Survey: More Americans Than Not Have Consumed Cannabis

Colorado: $12.3B in Legal Cannabis Sales in 7 Years

April 5, 2022

Local Cannabis Laws Are Keys to Consumer Behavior

April 19, 2022By Dr. Molly McCann Ed.D., Senior Director of Consumer Insights, New Frontier Data

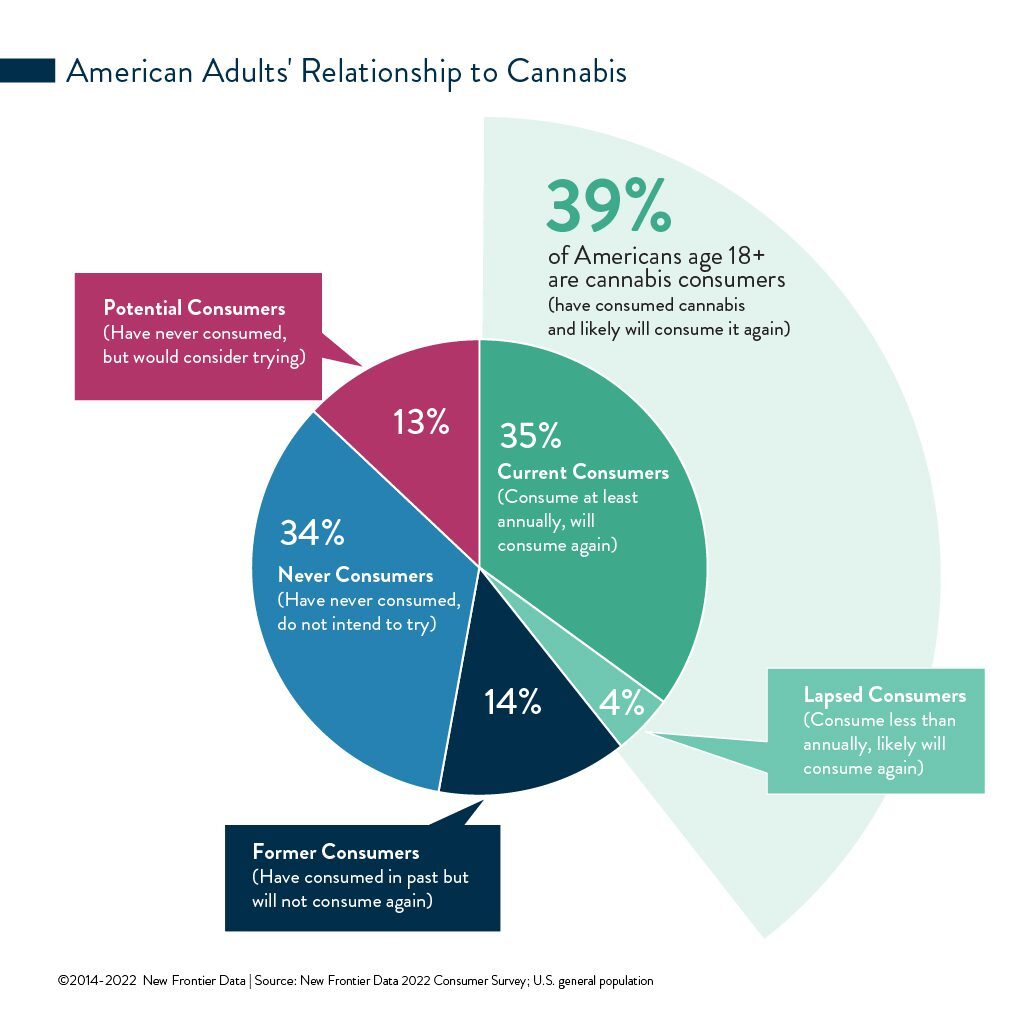

A majority (53%) of U.S. adults have consumed cannabis with THC, according to New Frontier Data’s latest cannabis consumers’ survey. Among those having tried it, two-thirds report having used it at least annually, and plan to consume it again. While more than one-third (34%) of adults have never tried cannabis and do not intend to, roughly 1 in 8 (13%) among adults have not tried it but would consider doing so in the future.

Those results are takeaways from New Frontier Data’s 2022 U.S. Cannabis Survey, a demographically representative, census-aligned, online survey of 4,682 consumers and 1,250 nonconsumers polled to assess cannabis consumer attitudes, perceptions, and consumption patterns across legal and unregulated markets. Likewise, the survey plumbed beliefs, attitudes, and potential future use among nonconsumers. Findings from the survey will be shared in New Frontier Data’s Cannabis Consumers in America: Dynamics Shaping Normalization in 2022, to be released next week. Meanwhile, a wide range of comprehensive and specific data and analysis is always available via New Frontier Data’s online business intelligence platform, Equio® including more, overlapping data points and insights available within the U.S. Consumer Dashboard and among our library of free reports.

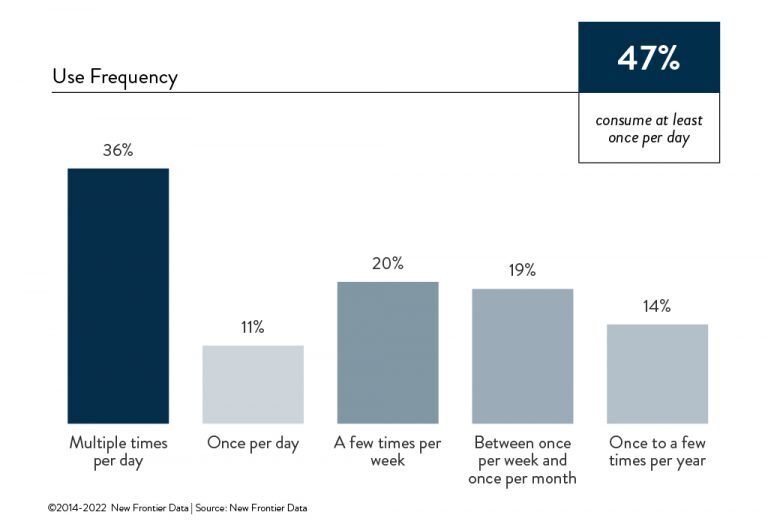

Use Frequency

More than one-third (36%) of current consumers use cannabis multiple times daily. Another one-third consume once a day or every other day (31%), and one-third (33%) consume between once per week and once per year.

Among nearly half of consumers, cannabis use is routinized. Many cannabis consumers have integrated cannabis into their daily routines, with nearly half (47%) consuming cannabis daily, and two-thirds (67%) consuming at least once per week. The advancements in product innovation that enable consumers to use cannabis more conveniently and discreetly, coupled with the proliferation of products that can be used for specific use cases (e.g., pain, sleep, relaxation, exercise, creativity, etc.) have broadened the ways in which consumers can use cannabis per their specific needs and use cases.

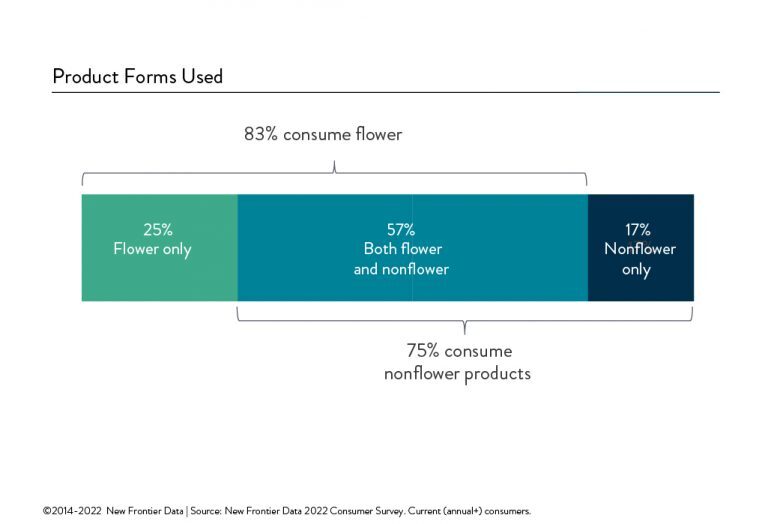

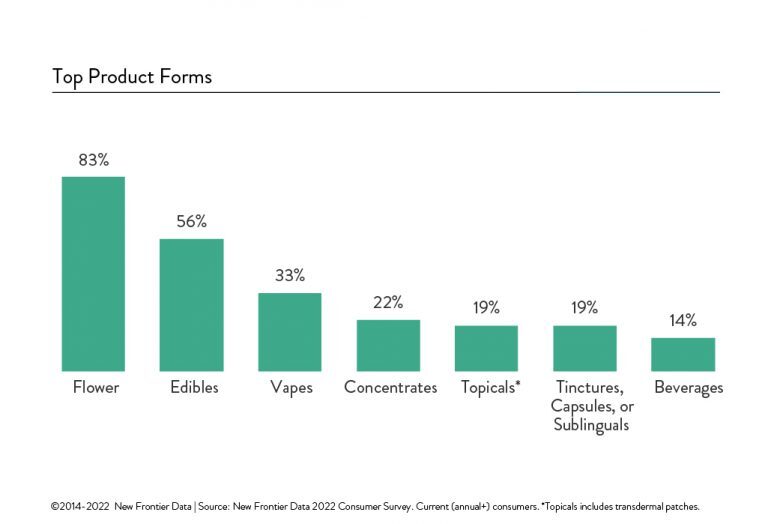

Product Forms

A majority (57%) of current consumers use both flower and non-flower cannabis products. One-quarter (25%) exclusively use flower, while 17% use exclusively non-flower forms.

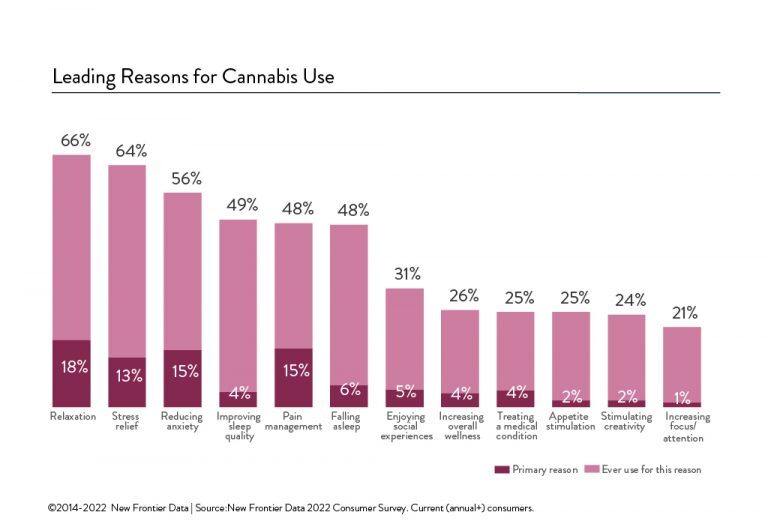

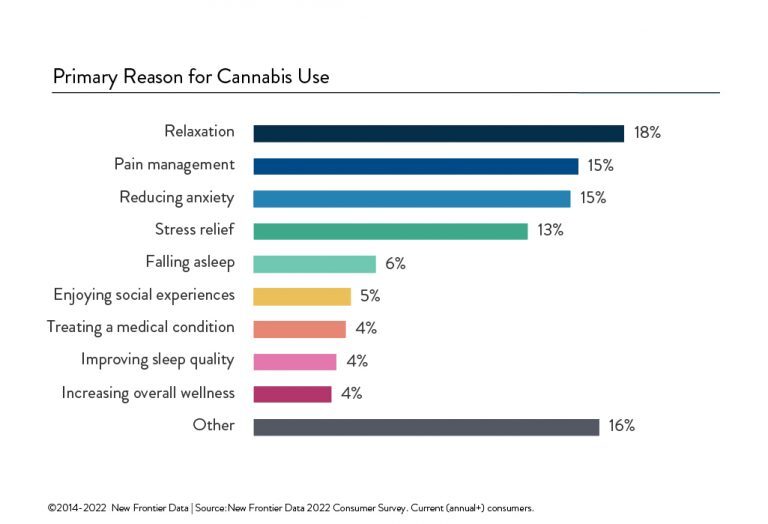

Reasons for Use

Together, aims for “unwinding” (i.e., relaxation, reducing anxiety, or stress relief) comprised the primary motivation for use among nearly half (46%) of current consumers.

Reasons for cannabis use remain highly diverse and personalized, raising the stakes for targeted consumer strategies. The industry is evolving beyond a one-size-fits-all approach during an era where brands could be indiscriminate about whom they targeted for their products. With consumers becoming far more intentional about their uses, and the primary motivations for consumption encompassing relaxation, pain management, improved sleep outcomes, treating a medical condition, or improving overall wellness, it is increasingly important for brands to invest in understanding both who their consumers are and why they consume. As the industry grows in scale and specialization, differentiated brands with resonant products aimed at well-defined target segments are far likelier to secure effective competitive market positions over the long term than are brands aspiring to serve the broadest base possible without tailoring to individual subgroups’ needs.

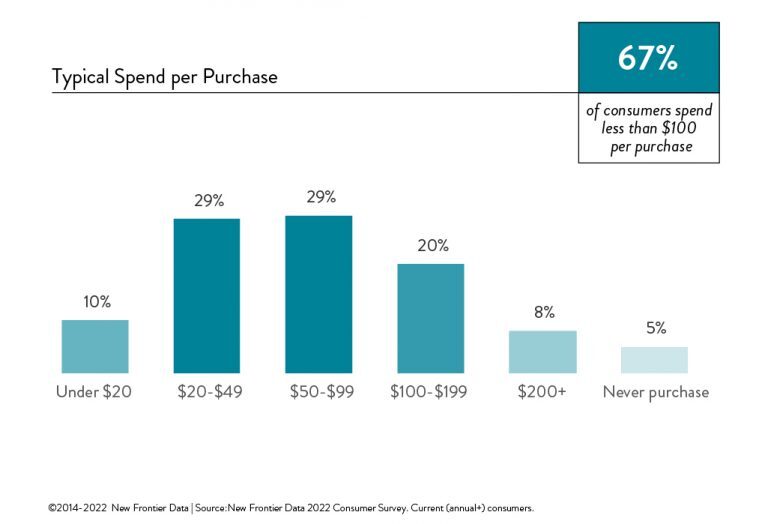

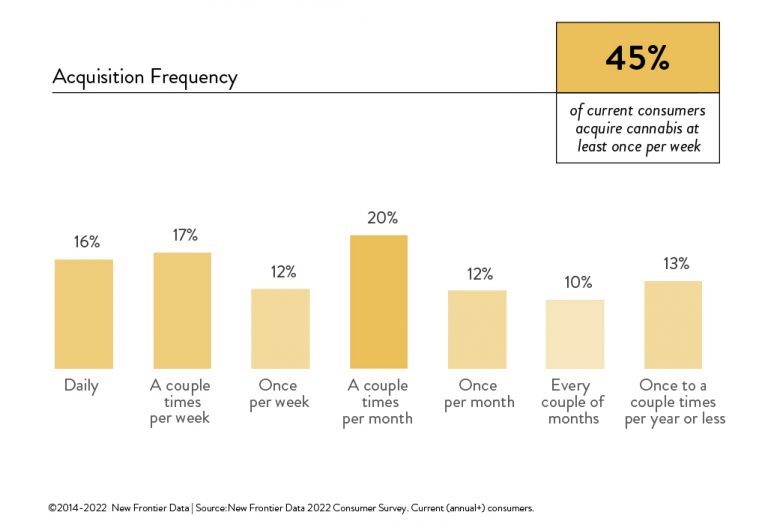

Acquisition & Spending

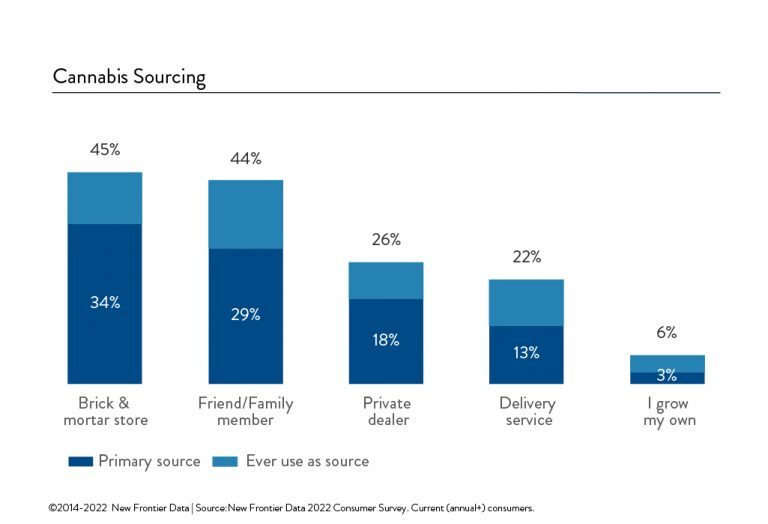

Brick-and-mortar stores are followed closely by friends/family members as consumers’ primary sources for cannabis. More than 4 in 10 (43%) of report supplying friends or family with cannabis, while 12% say that they do so regularly.

Likewise, 43% of current consumers also report having sourced cannabis from out of their state of residence, whether to consume while traveling or to bring products back home.

For most consumers, cannabis is a low-spend/high-frequency purchase. Nearly half (45%) of consumers purchase cannabis at least once per week, with 2 out of 3 (67%) among them spending less than $100 per purchase. The high-frequency nature of those purchases (coupled with keenly expressed interest in new products), signifies opportunities at each touchpoint for retailers and brands to engage and educate consumers.