Federal Gridlock and Reefer Madness: The Hurdles Facing the Cannabis Industry

Exploring the Future of Cannabis: Insights from the 2023 Cannabis Conference

August 22, 2023

Exciting News! We’ve been nominated for an EmJay

September 7, 2023By Dr. Amanda Reiman (Ph.D., MSW), Chief Knowledge Officer, New Frontier Data

“Oh, you work in cannabis! That must be so exciting!” I hear this a lot. After 20+ years working on behalf of the plant, people outside the industry assume that I spend my days tasting delicious cannabis products, reveling in the expansion of legalization, and counting my money. As anyone in the cannabis industry can tell you, the truth is far less glamorous and infinitely more stressful. So, instead of another piece about how “exciting” the industry is and how “lucky” we are to be a part of it, I wanted to go into some of the reasons why being in this space is just so darn difficult.

Consumers are still finding their footing.

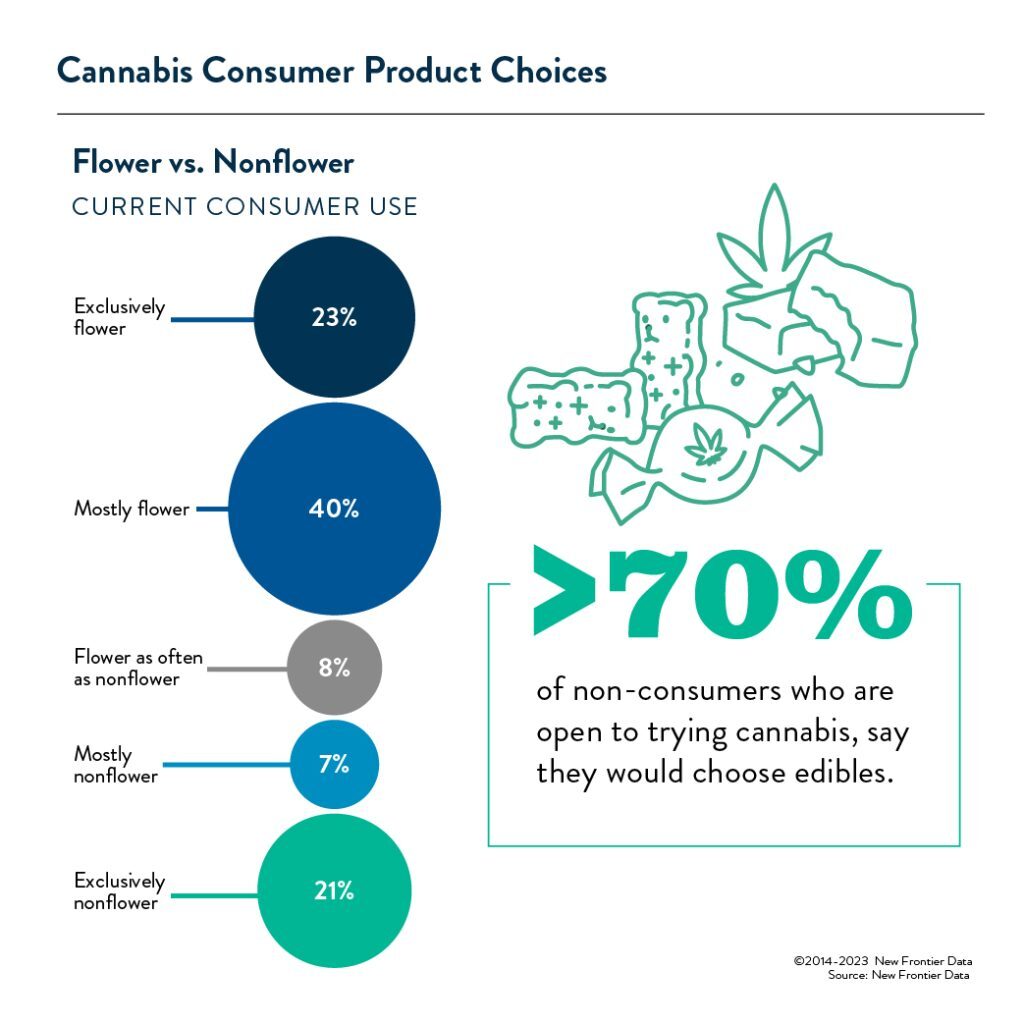

Even though it may feel like ages ago when the only options for purchasing cannabis were baggies of unknown flower, it takes people quite a while to adjust to a new way of engaging in commerce. Online shopping, streaming TV shows, and electric cars, all feel commonplace in society today, but this adoption did not happen overnight. Rabbit-eared televisions gave way to cable, which led to DVR’s, which preceded Netflix (which used to be a DVD rental company). We often forget the process of change once we are on the other side of it. For many cannabis consumers, the defaults of product choice are potency and price, reminiscent of how people purchased cannabis when it was illegal. This makes it difficult for retailers and brands to forecast which products will be a hit, and whether consumers are ready for novel delivery methods like beverages, or whether they will respond to products with minor cannabinoids or lower potency. Basically, while cannabis products look more and more like CPGs in other sectors, consumers are still motivated by pre-legalization characteristics. In the 2023 Consumer Survey from New Frontier Data, over 60% of current consumers say they use mostly flower, but when asking non-consumers who are open to trying cannabis, over 70% say they would choose edibles. This shows a divide between those who purchased when it was illicit, and those who will enter the world of cannabis in a fully regulated marketplace.

The inaction of the Federal government.

Back in 2012, when I was working for the Drug Policy Alliance, around the office we used to predict that federal legalization would happen in 2025. At the time, many viewed that as a pessimistic take. Surely the legalization of cannabis in a handful of states would push the Feds to act. Now, in 2023, I think we were too generous in our estimate. SAFE banking, probably the lowest-hanging fruit of any federal cannabis policy, has been stuck for over a decade. And even though research shows that both Democrats and Republicans support cannabis legalization, the powers in DC just haven’t been able to get over their Reefer Madness long enough to make any moves. Due to this propaganda-induced paralysis, cannabis companies are not able to secure small business loans, or take credit cards, or move product from one state to another. This inaction has impacted investment both in terms of availability and who is willing to invest. Because of all this, the cannabis industry has a ceiling, and we are hitting our heads on it. Unless and until cannabis is no longer a prohibited substance in the eyes of the Federal government, the industry will not be able to reach its full potential.

The remnants of Reefer Madness.

Speaking of Reefer Madness, many of the policies that make the industry so difficult are rooted in fear about cannabis and what it does to people. Tax rates higher than alcohol (a drug that is far more dangerous to individuals and society) not only drive people into the unregulated market but are an example of the overestimation of harm accounted for by excise taxes. The purpose of excise taxes is to counteract the costs of the harm that the products pose to individuals and society and to discourage overuse. The fact that cannabis taxes are so high shows that there is an assumption of great cost from its use. This is simply not true. In fact, research suggests that cannabis legalization is associated with lower costs related to its medical use and its role as a substitute for opiates, alcohol, and other drugs. Furthermore, onerous rules around packaging and the barriers to marketing can be tied to fears about cannabis that have been largely unfounded. These regulations, touted as public safety measures, are actually harming the industry more than they are protecting the public.

To be honest, I don’t know when it is going to get better. As more people try cannabis and those most impacted by Reefer Madness age out of power, I think we will have a chance to rebound as an industry, but that will take time. The recent announcement from the Department Of Health and Human Services recommending the move of cannabis to Schedule III is a step in the right direction. But just like state-level legalization, there will be a lag between policy change and implementation. In the meantime, one thing we can rely on is data. Data gives us an objective view of the lay of the land and helps us make calculated decisions. That is why I am grateful to be working with New Frontier Data, a beacon of rationality in a storm of uncertainty. It will get better, in the meantime, at least we have cannabis to soothe our anxiety about the state of the industry.