Familiarity Breeds Contentment with Cannabis Consumers

$97B in 2021 U.S. Cannabis Sales Fueled by Routine and Intentional Consumption

April 20, 2022

Attracting Nonconsumers as Potential Legal Cannabis Customers

May 3, 2022By Dr. Molly McCann Ed.D., Senior Director of Consumer Insights, New Frontier Data

As legal cannabis becomes ever more accepted by consumers, it becomes vital for brands, retailers, and operators to foster a nuanced understanding of who those consumers are, why they use the plant, and how their preferences are evolving amid rapid innovation in the product landscape.

Since 2018, New Frontier Data has surveyed more than 20,000 consumers to benchmark and analyze cannabis consumption behaviors. Cannabis Consumers in America: Dynamics Shaping Normalization in 2022, New Frontier Data’s latest report (published in partnership with cannabis wellness company Jointly), looks at behavioral drivers and social attitudes as the market’s maturity brings significant changes in how consumers are integrating cannabis into their lives.

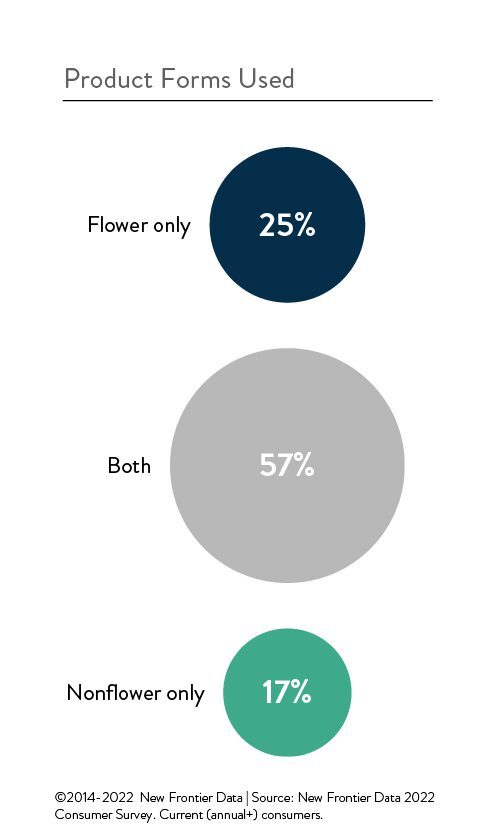

Expanding Intentions for Cannabis Consumption

The research findings continue to validate how, as the market of 49.5 million legal U.S. consumers matures, cannabis consumers are becoming more intentional about their use of the plant, both seeking specific experiences from their cannabis use and aligning the products they choose to those outcomes. While the top reasons for consuming cannabis remain largely unchanged – i.e., seeking relaxation, pain management, improving sleep outcomes, or treating medical conditions – the broadening ways to achieve desired outcomes from the wide array of products on the market is leading to significant changes to how consumers integrate cannabis into their lives. A majority (57%) of current cannabis consumers use both flower and nonflower product forms. One-quarter (25%) exclusively use flower, while 17% exclusively use nonflower forms.

Flower Remains Most Preferred

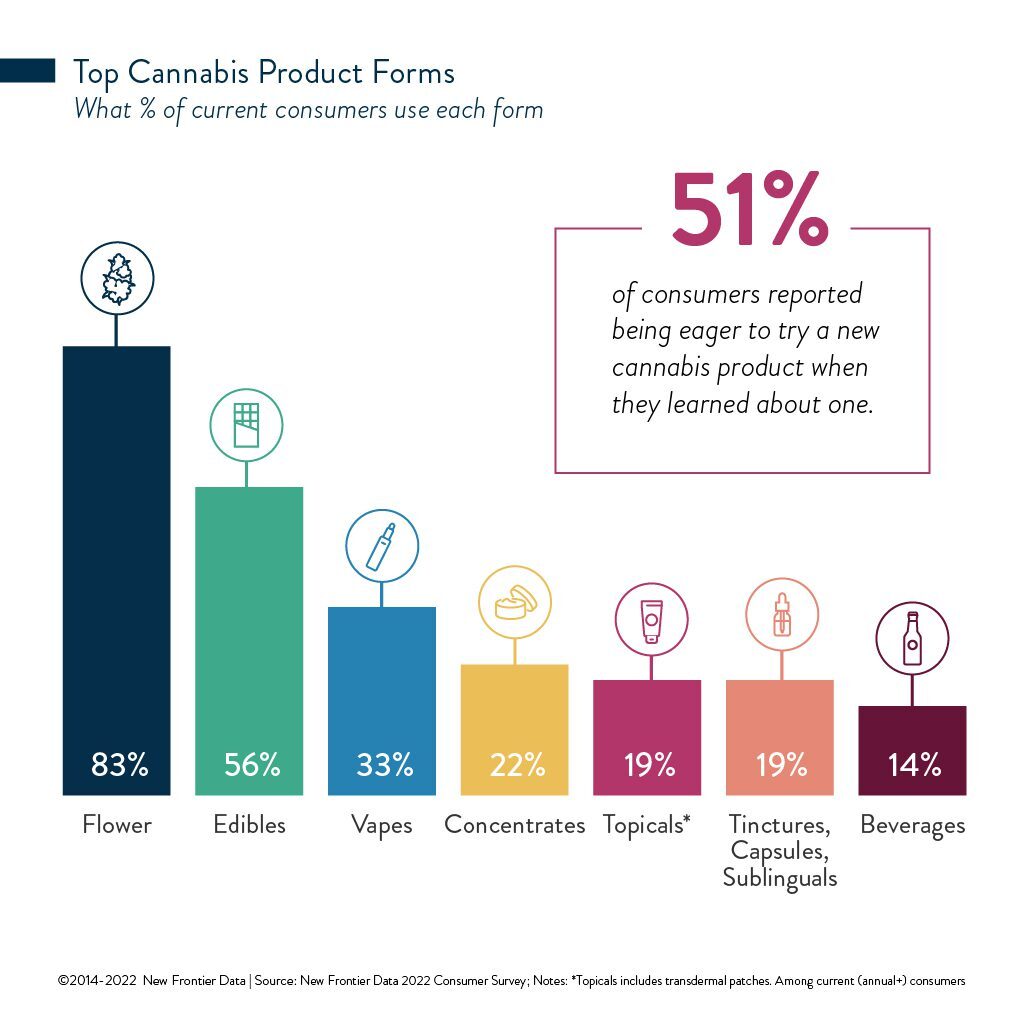

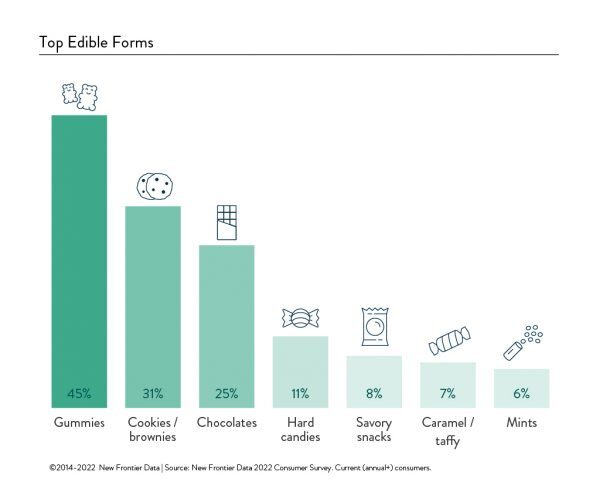

Flower remains the leading product form, currently used by 83% of consumers. Edibles were the second-most widely used product type, enjoyed by 56% of those who consume cannabis at least once per year. One-third (33%) of respondents reported using vapes, and roughly 1 in 5 (22%) reported using concentrates, while 19%, respectively, reported using either topicals, or tinctures, capsules, or sublinguals. Roughly 1 in 7 (14%) of current consumers reported drinking cannabis-infused beverages; virtually all cannabis beverage drinkers also consumed solid edibles.

In a fragmented product landscape, flower remains king. Even with hundreds of thousands of products now available in legal markets nationwide, flower’s dominance of consumer preferences and use remains unchallenged. It remains both the most widely used form of cannabis, and the favorite for consumers overall. As such, while emerging product categories including beverages and pills present significant potential opportunities to capture future demand, retailers should particularly notice the continued dominance of flower over the medium term.

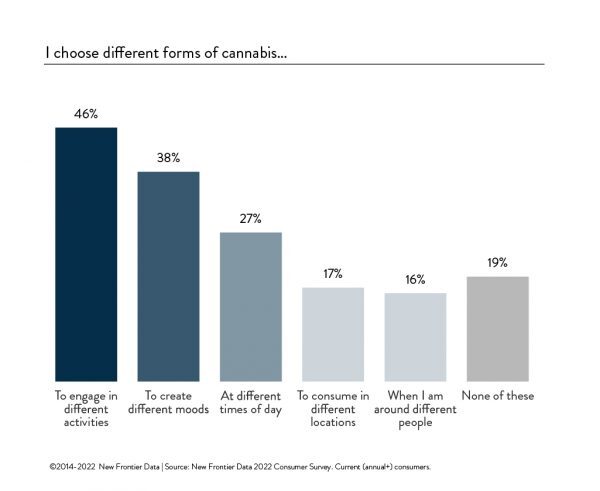

When choosing which products to consume, function dictates form: Among the majority of consumers who use more than one form of cannabis, their chosen activity is the leading determinant (46%) for the form used. Consumers’ choice of product form is also influenced by whichever mood they want to create (38%), or the time of day (27%), indicating that context and intentionality are key factors in understanding consumer behavior.

Fitting Forms to Lifestyles

The alignment of product form and activity is helping drive diversified product uses, resulting in ever more consumers’ using more than one form. For brands and product manufacturers, it is therefore increasingly important to consider the contexts for their products’ consumption. Any poor alignment can negatively impact consumer adoption, and subsequently also a company’s bottom line.

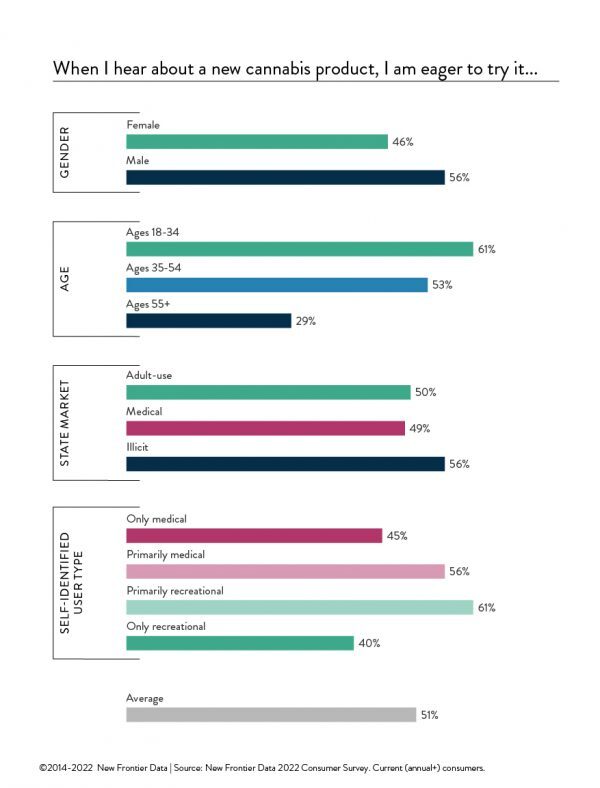

Consumer excitement to try the latest thing highlights challenges for building brand loyalty in a nascent, highly dynamic market. Even as flower remains the dominant product category, consumers are eager to explore new product offerings. More than half (51%) of all consumers say that they are eager to try new products when they learn of them, and among consumers ages 18-35, 61% express eagerness. Such enthusiasm suggests a positive environment for brands’ launching new products, even in crowded spaces, as there remains a large cross-section of consumers interested in trying a latest thing. The challenge for brands, however, is that it also suggests that brand loyalty remains low, meaning that brands cannot rest on their laurels once they have secured a customer, as that customer might be readily poached by a new entrant.