Profitability vs. Accountability: Questions and Unintended Consequences Amid Delta-8 THC Debate

New Frontier Data Releases First Comparative Study on EU and US Cannabis Regulations

July 28, 2021

Fueled by Innovation and Consumer Demand, Infused-Product Niche Riding New Highs

August 9, 2021By J.J. McCoy, Senior Managing Editor, New Frontier Data

In an increasingly expanding industry characterized by uneven approaches and patchwork regulations nationwide, one constant is a lack of clarity. The evolution of cannabis regulations will continue to feature some complex and often chaotic undertakings, and the meteoric popularity of delta-8 THC (D8) throughout the United States is a prime example of an innovative product’s filling a void via a regulatory loophole.

Technically, D8 is not extracted from hemp, but instead produced chemically through isomerization of CBD that can be extracted from the plant. According to the letter of the law spelled out in the 2018 Farm Bill, all hemp-derived cannabinoids with a delta-9 THC concentration under 0.3% are lawful, but “synthetically derived” THC remains prohibited. As a derivative compound of CBD, D8 has escaped widespread scrutiny thanks to ambiguity in how it is classified by federal and state authorities.

As detailed in New Frontier Data’s latest report, 2021 Cannabis Regulatory Landscape: Emerging Trends in North America & Europe, the evolution of cannabis regulations will continue to be a complex and often chaotic undertaking. The strong likelihood that delta-8 THC will ultimately be classified as an analog of delta-9 THC (and thereby subject to the same restrictions), underscores the importance of closely monitoring the regulatory environment and preparing one’s business for policy changes. In the case of D8, producers will enjoy a brief period of limited regulation, high prices, and strong consumer demand. However, once fully regulated, opportunities will likely be limited if not prohibitive, with significantly higher barriers to entry.

The 2018 Farm Bill defines hemp and its byproducts as “all derivatives, extracts, cannabinoids, isomers, acids, salts, and salts of isomers, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent.” Based on that language, D8 is legal by virtue of its not containing any delta-9 THC.

Meanwhile, processors found that they could earn significantly higher returns by converting CBD isolate into D8 (a slightly less potent psychoactive compound than delta-9 THC) through a relatively simple chemical process. With supply borne of a glut in biomass, American hemp farmers enthusiastically jumped at the chance to unload their surplus while consumers nationwide enjoyed the sudden availability of D8’s (comparatively mild) psychoactive effects even among states where cannabis remains prohibited either for adult-use or medical consumption. The growth of the market for it, and the challenges which regulators have continued to face in trying to determine how to regulate it, illustrate the challenges that policymakers face as they try to govern a D8 market experiencing unprecedented growth.

As New Frontier Data reported earlier this year, delta-8 THC’s legal status is ambivalent at best: The nature of the loophole having allowed for its production and sale was couched in the legal interpretation of “synthetic”: The 2018 Farm Bill states that all cannabinoids derived from hemp with a delta-9 THC concentration of less than 0.3% are lawful, but adds that “synthetically derived” THC remains illegal. Though D8 is organically present in some hemp cultivars, it can also be readily derived from CBD molecules collected from hemp – allowing for delineation of D8 to become ever more blurred.

Now, as the compound’s popularity continues to gain currency, state regulators and lawmakers are playing some legislative catch-up to rein it in, if not ban it outright as some of the largest U.S. cannabis companies intend.

While some lawmakers in Texas remain adamant about keeping cannabis illegal for adult use, they have meanwhile effectively defended the use of D8 in consumable hemp products. Proponents of D8 in the Lone Star State recently fended off a bill in the state legislature to outlaw sales of the compound (whether in gas stations or distributed nationwide by mail).

Even trade groups find themselves at odds over it: While the U.S. Hemp Roundtable warns that advertising D8 products as “hemp with a high” could jeopardize the crop’s hard-won federal legal status through the 2018 Farm Bill, the Hemp Industries Association worries that some lawmakers are too quick to crack down on an increasingly popular (and profitable) consumer product. While the National Industrial Hemp Council is reportedly working with Congress to address issues at the federal level to preclude states’ intervention, Hemp Benchmarks is keeping running track of policy updates state-by-state.

In August 2020, the DEA released its Interim Final Rule for hemp, ostensibly banning D8 along with all variations of tetrahydrocannabinol molecules. Yet, patchwork regulations and uneven enforcement of the rule have spurred legal challenges questioning the DEA’s authority to legislate it via policy, while the entrance of a more cannabis-tolerant Biden administration has thus far tempered enforcement action from the agency.

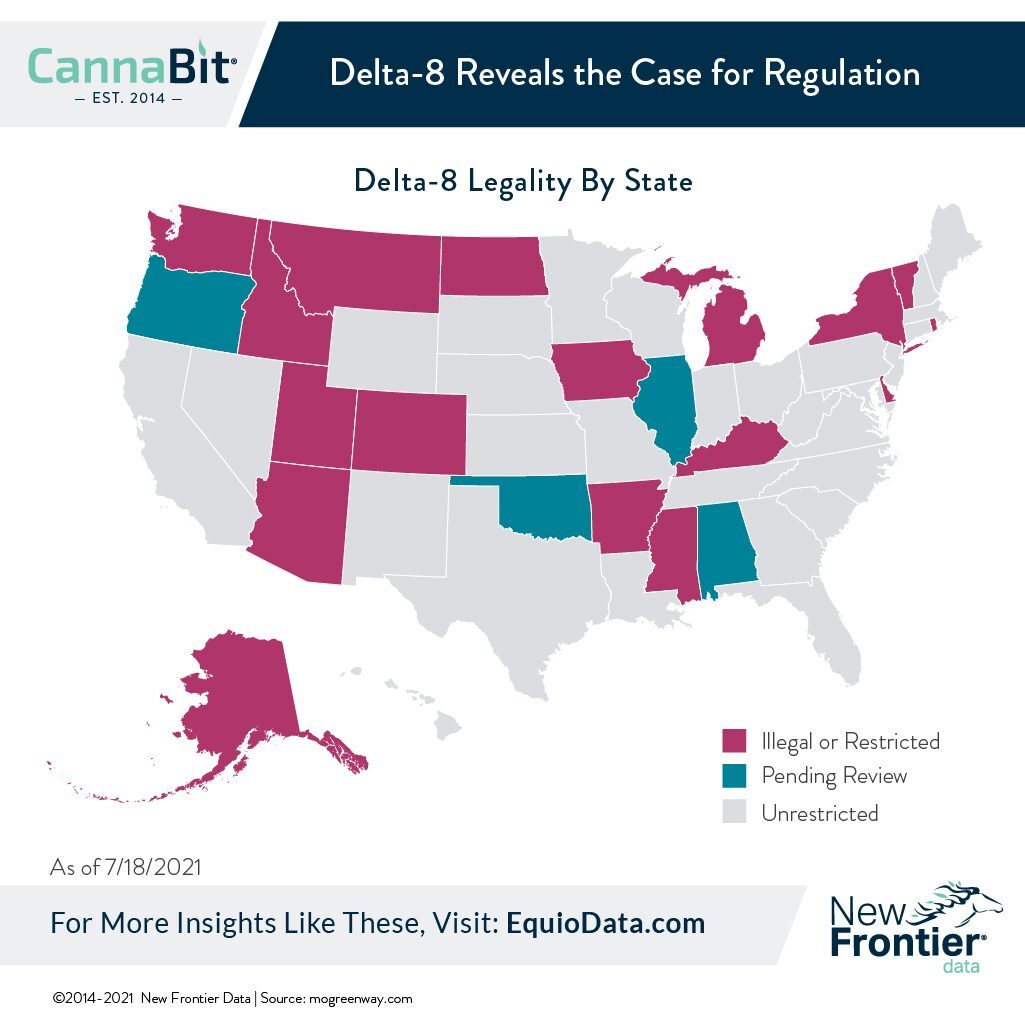

As of the end of July, 34 states and the District of Columbia were reportedly allowing production, sale, possession, or consumption of delta-8 THC, while 16 states had restricted or banned such (with legislative reviews pending in five states).

Meantime, of course, cannabinoid extractors facing a massive surplus of hemp-derived CBD seized upon the opportunity. While some producers and marketers are touting D8’s purported benefits for relieving pain, anxiety, and nausea, others are brazenly exploiting its psychoactive properties, marketing it as a kind of “marijuana-lite”. Meanwhile, the nationwide lack of product standards or consistent dosing recommendations are raising concerns among hemp industry advocates, public health officials, and legal cannabis producers alike.

As recently reported by Chemical Engineering and News, concerns range beyond unintended consequences from unidentified by-products and lack of regulatory oversight, to producers cutting corners in favor of profit motive over either sound chemistry or professional ethics. Kyle Boyar, staff research associate at the University of California San Diego’s Center for Medicinal Cannabis Research, was quoted in fearing that “a lot of irresponsible production is going on in the sense that most of these people are getting their information from online forums, and many of them aren’t necessarily trained chemists.”

In a pharmaceutical laboratory’s environment, Ph.D. chemists ensure that products do not include harmful unconsumed reactants. But with unregulated D8 production, no one is reliably measuring pH levels or testing for strong acids and residual metals left behind through the process, much less tracking health effects or risks posed by the impurities.

To date, the only reported – and very small – clinical trial of D8 was observed more than 25 years ago, when Raphael Mechoulam, famed professor of medicinal chemistry at Hebrew University of Jerusalem and the former president of the International Cannabinoid Research Society, administered it to eight pediatric cancer patients in conjunction with chemotherapy sessions. By Mechoulam’s own account, “no one has taken delta-8 [THC] and delta-9 [THC] and given them to healthy people and tracked the difference. And even the effects of delta-9 [THC] depend greatly on the dose.”

The uncertainty amid politics and profits has been underscored by the U.S. Cannabis Council (USCC), which sponsored its own D8 study, including a summary that “the fact that it is being sold outside of the regulated marketplace with no oversight or testing and is readily available to children is alarming, and it presents a public health risk of potentially wider impact than the vape crisis.” The USCC’s sample testing of products purchased in eight different states reportedly found potentially harmful compounds including chromium, copper, lead, and nickel, along with unsafe solvents including acetone, dichloromethane, ethyl acetate, heptane, hexane, isopropanol, and methanol.

Such findings illustrate the degree to which regulations are inconsistent across markets even where some general agreement might be expected, such as in the U.S. or the EU. It is likely that such inconsistencies will persist for the foreseeable future as markets continue to evolve.

What can be generally agreed upon for the moment is that the controversy is indication of a maturing industry seeking safeguards and legitimacy. That legal cannabis companies and state governments from Colorado and California to New York are calling for federal intervention and nationwide regulation is further indication that the times indeed keep changing.