Unlocking the Midwest: Cannabis Legalization and Consumer Insights

2023 Archetypes: Low-Frequency Consumers

July 25, 2023

Exploring the Future of Cannabis: Insights from the 2023 Cannabis Conference

August 22, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

Will it play in Peoria? This American colloquialism refers to whether a new trend, behavior, or event will garner mainstream acceptance. “Peoria” refers to the town in Illinois and the sentiment is that if the Midwest accepts it, it is officially non-controversial. When cannabis legalization first hit the scene in 2012, it was popping up in places to be expected, namely, the coasts. Early legalization victories in states like Colorado, Oregon, Washington, and Maine were not too surprising, as those states are known for a mix of progressive yet Libertarian-leaning politics. But the real question was, when will legalization make its way into the Heartland? That question was answered in 2018 when Michigan became the first midwestern state to approve adult use legalization. Given the progressive history of cities like Ann Arbor and the presence of a large urban center like Detroit, Michigan may have been written off as an outlier. But they were followed by Illinois in 2020, and, to the shock of many, Missouri in 2022. Now, Minnesota is the most recent midwestern resident to launch an adult-use cannabis program. Ohio is aiming to get something on the ballot in 2024, and Iowa, Indiana, and Wisconsin? Don’t hold your breath.

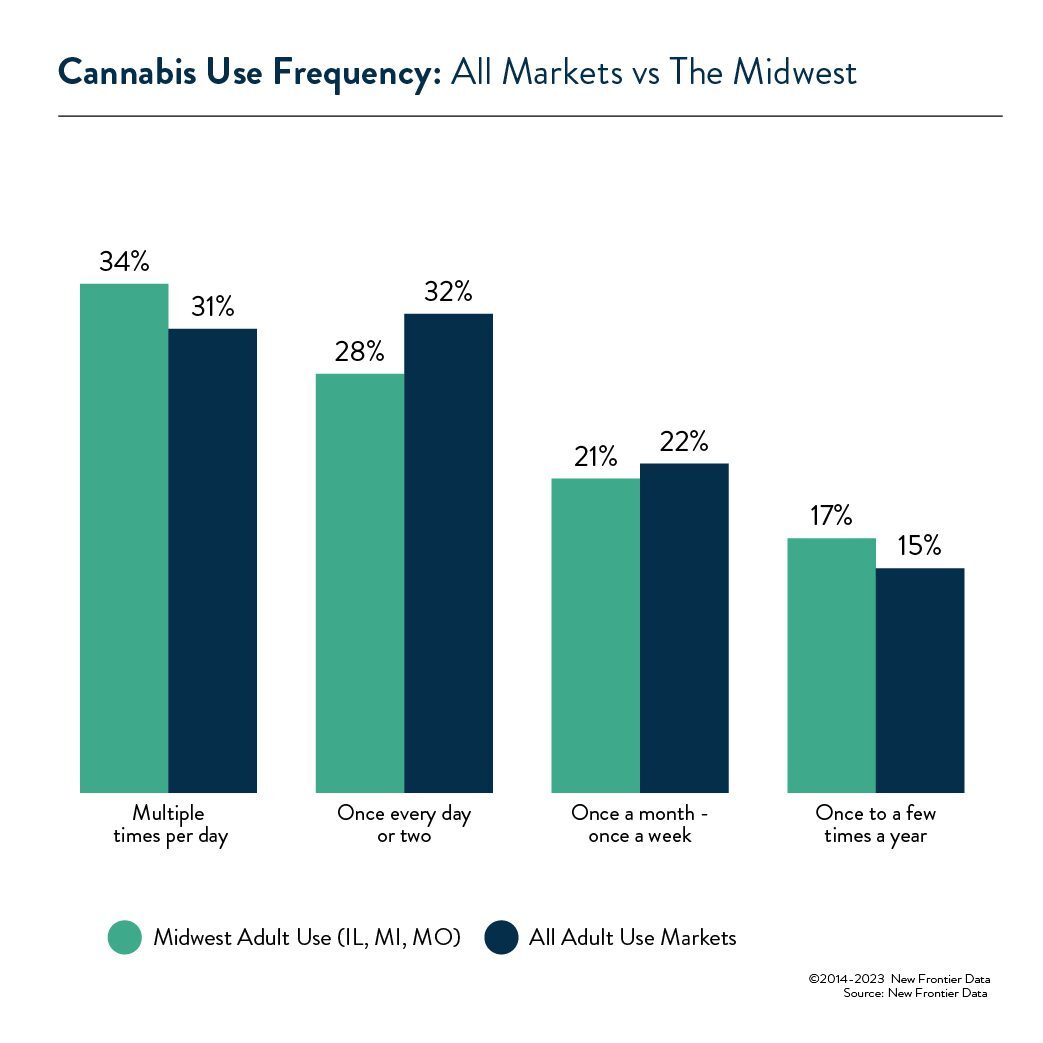

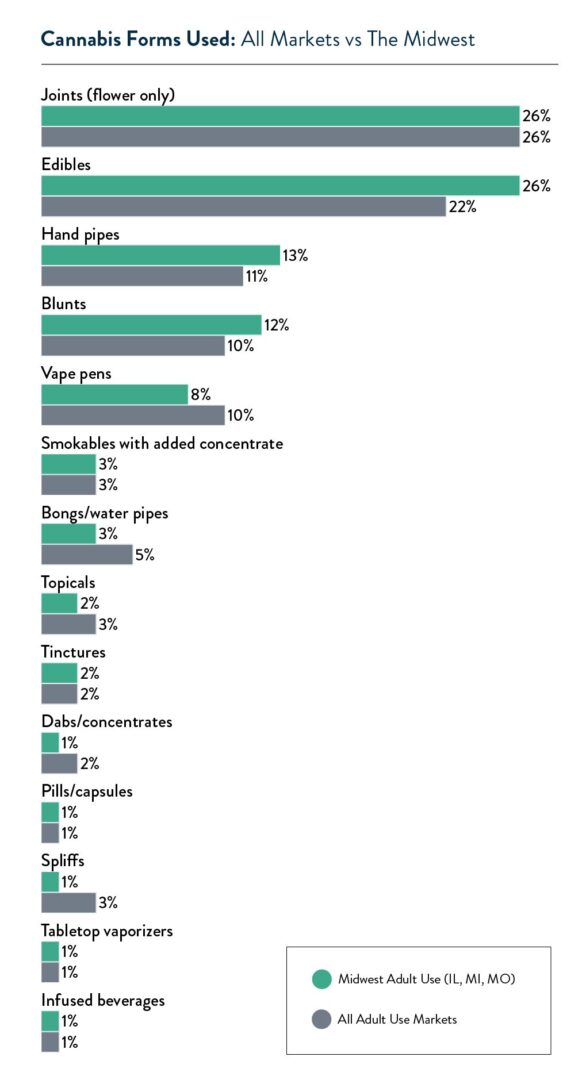

But this brings up an interesting question, are there differences in how midwestern consumers use cannabis compared to the general adult use population? And if so, are those differences related to the stigma that may still hang like a cloud over consumers in those states? In honor of the launch of Minnesota’s program, we dug into the use frequency and preferred method of ingestion for Midwestern consumers in adult use states (MI, IL, and MO) vs. The general population of U.S. adult use consumers.

Compared to consumers across all adult-use markets in the U.S., Midwestern consumers are slightly more likely to report use multiple times per day (34% vs. 31%) and slightly less likely to report use once every day or two (28% vs. 32%). Given the long history of enforcement and stigma against cannabis in this part of the country (save for Ann Arbor, MI which decriminalized possession of cannabis in 1974 and not without controversy), it is possible that legalization is opening opportunities that citizens are taking full advantage of.

Midwestern consumers were slightly more likely to say they prefer edibles compared to the general population of adult-use consumers (26% vs. 22%). This could be because of the continued stigma against cannabis and the desire to use without others knowing. It could also be that, unlike states such as California and New York, which had effective and efficient unregulated markets prior to legalization, edibles may not have been as available in Midwestern markets and therefore are attractive as a new product form for many consumers.

So, will it play in Peoria? I think the answer is yes, but….prohibition and the propaganda surrounding cannabis use still has a grip on many states in the U.S. Seeing cannabis legalization in those places may be more related to the tax revenue being lost as their citizens make the drive to the nearest legal state. But seeing cannabis legalization in the Wholesome Heartland speaks volumes about a society that no longer accepts cannabis as the devil’s lettuce and is ready to move past the Just Say No era.