Investor Optimism for Cannabis Market Remains Despite Pandemic Recession

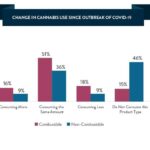

Change in Cannabis Use Since Outbreak of COVID-19

April 5, 2020

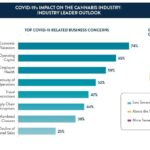

COVID-19’s Impact on the Cannabis Industry: Industry Leader Outlook

April 12, 2020By J.J. McCoy, Senior Managing Editor, New Frontier Data

Market insiders reportedly noted an unofficial change in the air among cannabis investors’ meetings last week, as overall Wall Street uncertainty about the economic aftermath of the COVID-19 pandemic was seemingly buoyed before the close of business on Friday.

Of course, the longer-term socioeconomic impacts from widespread sheltering in place are yet to be fully determined, and the next few months will yet reveal which markets are best positioned to make up for lost ground. But the early returns offer some hope.

Participating in an April 2 international industry event, New Frontier Data’s Global Cannabis Town Hall webinar, a panel addressed substantive issues including capital flow and deal-making, focus on R&D, efficiency and system automation.

The general consensus among investors would “affirm the strong foundation that sets the U.S. legal cannabis industry apart from other regional markets which are still in early stages of deployment,” suggested New Frontier Data’s Chief Knowledge Officer John Kagia. “The saving grace for the non-North American markets is that these disruptions are universal, so, at least for now, it doesn’t give anyone region a singular advantage over the other nascent markets.”

Overall, impacts of the COVID-19 pandemic will depend on:

- The scale of supply-chain disruptions,

- Consumers’ access to products,

- Impacts of the economic recession on spending,

- The status of cannabis businesses as essential or nonessential businesses,

- Investors’ willingness to fund expansion and increase capacity, and

- The length of disruptions in travel for key canna-tourism markets (e.g., Nevada, California, and Massachusetts).

Before the pandemic arrived, many cannabis businesses had experienced sharp declines in market value. From March 31, 2019, to March 24, 2020, the industry’s market cap saw a $38 billion overall decline among 14 of the industry’s largest companies, for an average drop of 46%.

Factors driving investor pullback have included:

- Legalization delays among key markets,

- Slow regulatory rollouts even after legalization,

- Delays marking incremental congressional reform,

- Increasing regulatory complexity,

- Limited existing or slow-developing activation of key supply-chain infrastructure,

- Sharp declines in wholesale CBD market prices,

- Slow transition of consumers from the illicit to legal markets, whether due to limited access or burdensome taxes, and

- Federal intervention discouraging or delaying major deals (and thereby dampening investors’ enthusiasm).

“COVID-19 throws a lot into question,” Kagia noted. “We know that in 2019 the North American market drove about $16.1 billion in retail sales, expected to grow to over $33 billion by 2025 (combined U.S. and Canadian numbers). Given the closures, the disruption, the unemployment and impact on consumer spending, it’s now much too early to tell what the growth outlook will look like.”

Amid the uncertainty, however, there remain fundamental assumptions. Consumer demand for medical and adult-use cannabis is expected to rise. Thus, legal cannabis is expected to fare better than most other sectors, with the fastest growth achieved in North America. Investors expect to invest either the same amount or more so than they did in 2019, reflecting a very bullish market despite general global economic challenges.

Bob Hoban, president and founder of Hoban Law Group in Denver, noted that the cannabis industry’s triad of marijuana, hemp, and CBD is unlikely to fare equally, given the diversity of each one’s respective market and regulatory environment. In broad terms, New Frontier Data’s references to the legal cannabis market refers to medical and adult-use programs, but it is industrial hemp which has been nationally freed from federal prohibition, while CBD stakeholders yet find themselves in a regulatory haze yet to be cleared up before its full production environment can be realized.

The hemp sector was already dealing with uncertainties and supply-chain challenges before the pandemic arrived. The subsequent disruptions delaying build-out of key industry infrastructure (most notably the processing capacity for hemp fiber) will only push out the timelines for capital-constrained hemp farmers to recoup their investments. Both hemp and CBD may not benefit from the “essential” designations recognized for marijuana retail and supply-chain businesses.

Those differences noted, some early indicators offered some hopeful signs despite the economic shutdowns from jurisdictions sheltering in place. In those markets where cannabis availability is deemed essential activity, governments and businesses have been working to minimize disruption to consumer access and reduce customer risk by allowing drive-through service, curbside pick-up, and delivery services which will likely remain after the pandemic protocols wane. It seems likely that delivery will become much more mainstream with virtual or remote access expectedly gaining traction (though security and data privacy will likewise gain heightened scrutiny as critical issues).

Mitch Baruchowitz, managing partner at New York-based Merida Capital Partners (which per full disclosure is an investor in New Frontier Data), noted reason for optimism amid the crisis. “As you saw in the second half of 2019, the capital markets in cannabis were already kind of frozen up,” he said, though “there’s a huge global base of cannabis consumption. Whether it’s medical or adult use, let’s skip that right now as a designation because we don’t really know each person’s self-medication.”

Baruchowitz explained that “what we do know is that people who are going to be locked up in their houses would prefer cannabis to alcohol if they consumer both as one of their vices — alcohol probably much more of a social lubricant, cannabis a couch-locked lubricant… It is not only recession-proof, but we have found out some fundamental things about cannabis, which is [that] people will stock up if they feel like they may not have access to it. They are deeply concerned if they do not have access to good flower.”

To that end, he noted, “as you see a shift in the supply chain for the black market, you start to see that people are going to go to dispensaries because they don’t know if they can go to their [illicit] dealer, or get the same variety. That makes [the legal market] not only recession-proof, but global-crisis-proof.”

Certainly, entrepreneurial investors are making educated bets that history will bear that out amid the more obvious unknowns of unprecedented global economic uncertainty.