Cannabis Marketers Express Optimism About Growth Opportunities at Denver Summit

How Concerning Is Inflation for Cannabis Consumers?

June 10, 2022

39% of Millennial Cannabis Users Report Consuming Multiple Times a Day

June 15, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

“Last year, there were about 50 million unique individuals who legally purchased cannabis in the United States. There are about 164 million pro-cannabis consumers in the United States, which means that there are a little over 100 million people sitting on the bench… Our job is to bring those consumers into this market.”

That was the proverbial gauntlet tossed by New Frontier Data’s CEO Gary Allen to attendees of last week’s Cannabis Marketing Summit in Denver. On the heels of releasing our 2022 Cannabis Digital Marketing Survey, he and VP of Marketing & Communications Susan Hammann were featured speakers at the event, a three-day summit exploring best practices, strategies, data, and measurement tools.

Anticipating 18 New State Markets by 2030

Based on New Frontier Data’s analysis of state legalization efforts, there are nine states demonstrating strong likelihood to legalize adult-use cannabis by 2030, with another nine states likely to legalize it for medical use. Should all 18 states indeed enact those measures over the next eight years, it would add an additional $14.5 billion (from a projected $58 billion to $72 billion) to U.S. legal retail sales by 2030. The new markets would increase the percentage of Americans living in states with some form of legal cannabis access to 96%, and of those living in states with legal access to adult-use cannabis to 64%.

“That’s a lot of money, a lot of consumers, and massive opportunity,” noted Lisa Buffo, founder and CEO of the Cannabis Marketing Association. “Marketing budgets typically account for between 5% and 20% of annual revenue; cannabis budgets appear to fall on the lower end of that scale. Even 5% of a $58 billion industry equates to $2.9 billion spent on marketing and advertising. With that much money and effort, marketers need resources and best practices to verify return on that investment.”

New York’s Cannabis Control Board this month approved new packaging and marketing rules for legal cannabis. Plain, child-resistant packaging and labeling will note that the product contains cannabis with THC. Cannabis marketers will be able to plug their products on TV and radio and social media just as beer and liquor manufacturers do, while banning the targeting of minors either through celebrity endorsements or images of cartoon characters or toys. Also prohibited will be promoting products with slang such as “pot”, “stoner”, or “weed”. Each package of cannabis, edibles, or concentrates will show the universal state symbol of approval (containing a yellow THC flower in a triangle, with 21+ symbol in a red circle atop the New York State logo), with the state label confirming that the product is legitimately licensed and lab-tested.

At the other end of the promotional spectrum, the town of Moffat, Colorado’s board of trustees last week discussed changing the town’s name to Kush to promote its legal cannabis industry. Last year, the town reportedly collected some $400,000 in excise taxes (up from $80,000 five years earlier), nearly all of them from cannabis.

Identifying a Brand’s Audience

In the course of conducting the marketing survey, NXTeck (New Frontier Data’s AdTech division) asked industry marketers about the current state of cannabis marketing practices, applying a focus on digital tools.

Several themes emerged. More than 80% reported difficulty getting the right message to the right audience. Cannabis marketers currently focus a lot of their limited resources on social media and other top-of-funnel brand awareness campaigns. Most cannabis marketers work with shoestring budgets; nearly half of all respondents reported having annual budgets less than $50,000.

Cannabis marketers are misusing or underusing channels that perform well, presenting strategic opportunities to improve results from bottom-of-funnel efforts like email marketing and programmatic advertising campaigns. While dealing with typically limited budgets and small marketing teams – budget constraints (63%) and staffing constraints (46%) topped the list of challenges – most cannabis marketers have ambitious goals. Many have national campaigns underway, and market to both businesses and consumers – stretching resources even thinner.

Delivering the right messages to their best audiences will only become more difficult as the number and diversity of U.S. cannabis consumers continues to grow rapidly. Yet, they have the power to overcome those challenges.

In New Frontier Data’s business intelligence platform Equio, the NXTeck Audience Builder tool allows users to choose a variety of filters to best identify and select their target market(s), consumer types, and product preferences to reveal their market potential, as backed by the largest set of cannabis consumer data available in the market.

NXTeck is the only cannabis-industry solution informed by location, point-of-sale, social science, and consumer data. It affords access to the largest database of cannabis consumers through first-party location and point-of-sale data for 88% of the market.

Achieving Balance to Help the Bottom Line

“The return isn’t always in revenue,” Allen reminded the conference attendees. “It’s developing the brand, the engagement. It’s also about knowing which [key performance indicators] to track, and which KPIs to communicate to the executive team… understanding that with certain campaigns, it’s not always about the revenue.”

Striking the right balance is vital. “It’s really important for us to understand that we need revenue, we need customers – obviously consumers – but again,” Allen elaborated, “we still do need to build the brand.”

He stressed how the nascent industry still has lots of capacity for establishing a market niche. “In our consumer survey, we found that 73% of all consumers didn’t [care about] what your brand is, they care what your price is. That’s it.”

When asked, “what is your average marketing email open rate?,” 14% of the marketing survey respondents said “not sure,” but 32% of respondents reported an average marketing email open rate equal to or greater than 20%. Understanding the importance of improving open rates can lead to monumental improvements in campaign performance. Even more marketing respondents are overlooking powerful yet slightly more advanced optimization strategies; fewer than half (47%) conduct A/B testing as part of their campaign implementation, for example. These and other tried-and-true strategies have been proving their worth in other industries for well over a decade, and marketers can expect to see improved results as they move to adopt these best practices.

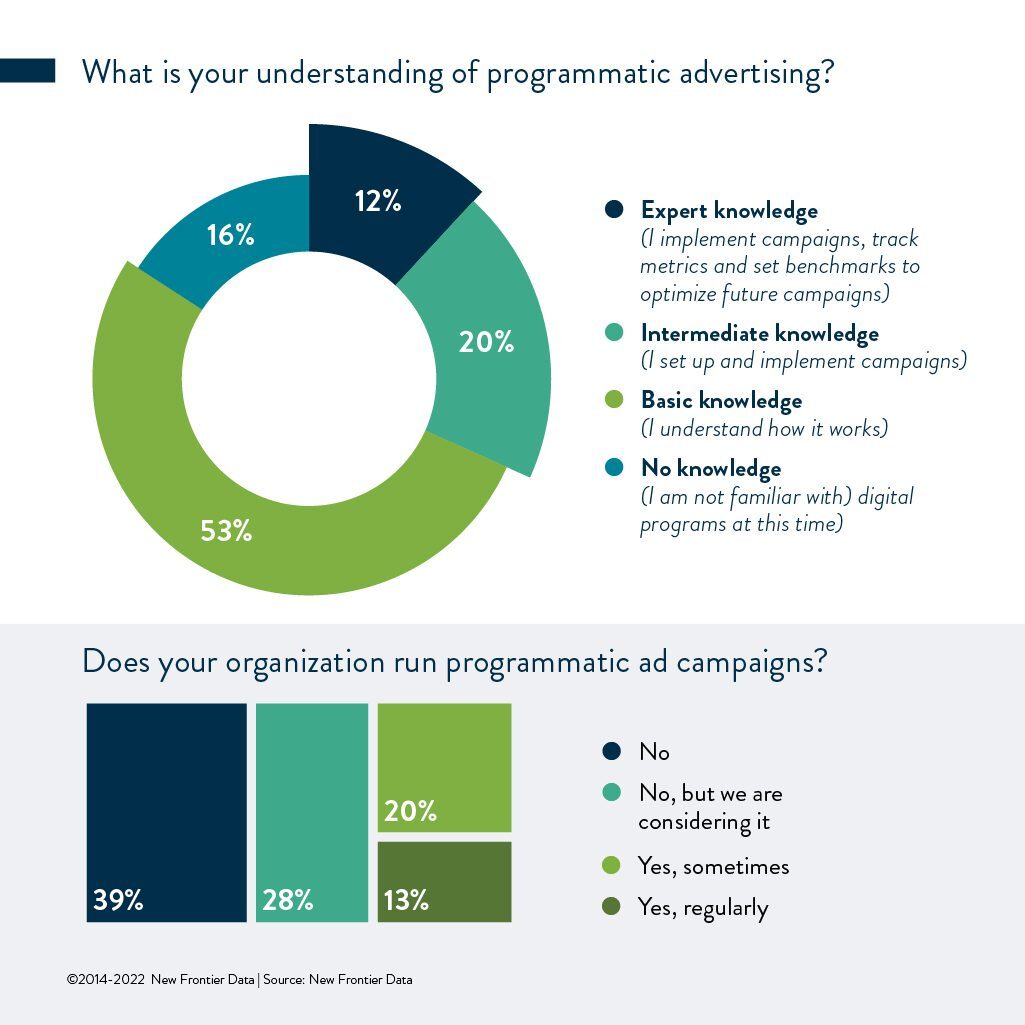

The same is true with paid media. Marketers reported running campaigns in a variety of different top-of-funnel ad channels in 2021, but only 27% implemented programmatic ads. Despite the fact that programmatic ads have the unique ability to connect online, mobile, and point-of-sales ads to a targeted subset of cannabis consumers for any given brand, more than two-thirds of respondents reported having only a basic knowledge of programmatic advertising.

As more marketers learn and embrace the different strengths of various ad channels and put them to work in unison, results are sure to increase. Cannabis brands of all kinds should work to better coordinate their media buys to raise (top-of-funnel) brand awareness and convert prospects to (bottom-of-funnel) sales. Those that evolve their media buying habits most quickly will seize the competitive advantage.