Home Is Where the Flower Is: Cannabis Homegrowers on the Rise

Cultivating the Homegrowing Consumer

August 9, 2022

Opportunities Outweigh Any Barriers to Cannabis Homegrowing

August 23, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

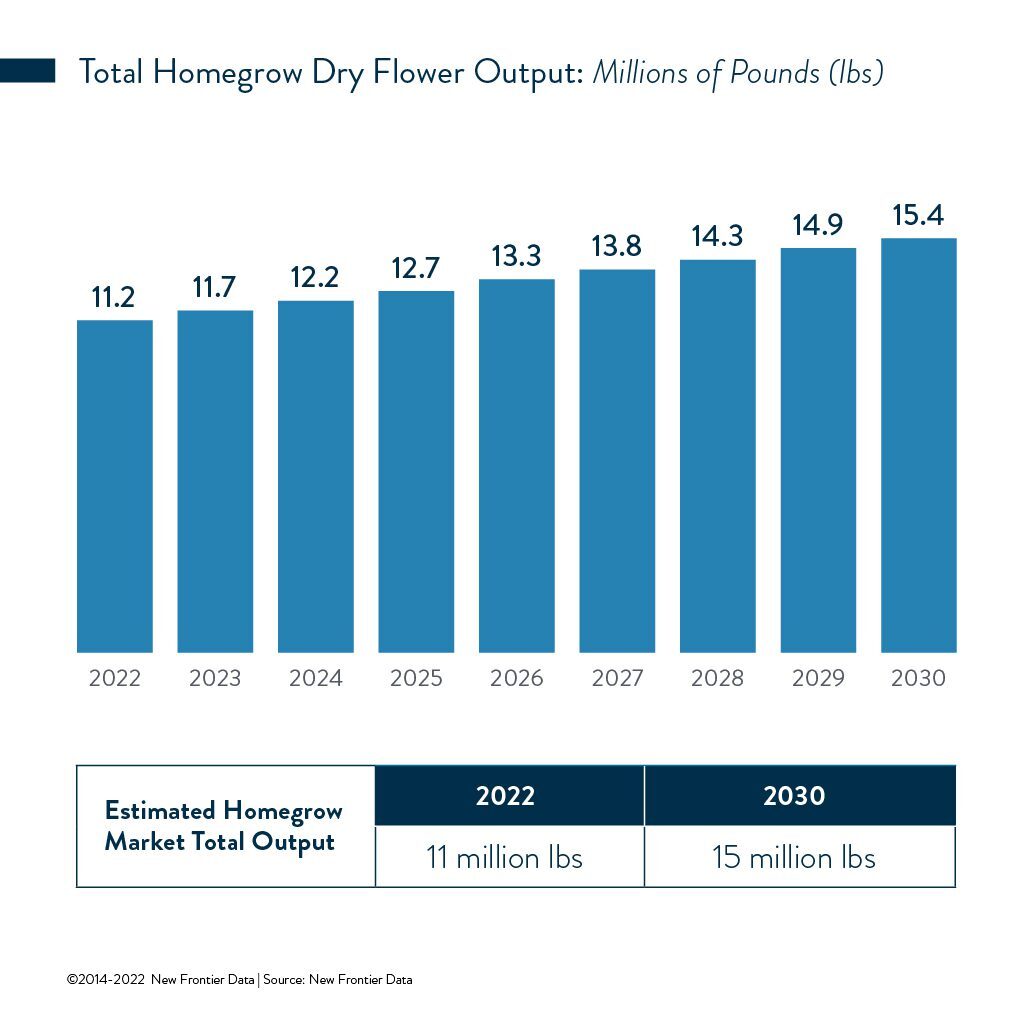

In 2020, Colorado produced 816,000 lbs. of dry flower while generating $2.2 billion in legal sales. By a conservative estimate, homegrowers this year will produce more than 11 million pounds of dried flower. The scale of the homegrow market’s output underscores the important additive role that residential cultivation plays in the national supply of cannabis, which supplements both commercially legal and illicit producers’ stockpiles.

As consumers, homegrowers tend to be intentional with their use and prolific in their consumption of cannabis. Only one in three homegrowers report being the only ones to consume what they grow; nearly half (49%) say that they share with friends or family.

Homegrowers Tipping Their Green Thumbs

As cannabis — and, by extension, homegrow operations — become increasingly normalized, it is essential to understand the biggest producers in the market. Most growers (62%) keep six plants or less at a time, while harvesting up to three times a year (73%). Those practices fall in line with most state regulations, which limit homegrowing to six plants at a time per person.

A notably common exception to such cultivation caps is extended to registered medical patients. Registered medical patients are twice as likely to have tried homegrowing their cannabis compared to consumers who have never registered. Almost half (47%) of currently registered medical patients report growing seven or more plants at a time.

Medical cannabis regulations have been easing of late. As states expand qualifying conditions or grant physicians wider discretion to recommend cannabis, prospective patients may find it easier to join a regulated program. Nevertheless, expanded access to medical markets and increased numbers of homegrowers do not necessarily increase the cannabis supply at large: Registered patients who are homegrowers are also likelier to claim that they alone consume the cannabis they grow (39%) as compared to consumers who have never registered as medical patients in their state (29%). For more specific information about medical market sizing and legal access, consult the U.S. Cannabis Dashboard in New Frontier Data’s Equio business intelligence platform.

When it comes to homegrowing, experience yields the best teacher: Practiced growers are likeliest to report growing more plants at a time, and to reap higher volumes from each grow. Those cultivating more than six permitted plants may be legally doing so as part of state-sanctioned medical collectives (e.g., California). Others still participate in illicit markets.

Production Follows Intention

Production output is a key indicator of whether a grower shares their yield: Half of those producing less than 1 ounce reported consuming all of it themselves, whereas about one-quarter (26%) of those producing 3 pounds or more consumed it all alone.

Approximately 1 in 4 growers (26%) describe their grow as either both a hobby and a commercial endeavor, or exclusively commercial. Self-identified commercial growers tend to grow more plants at a time, produce more dried flower per harvest, and yield more harvests annually as compared to average homegrowers. Nearly half (45%) of commercial growers report producing more than 3 pounds of dried flower per harvest, compared to slightly over 1 in 4 (26%) among personal homegrowers.

Self-identified commercial growers also report having spent more for supplies, and committing more time each week on their growing activities. Half of commercial growers report spending 6+ hours weekly on their grows, while 35% of hobbyist growers report spending that much time doing so.

Future Looks Rosy

Even after seeing the effects as access increases, flower’s relative market share diminishes, and new markets come online, homegrowers are likely to continue to produce their own flower. Moreover, established growers are likely to become increasingly efficient and expand their operations with experience. New Frontier Data projects that by 2030, homegrowers will produce more than 15 million pounds of dried flower annually. Brands and producers are already keenly aware of the competitive challenges posed by other corporate cultivators, but understanding the nuances of personal production will become increasingly important.

For more information homegrowers and home-grown cannabis, check out New Frontier Data’s latest report: The U.S. Cannabis Homegrow Market: Motivations, Processes, and Outcomes.