State Medical Cannabis Markets Vary with Saturation Levels

State of the Cannabis Union July 2019

July 7, 2019

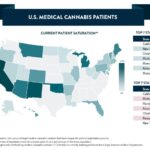

U.S. Medical Cannabis Patients

July 14, 2019By New Frontier Data staff

As of the first half of this year (through June), the total number of Americans registered as patients in legal medical cannabis markets nationwide numbered 2.2 million. Just as each patient’s prognosis is unique, there are some compelling characteristics to be diagnosed state by state; this is a sampling.

Oklahoma (138,230 registered patients, 3.49% market saturation)

Due largely to offering low barriers for patients – doctors can write recommendations for any conditions they think might be helped with cannabis – the Sooner State saw the second-highest patient saturation in the country after just 11 months of patient registration.

Already, the Oklahoma Medical Marijuana Authority (OMMA) has enrolled more than 3.5% of the state’s population as patients. The OMMA attributes the state’s strong patient participation to minimal financial obstacles and a lack of restrictions on qualifying conditions.

Oklahoma voters approved the state’s medical program in June 2018, and in less than a year, OMMA approved 3,211 licenses for growers, 1,548 for dispensaries, and 859 for processors. Conversely, since neighboring Arkansas approved medical cannabis in 2016, that state has opened but three dispensaries, due to drawn-out legal conflicts regarding restrictions on commercial licenses. With an estimated 2018 population of 3.9 million residents and nearly 140,000 patients registered by June 17, Oklahoma’s registration rate is around 35 per 1,000 people.

Vermont (7,564 registered, 1.21% saturation)

Since legalizing adult-use possession and home-growing of cannabis in July 2018, Vermont’s medical program has seen patient participation decline. The state’s dispensaries have reported a 25% to 30% decrease in sales, and demand has shifted to infused products as commercial infused products far exceed the quality that home-growers can produce. There is also less incentive to register as a patient since there is no risk of criminal charges since the state’s 2018 legalization of cannabis possession and use.

Oregon (28,024 registered, 0.66% saturation)

Though Oregon was among the earliest states allowing medical cannabis, its patient rolls have been in steady decline since 2016.

State politics factored in, according to New Frontier Data’s Senior Economist and Vice President Beau Whitney: “The medical cannabis program didn’t have a lot of political support in the legislature, which made it difficult to advance the changes needed to keep the program viable,” he said. Regulatory changes also impacted the program’s growth. “The cost of medical cannabis increased significantly with a requirement to have few patients per grower, as well as an increased cost for a grower’s license.”

The trajectory of Oregon’s program illustrates the importance of political support and the need for carefully calibrated regulatory changes to minimize market disruptions and ensure that the legal market can compete against the unregulated one.

New Mexico (73,535 registered, 3.52% saturation)

The Land of Enchantment has enjoyed a long lead time for establishing its saturation rate of 3.52% representing nearly 74,000 patients who enjoy relatively low barriers to entry, and more than two dozen qualifying conditions through New Mexico’s Compassionate Use Act.

New medical cannabis rules took effect on June 14, redefining a “qualified patient” by removing a requirement that a patient be a state resident. While the state’s health department asserted that allowing non-New Mexico resident to obtain patient cards and purchase medical cannabis encouraged out-of-state diversion, one of the state’s largest cannabis companies (Ultra Health, which operates 17 dispensaries statewide) threatened to take the state to court over the policy change. In 2016, Ultra Health successfully sued the state to allow cultivation limits to expand from 450 to 2,500 plants (for a temporary limit due to expire on August 28).

Last week, New Mexico industry officials and policy experts convened for the first time with official intentions to craft legislative proposals for adult-use legalization.

Nevada (11,194 registered, 0.36% saturation)

Nevada has seen nearly a 40% decline in medical-use registrants since 2017, as the state’s adult-use market has seen explosive growth. That noted, Nevada became a trendsetter by dint of Governor Steve Sisolak’s signing AB 132 into law last month, prohibiting employers from rejecting prospective employees based on pre-employment cannabis drug tests.

Laws like Nevada’s (along with those in New York City, New Mexico, Oklahoma, and most recently New Jersey), protect qualified medical cannabis users in the workplace and portend far-flung implications for other markets, including new rights for consumers of legal cannabis.

Colorado (83,621 registered, 1.46% saturation)

With the advent of Colorado’s adult-use market, the state has seen a 19% decline in medical cannabis cardholders since 2014. In becoming the first state to surpass $1 billion dollars in collected revenues from legalized cannabis, Colorado has also typified some traits seen when medical-use programs make room for discretionary cannabis markets.

Colorado has more than 80,000 patients in its program, with 93% reportedly suffering from severe pain. The patients who remain in medical programs post-adult use legalization are generally those who require significant quantities of cannabis (sometimes above the recreational market limit) to manage their pain. Furthermore, the tax exemption for medical cannabis can be critically important for patients spending hundreds of dollars monthly for cannabis.

Effectively managing the medical program following adult-use legalization reduces the risk of product shortages, prices spikes, and access issues for medical patients. While local regulations including widespread moratoria on recreational cannabis businesses have had significance in the extant size of the medical cannabis market, Colorado shows how it is possible to maintain a large and stable medical patient base amid a growing adult-use market.

California (408,240 registered, 1.02% saturation)

While being the largest among all U.S. legal markets, California does not track its medical patients, but the passage of Proposition 64 three years ago has definitely caused some disruption as the rollout of statewide adult-use legalization has suffered from regulatory missteps.

For instance, medical cannabis had been protected by law in the Golden State, but Prop 64 subsequently empowered local governments to regulate all cannabis, with the results seeing an unanticipated preponderance of local jurisdictions showing reluctance either to participate in the market or to grant permits for cultivation.

Other unintended consequences of statewide legalization have included the degree to which consumers who had once registered for medical cards see no need to use them, especially as patients are not exempt either from excise or local government taxes, which comprise the majority of the state’s high taxes on cannabis. Between high taxes on medical cannabis, and a slow rollout of adult-use sales, many patients have been pushed into the state’s unregulated market, where prices are lower and high-quality products are widely available. It will take time for the complex dynamics in California’s cannabis market to be resolved. However, as the state has the nation’s longest-standing medical market, the largest cannabis consumer market, and is by far the country’s largest cannabis producer, California has the unique assets to be the world’s most advanced medical cannabis market. Nevertheless, until key regulatory and bureaucratic issues are addressed, patients will be driven out by cost and access.

Arizona (199,943 registered, 2.79% saturation)

After attempts to enact adult-use measures failed in Arizona, patient registrations have surged beyond previous predictions, and changes are coming to the state’s eight-year-old medical marijuana program. After the passage of SB 1494 signed into law last month by Governor Doug Ducey, nearly 200,000 patients, caregivers, and dispensary operators will have access to safer medicine through a state-certified cannabis testing industry, and a revamped registration process costing only half what it previously had.

Alaska (292 registered, 0.04% saturation)

Participation has completely dwindled in the wake of recreational dispensaries’ opening. Alaska has seen the second-sharpest decline in its medical market saturation, experiencing a 63% drop in medical cardholders after recreational sales began in 2016.