Attracting Nonconsumers as Potential Legal Cannabis Customers

Familiarity Breeds Contentment with Cannabis Consumers

April 26, 2022

Cannabis Industry Stakeholders Urged to Address Social and Environmental Challenges

May 9, 2022By Noah Tomares, Research Analyst, New Frontier Data

As cannabis consumers around the country last week celebrated the proverbial high holiday for the plant on 4/20, those in New Jersey had special cause to celebrate, but missed it by a day.

More than a decade after the state’s Compassionate Use Medical Marijuana Act was signed into law, sales of recreational use of cannabis to anyone 21 or older were first allowed in the Garden State.

New Jersey’s entrance among 18 states (and the District of Columbia) with legalized cannabis for adult use comes as the plant has found increasing acceptance and normalization nationally. According to the most recent Gallup poll, more than 2 in 3 (68%) of Americans support legal cannabis.

As an East Coast recreational market, New Jersey’s dispensaries now offer a unique opportunity to individuals considering trying cannabis for the first time. If a reverse pipeline from New York may be minimalized due to logistics and New York’s having decriminalized cannabis, the proximity to the cultural and tourist mecca should nevertheless promote interest in New Jersey’s cannabis.

Nationwide, New Frontier Data found 17% of consumers reporting having purchased cannabis out of state to bring back home, while 54% say that they have never purchased cannabis outside of their state of residence.

New Jersey’s Market Precedes New York’s

After legalizing adult-use cannabis last year (medical cannabis has been legal since 2014), New York plans to begin sales later this year as the state grants licenses to retailers, with priority given to those having been (or having a family member) convicted of a cannabis-related offense.

More than 1/3rd (35%) of U.S. adults are current cannabis consumers, meaning that they consume cannabis at least annually, while fewer than 1/2 (47%) of adults claim never to have consumed cannabis. The latter cohort (47%) includes those reporting that they would consider trying cannabis (13%), along with those definitely intending to consume cannabis (34%). As new markets open, and potential consumers are first introduced to legal cannabis, it is profoundly important to understand their attitudes and motives about whether to enter the market.

Addressing Uninitiated Consumers

Among nonconsumers, circumstances likeliest to make them consider trying cannabis are typically health-related. At rates of nearly 2 in 5, nonconsumers said that they would consider either trying cannabis at their doctor’s recommendation (39%), or if they developed a medical condition treatable or manageable by cannabis (37%).

Legality also represents a significant barrier to potential consumers: 1 in 5 (20%) among consumers living in states where cannabis is illegal reported that they would consider trying it were it legalized in their state. A similar proportion (19%) of those under age 21 said that they might try cannabis once they reach legal age.

Familiarity Breeds Consumption

When asked about the current appeal of products on the market, nonconsumers were more likely to favor noncombustible/non-inhalable forms of cannabis (e.g., edibles, topicals, or infused beverages). Those products represent a viable entry point for nonconsumers, as they more closely align with familiar products.

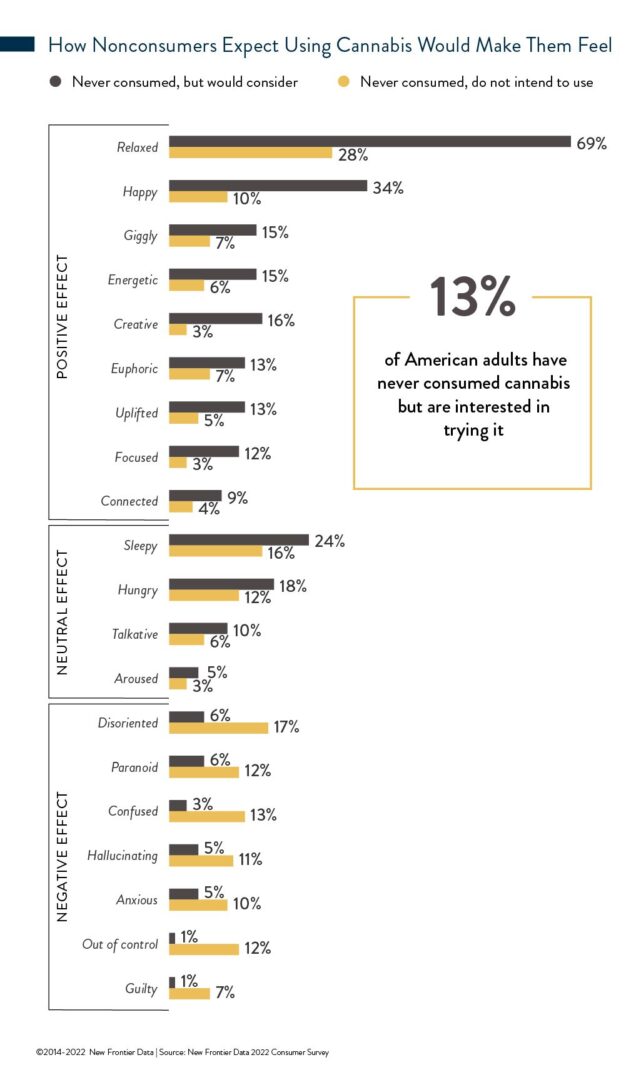

The anticipated effect of cannabis is a key consideration for potential consumers. Nonconsumers reporting unwillingness to try cannabis are more likely to anticipate a negative effect. Unwilling nonconsumers primarily anticipated feeling relaxed (28%), disoriented (17%), or sleepy (16%).

Conversely, willing nonconsumers are far likelier to anticipate more positive effects, including feeling relaxed (69%), happy (34%), or sleepy (24%).

Despite the disparate attitudes towards potential cannabis use, willing and unwilling nonconsumers shared two of the three primary anticipated effects (albeit at different rates), indicating some consistency in their perceptions.

Approaches to reframe or educate nonconsumers about cannabis’ effects may alter expectations for experiences, and may persuade reluctant individuals to try it. One in 7 nonconsumers indicated being somewhat likely to try cannabis in the following six months. As cannabis becomes more legally available, social stigma diminishes, and more consumers share experiences, nonconsumers will likely become more aware of cannabis’ typical effects, potentially disabusing their misapprehensions, and encouraging nonconsumers to try it.

For more information about cannabis consumers’ attitudes and tendencies, check out New Frontier Data’s latest report: Cannabis Consumers in America: Dynamics Shaping Normalization in 2022.