Exploring the Future of Cannabis: Insights from the 2023 Cannabis Conference

Unlocking the Midwest: Cannabis Legalization and Consumer Insights

August 8, 2023

Federal Gridlock and Reefer Madness: The Hurdles Facing the Cannabis Industry

September 5, 2023By Noah Tomares, Senior Research Analyst at New Frontier Data

Before Tropical Storm Hillary made its debut on the west coast, cannabis cultivators and operators braved the August heat in Las Vegas to attend Cannabis Business Times’ Cannabis Conference. There they attended a variety of informative workshops and presentations, covering everything from homegrow techniques to strategies to aid operators in addressing` funding challenges.

New Frontier Data’s Senior Research Analyst, Noah Tomares, was in attendance and spoke on the state of the cannabis market as well as some predictions for the years ahead.

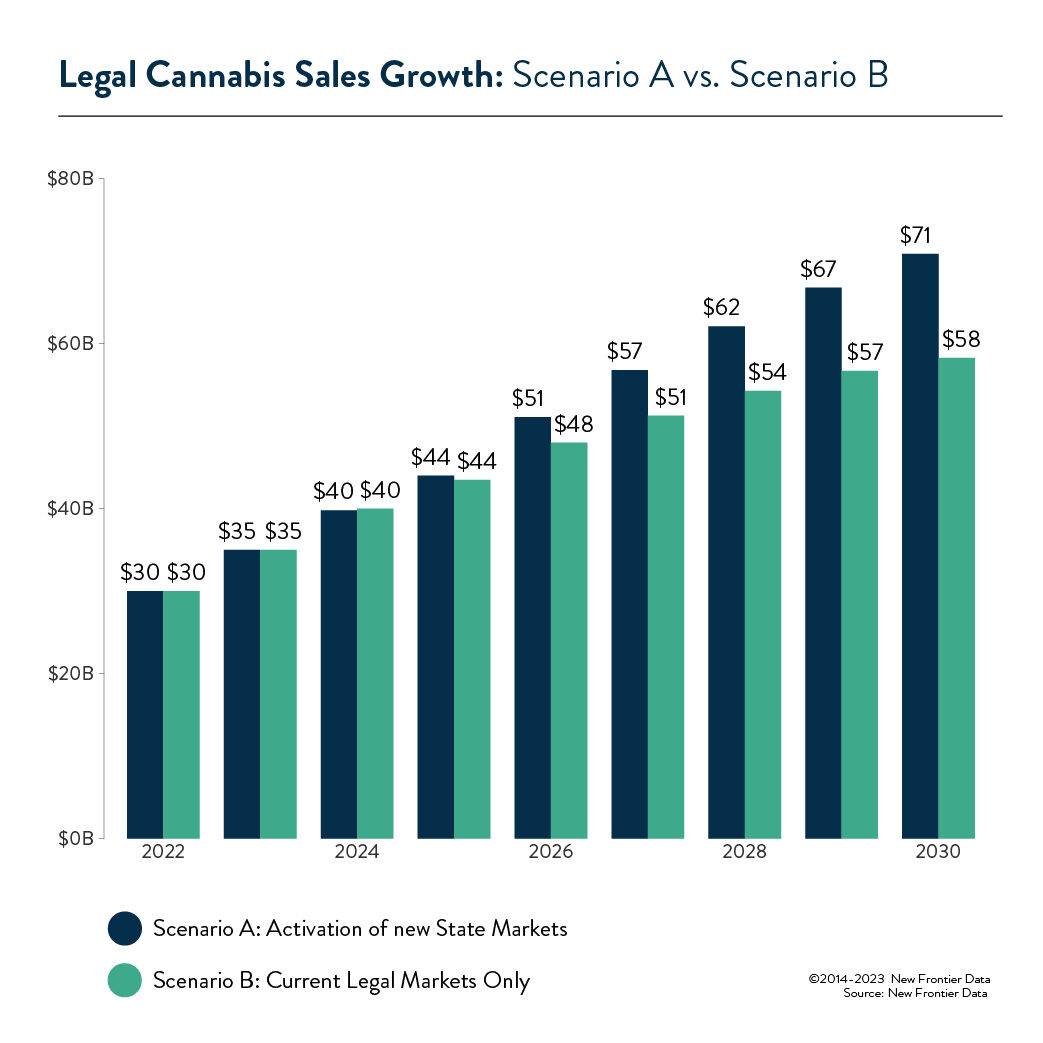

First some context. 24 states have legalized both Adult-Use & Medical-Use of cannabis, 16 have legalized Medical-Use only, and 11 states have no legal market. That places just under 75% of Americans—or 250 million Americans—in a state that has some access to high-THC legal cannabis. New Frontier Data projected that annual legal sales of cannabis in the U.S. totaled an estimated $30 billion in 2022 and are projected to surpass $35 billion in 2023.

While the industry faces several challenges on the path toward mainstream normalization, including a lack of action on federal policy, negative price pressure, and lack of available capital, one particular thorn in the industry’s side is the continued dominance of the illicit market.

Illicit sales of cannabis in 2022 reached $77 billion; more than double the total legal sales that year. Looking just at current legal markets, New Frontier Data projects that the illicit market will continue to dominate legal sales through 2030.

It is worth noting that more consumers are purchasing their cannabis from brick-and-mortar dispensaries. Two in five (43%) of current consumers reported that their primary source of cannabis is a brick-and-mortar dispensary—a significant increase from last year’s 34%. Of course, home-market type continues to play a pivotal role in determining where consumers are most likely to acquire their cannabis.

With that in mind, we do expect new markets to come online in the next few years. For a detailed list of which markets New Frontier Data is tracking and a timeline of their expected legalization, check out New Frontier Data’s 2023 U.S. Cannabis Report. If these markets were to come online, we would see further acceleration of legal market sales year over year. We might see legal sales top illicit sales by 2028 and by 2030, 58% of all cannabis sales in the United States could be coming from the legal market.

Comparing current legal states to the potential model, we could see an additional $13 billion (22% growth) in annual sales by 2030. Moreover, if these states all expand legal access in the next few years, there would be only 3 states left without a legal cannabis market. That would mean 94% of Americans would be living in a state that has some form of access to high-THC legal cannabis.

For more information on the most significant challenges and opportunities facing the cannabis industry, as well as a look at other changes in consumer preferences since last year, check out Equio!