Cannabis Industry Focal Points, 2020: 10 Market Trends for the New Year

Ten Intriguing Statistics from 2019

December 15, 2019

States With Potential to Pass New Cannabis Legalization Measures in 2020

January 12, 2020By John Kagia, Chief Knowledge Officer, New Frontier Data

As 2019 was a year of volatility and turbulence for the industry while major new markets in California and Canada lumbered (sometimes unsteadily) to gain their footholds, the legal cannabis industry’s largest companies saw dramatic declines in valuations, anticipated U.S. policy reforms failed to materialize, and capital markets tightened. Those who expected a walk in the park likely now feel trampled.

Yet for those having taken clear-eyed looks toward the long view, the horizon remains bright, and 2020 portends better clarity.

Broadly speaking, key industry fundamentals remain true:

- As public support and social acceptance of cannabis reform grows, governments will face greater pressure to legalize, and cannabis will be increasingly normalized;

- Where legal and affordable, demand for recreational cannabis will be very strong;

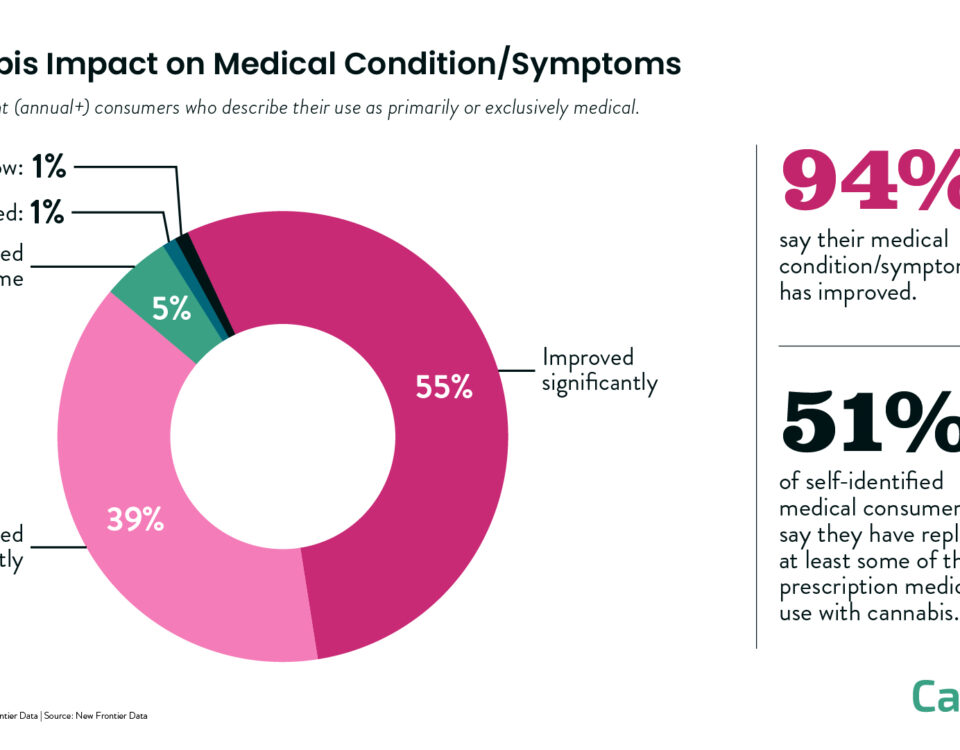

- Research and development will further advance the therapeutic value of cannabis, raise its profile as a complement or substitute for pharmaceuticals;

- Innovation will continue to drive new consumer experiences, even toward novel and disruptive applications; and

- Increased competition and scale will increase quality while lowering costs, leading to improved consumer experiences.

Those noted, some critical variables remain to be interpreted and navigated in the coming year:

- In an election year, Washington’s political climate may delay progress on federal cannabis reform even as state-level legalization gains important ground. The 2020 presidential campaigns promise to be among the most contentious in decades. In an environment where appetite for compromise is suppressed, meaningful legislative reform is unlikely. Yet, wherever Congress might stall, individual states march along: Major markets in play include New York, New Jersey, Florida, and Arizona, and legalization in each will increase pressure for federal legalization on whichever party wins the White House. Indeed, if all prospective states pass legalization measures, more than half the U.S. population will live in fully legal markets. Trends toward subnational legalization will extend internationally, especially where provincial or national governments feature a high degree of autonomy.

- Courts and causes of personal liberty will play expanding roles in advancing legalization globally. Mexico, South Africa, and Georgia each staked landmark legalization through court decisions which found cannabis prohibition in violation of civil rights. New Frontier Data is tracking developments in more markets where courts seem inclined to end prohibition, especially in countries where legal and political structures do not lend themselves to ballot initiatives or legislative approval.

- Supply-chain inefficiency will disrupt emerging markets globally as export supplies outpace import demand. As more countries legally accept medical cannabis and CBD products, production has surged. Developing countries from Colombia to Zimbabwe are investing heavily toward capacity, particularly to serve European and Asian markets. However, the small medical markets in most of the target countries will not be able to absorb the surging supply, which will leave many growers with stocks they cannot sell. The issue is compounded by lack of standard commodity trading systems for cannabis, which would enable buyers and sellers to more efficiently connect and trade. In the near term, disruptions caused by market inefficiencies will remain acute to small and heavily leveraged producers, though those companies which survive will be well positioned for growth as more countries legalize and supply chains stabilize.

- Maturation and professionalization will normalize business practices. As cannabis becomes more mainstream, executives from other economic sectors are being recruited for industry leadership positions. The need for seasoned professionals with experience navigating complex and hypercompetitive markets is becoming more acute as the industry undergoes a critical transitional phase. In addition to recruiting top talent from across the global economy, organizations are expected to offer industry-specific professional development and training programs tailored to mid- and junior-level personnel.

- The rise of hyper-segmentation and consumer targeting will deepen understanding about cannabis consumers. Big data is playing an ever-increasing role in identifying, segmenting, and targeting consumers. Using data on demographics, psychographics, consumer behavior, and geolocation, brands will be able to target consumers in increasingly granular ways. However, given cannabis consumers’ historical discretion, some may recoil about having their cannabis behavior so comprehensively mapped. While brands must move from a one-size-fits-all approach to a more nuanced understanding of who their consumers are, they must also beware being perceived as violating customers’ privacy or trust.

- Separating fact from fiction in cannabis product claims. Amid a miasma of internet trolls, bots, and deep fakes, it is becoming vitally difficult to separate truth from fiction. With CBD’s surging popularity, some companies are capitalizing on the frenzy to push products based on false or unproven claims. The FDA has already issued cease-and-desist letters to several companies for making unfounded CBD marketing claims, but policing wellness claims on the deep web is proving far more difficult. During this period of meteoric industry growth where marketing efforts have far outpaced research, consumers have need to be more vigilant in assessing health claims made about cannabis, while regulators need to be more proactive in pursing companies making false or misleading claims.

- Increased public funding of cannabis research will inform policy, shape public opinion. Historically, national funding for cannabis research has focused on identifying negative health and social effects. However, as more governments transition to fully legal markets, both national and state-level governments are allocating more resources toward understanding the therapeutic potential of cannabis. Since government policies have historically lagged behind public opinion regarding cannabis, new government-funded studies will provide important insights in reorienting public policy away from stigma-based prohibition to science-based regulation.

- Even as drug testing becomes more precise, questions persist about impairment. As the first roadside cannabis breathalyzers begin to roll out, real questions remain regarding what constitutes impairment. Given wide variance in how individuals process and tolerate cannabis, and recognizing that cannabis residue lingers in the bloodstream for weeks after use, tests which detect active metabolites (indicating use within the preceding few hours) will be imperative to the issue, whether on the roads or in a standard workplace. Pending consensus on a uniform measure of impairment, however, significant questions will remain about how to assess which and to what extents drivers and employees pose risks to public safety.

- Greater focus on cannabis’ role in sustainability amid climate change. Wildfires raging in Australia signify but the latest environmental catastrophe raising concerns about the long-term impacts of climate change. Hemp, especially, is drawing focus for potential solutions to a spectrum of environmental challenges, from sustainable building solutions to house the world’s surging population, to need for plastic alternatives to mitigate the ecological damage of microplastic pollution. Hemp-derived cardboard could replace wood-based options in shipping, while hemp-based textiles seem increasingly obvious as alternatives to more resource-intensive staples like cotton.

With U.S. hemp having only been legalized again for about a year, new investment in its myriad applications has only begun. The coming year should mark significant growth in investment, with further commercialization of novel applications.

- Amid intensifying competition, litigation will take hold as a competitive strategy. In addition to increased discrepancies centered around intellectual property claims and breaches of contract, more lawsuits are anticipated to change regulations, block issuance of licenses, raise barriers to entry, or otherwise make the operating environment more challenging for competitors. While such tactics may be effective in serving the interests of some, they also create risks for a less efficient market, increasing retail costs, and ultimately slowing the transition of consumers from the illicit to the legal market, a fundamental objective of legalization.