Bureaucratic Restraints Constrain Cannabis as a Commodity

Expanding Legalization and the Erosion of the Illicit Market

June 21, 2021

Canada’s Unsteady Path is No Deterrent to Competition in EU Exporting

July 6, 2021By Noah Tomares, Research Analyst, New Frontier Data

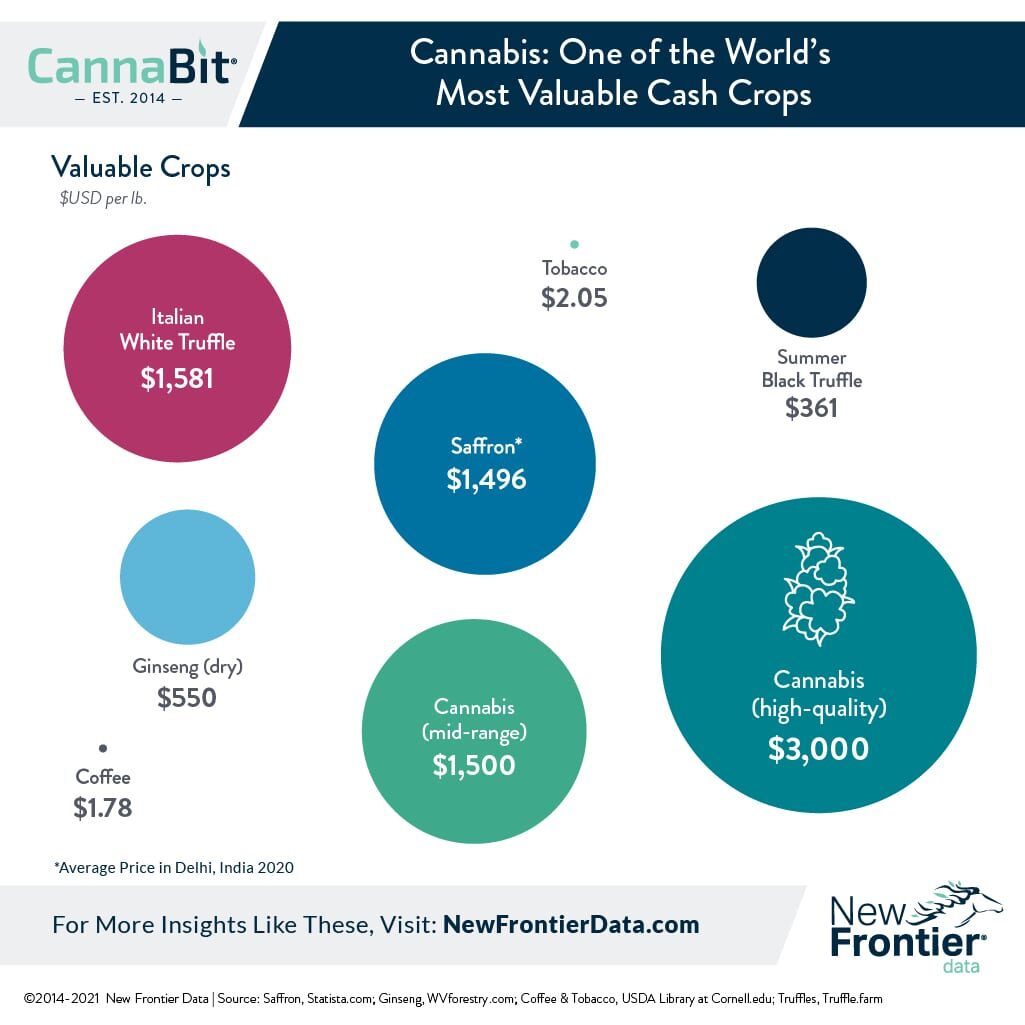

Both as the legal cannabis market generally continues its rapid expansion, and specifically during a season of drought and wildfires, improved water-use efficiency is more pressing a topic than ever. As reported in Cannabis H20 Water Use & Sustainability in Cultivation, New Frontier Data noted how in comparison to other major agricultural crops, the amount of water required to cultivate cannabis has a nominal impact regarding the total water used in farming. While cannabis cultivation required relatively trivial amounts of land and water, a tremendous amount of value is being produced for the burgeoning commodity. In the United States, a wholesale pound of quality smokable cannabis flower can fetch between $1,500 and $3,000 or more, while a pound of coffee or tobacco cost $1.78 and $2.05 per pound, respectively.

An in-depth look at water usage in the regulated cannabis cultivation market reveals how it compares to the illicit market and traditional agricultural sectors. On a per-pound basis, cannabis might be better compared to more valuable, scarce cash crops. Mid-range cannabis in the United States, costing approximately $1,500/lb., is comparable to the price a pound of saffron fetched in Delhi, India, last year ($1,496), or the same amount of Italian white truffles ($1,581). Notably, the substantial expense associated with saffron and truffles are in part derived from the labor-intensive collection process for the former, and the relative rarity and difficulty in procuring the latter.

Consequently, cannabis is not only one of the world’s most valuable cash crops, but the industry’s market value has potential to increase dramatically, with only incremental increases in production. Across the globe, nations which have legalized cannabis for either medical or adult use have found the plant to be an enticing source of additional revenue. At the same time, agricultural research and innovation should normalize cultivation practices and lead to greater resource efficiency.

However, substantial hurdles remain. Regulatory variance creates transcontinental complexity and risk. The global cannabis industry remains primarily engaged in medical markets. Consequently, countries tend to have strict and disparate regulations governing cannabis imports, which often vary widely across markets. While nations considering the importing or exporting of cannabis tend to share many of the same guiding principles, variations in the letters of the laws across countries can result in some negative externalities, introducing further difficulties for the international cannabis trade and limiting the tremendous upside potential for the lucrative cash crop.