Local Cannabis Laws Are Keys to Consumer Behavior

Survey: More Americans Than Not Have Consumed Cannabis

April 12, 2022

$97B in 2021 U.S. Cannabis Sales Fueled by Routine and Intentional Consumption

April 20, 2022By Dr. Molly McCann Ed.D., Senior Director of Consumer Insights, New Frontier Data

In the United States today, 74% of U.S. adults live in a state having some form of legalized cannabis with THC: 44% live in states which allow any adult to possess and use cannabis, and 30% live in states which permit cannabis for medical use (though the degree and type of restrictions in medical markets vary widely state to state).

As discussed in New Frontier Data’s upcoming report, Cannabis Consumers in America: Dynamics Shaping Normalization in 2022, we found that a consumer’s home state’s cannabis market regulatory framework was among the most consequential influences on consumer behavior—often a stronger predictor than a consumer’s gender.

Perhaps surprisingly, one element of cannabis-related behavior that is not affected by a state’s cannabis laws is how often consumers use cannabis. The distribution of use frequency is remarkably consistent across different state market types, meaning that whether cannabis is prohibited or legally available to adults in the state seems to have little or no impact on how frequently consumers use it.

Consumption patterns are normalizing across all markets

The legal status of a market is less influential in predicting frequency of use than are other demographic variables like age and gender. That indicates that while legalization may improve the quality and availability of cannabis products, the pervasive and deeply entrenched illegal market is not a barrier for consumers in unregulated markets, and consumer behavior is quickly normalizing across all markets. That is especially important in newly legal states which are likely to face considerably shallower consumer-adoption curves than in states which legalized earlier, when there were more substantial differences between consumer behaviors in legal versus adult-use markets.

An element of consumer behavior that does seem to be influenced by a state’s cannabis regulations is which high-quality cannabis product forms consumers in those states have access to, and therefore consume.

Consumers in illicit states were significantly more likely than were consumers in other markets to report using only flower: over one-third (34%) of consumers in illicit states consume only flower, compared to more than one-fifth (21%) of consumers in adult-use states. Regulated markets provide easier access to alternatives to smoked items, so consumers in adult-use markets are the most likely to use non-flower products, followed by consumers in medical-only markets.

Some may be surprised that flower-only consumption was not more dominant in illicit markets—even in those states, a majority (52%) of consumers reported using both flower and non-flower forms. Though they may not have as convenient or consistent access to high-quality, value-added cannabis products, many consumers in illicit markets are still occasionally acquiring products that originated in legal markets. More than 2 in 5 (43%) of current consumers report having sourced cannabis from outside of their home state—whether while traveling to legal markets themselves, or via friends or family when they traveled.

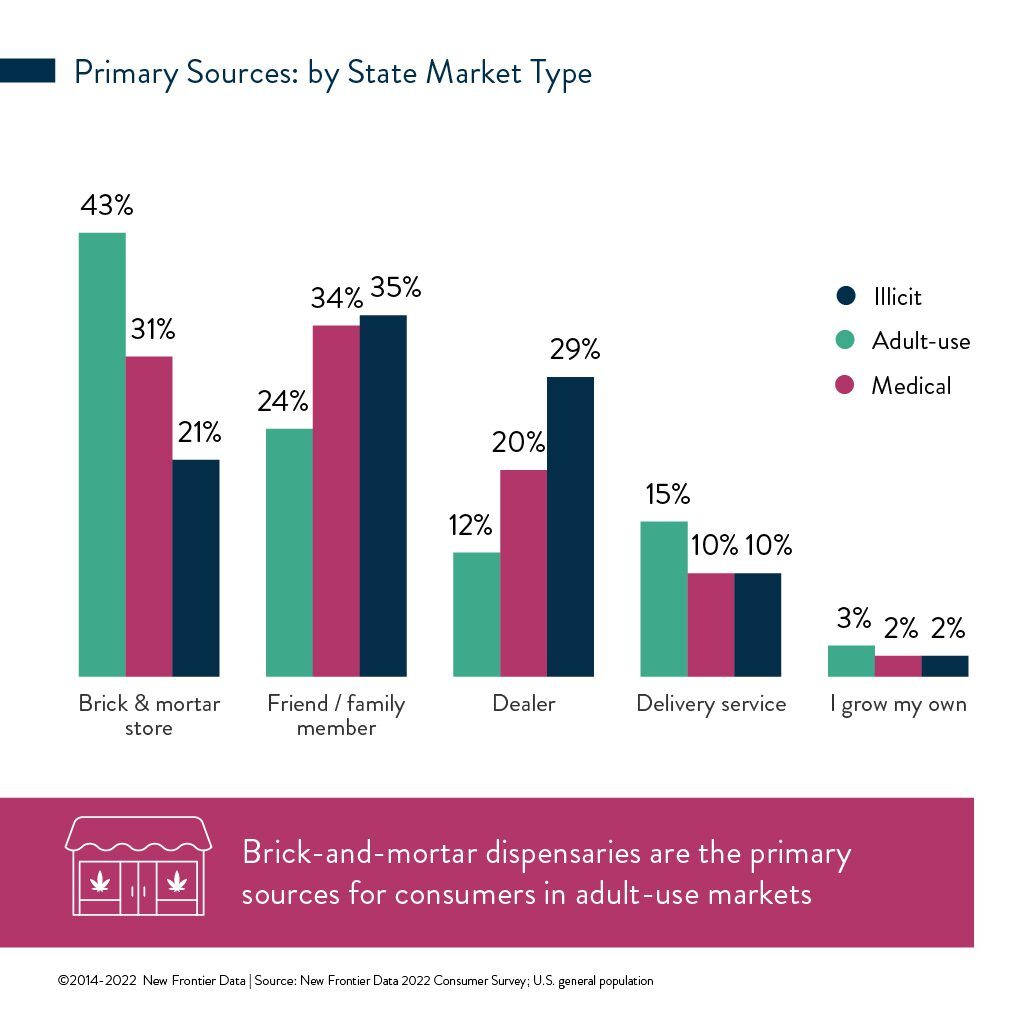

Sourcing is Vital

The greatest impact that state regulations seem to have on consumer behavior is on sourcing: a state’s cannabis laws greatly affect which sources its consumers use. Brick-and-mortar stores and delivery services — the primary regulated cannabis outlets — are utilized considerably more in adult-use markets than in other state markets. Informal sources like friends/family or dealers are the leading sources in illicit markets (where high-THC cannabis is completely prohibited).

In medical-only markets, brick-and-mortar dispensaries are primary sources for registered medical patients who have legal access to them. Friends/family are also major sources for consumers in medical-only markets, particularly among consumers who are not registered patients (and therefore cannot access cannabis directly through medical dispensaries). Notably, illicit dealers are significantly less utilized in medical-only states than in completely illicit states. That is likely because in medical-only markets, registered patients act as intermediaries between legal dispensaries and end users for many of their unregistered friends and family who consume. The existence of a group of people with legal access to cannabis means that there are fewer degrees of separation between a reliable, quality source and an unregistered end user, so reliance on dealers is lower.

Cannabis Consumers in America: Dynamics Shaping Normalization in 2022 discusses the findings of New Frontier Data’s 2022 U.S. Cannabis Survey, a demographically representative, census-aligned online survey of more than 5,900 respondents measuring cannabis-related beliefs, attitudes, and behaviors. The report will be released tomorrow.