Fueled by Innovation and Consumer Demand, Infused-Product Niche Riding New Highs

Profitability vs. Accountability: Questions and Unintended Consequences Amid Delta-8 THC Debate

August 2, 2021

Facing Extreme Weather and a Changing Climate, Cannabis Producers Must Adapt.

August 16, 2021By John Kagia, Chief Knowledge Officer, New Frontier Data

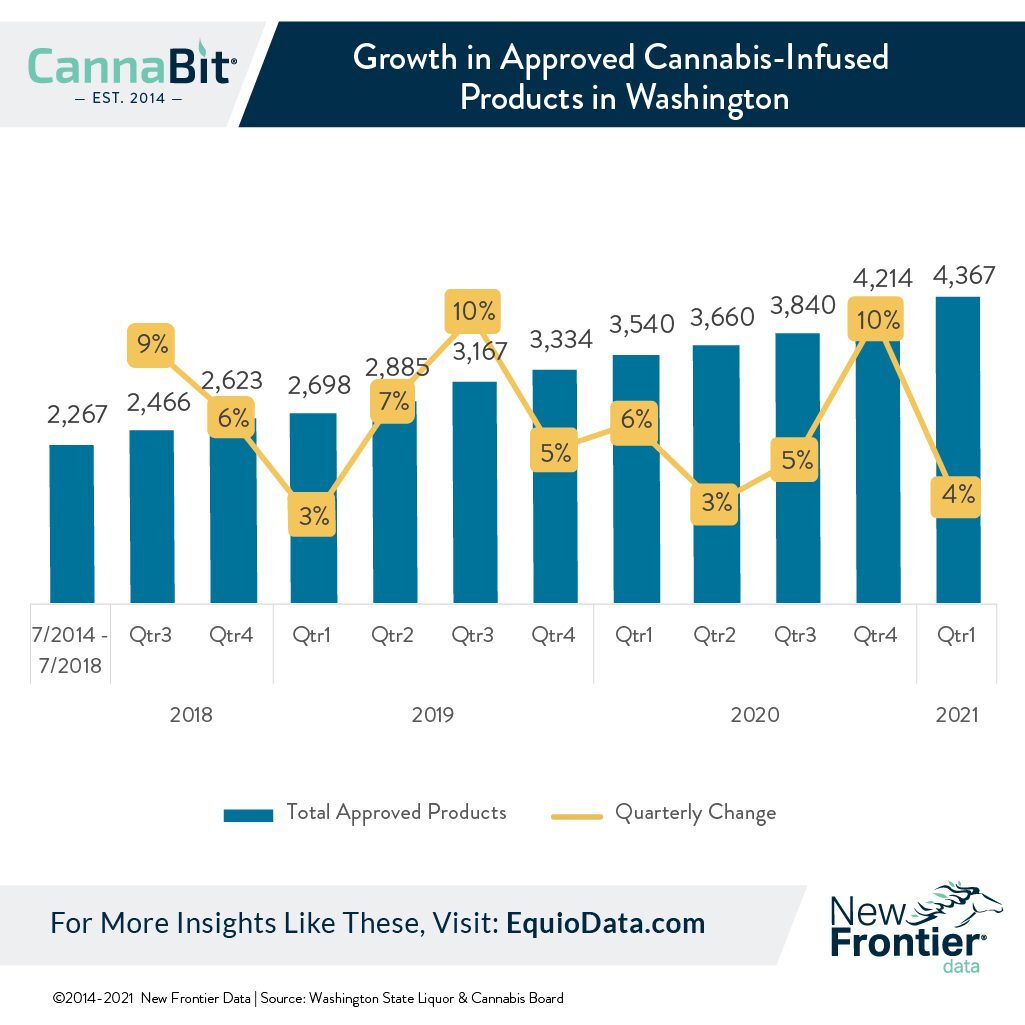

Propelled by surging consumer demand for noncombustible-based options in adult-use cannabis, Washington state’s highly fragmented ingestible product market has grown twice as fast in the past two years as it did in the previous four years (i.e., 2014-’18). In the past 2.5 years, the variety of new, approved products has consistently expanded ~5% to 10% each quarter, a trend which New Frontier Data finds likely to continue for the foreseeable future as both advancements in product formulations and heightened consumer sophistication regarding product profiles meld for increasingly refined consumer experiences.

The promotion of available products in Washington is being led by an elite group of companies which serve to underscoring the industry’s continuing consolidation. But five (less than 2%) among the approved 260 manufacturers are currently supply nearly one-quarter (22%) of more than 4,300 products on the market. Thirty companies (about 12% of approved manufactures) are producing 55% of the approved product catalog. Conversely, more than 60% of manufacturers busy themselves with making fewer than 10 products apiece, highlighting the fragmentation and diversification among smaller players in the space.

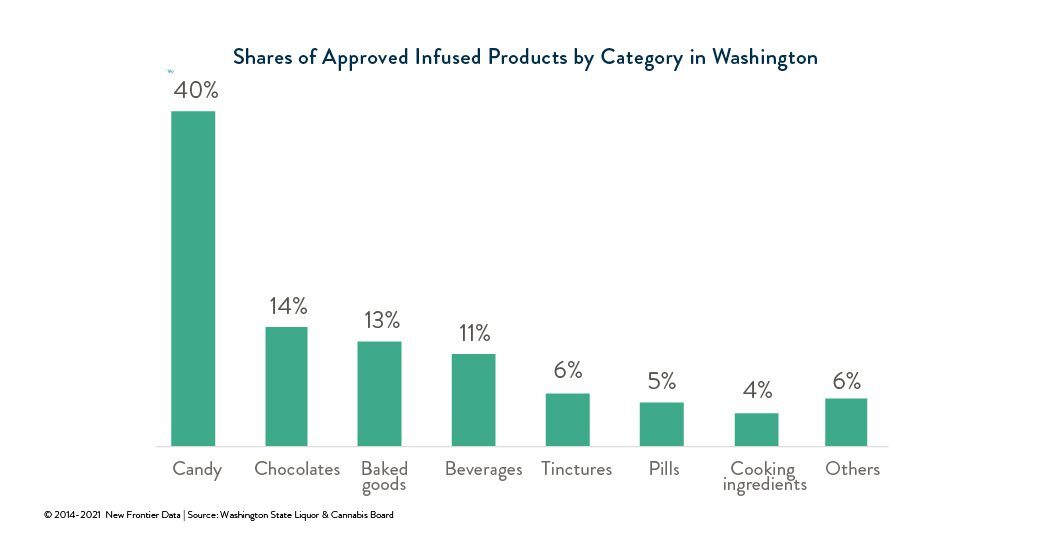

As a category, candy continues to lead the market, though its share has fallen well below half of the market as consumers embrace both sweet and savory goods (e.g., baked goods, beverages, chips, or cooking ingredients like cannabis-infused oils). Recent advancements in emulsification allow manufacturers to create uniform infusions in a nearly limitless range of ingredients, enabling them to push farther afield from well-tested forms. Such advancements have also opened the market to DIY products, (e.g., water-soluble powders) which afford consumers carte blanche for which edible forms to infuse, and at which potency.

The profusion in product offerings will make it increasingly difficult for companies with undifferentiated products to compete in the increasingly crowded market. However, opportunities to create new and novel infused product forms should ensure that —even while large companies become increasingly dominant — small operators with unique, high-quality offerings targeted at well-defined audiences should have opportunities to establish themselves in the sector.

The growth of infused products coincides with a sea change in cannabis consumer preferences: According to New Frontier Data’s latest cannabis consumer research, 51% of cannabis consumers now use both combustible and noncombustible products, and one-fifth (20%) exclusively choose noncombustible forms. Since 2018, the percentage of consumers reporting their use of edibles jumped from 35% to 54% of the demographic (a climb of 54%), while those who using topicals essentially doubled (i.e., from 9% to 17%).

The adoption of infused products has been especially pronounced in legal markets. Sixty percent of consumers in legal markets reported using edibles, compared to 49% among those living in markets without legal access. Similarly, legal-market consumers were nearly twice as likely (at 15%) to report consuming infused beverages than were those (8%) in unregulated markets.

While combustible products such as flower and extracts can be produced at scale in the illicit market, the legal market has a unique advantage with infused products. Due to the scale of infrastructure required to manufacture, package, store, and transport the products to market, the availability of high-quality, infused products has been key in getting consumers in legal markets to purchase from licensed dispensaries, since the illicit market more commonly tends to limit its range of high-quality products.

In the near term, innovators and entrepreneurs will continue to rush new products to market to see which forms and formulations are likeliest to resonate with consumers. As the data from Washington has shown, manufacturers are increasingly offering infused versions of almost any commonly available ingestible consumer product. However, as the sector grows and leaders consolidate, New Frontier Data expects product diversity to shrink as consumers content themselves with favored products and preferred brands, effectively pushing undifferentiated and uncompetitive products out of the market.

For more detailed insights about product preferences and trends across legal markets in the United States, visit and explore Equio for a free 7-day trial of New Frontier Data’s premier cannabis business intelligence platform.