suggesting that it will behoove members of both parties to consider the impacts which the cannabis industry is poised to have on an ailing economy.