Two Kentucky Bankruptcies Cast Shadow Across Hemp Industry

By Trevor Grode, Data Analyst, New Frontier Data

Two high-profile Kentucky hemp companies – GenCanna Global and Sunstrand, LLC, respectively – have filed for bankruptcy this month, creating doubts about the future of the hemp industry in the state.

GenCanna Global filed for Chapter 11 protection on February 5, following three months of layoffs, lawsuits, and setbacks at its Winchester facility. GenCanna – one of the nation’s largest CBD manufacturers – has been facing legal trouble since early last year, when the company was the subject of a separate $13 million lawsuit by contractors claiming that they had not been paid for construction work at the company’s manufacturing facilities. While filing Chapter 11 will allow GenCanna to continue operating without interruption, it has caused some to question the future of Kentucky’s touted hemp industry. Congressman James Comer, a key sponsor of the 2018 Farm Bill, observed that “for better or worse, GenCanna has been seen as the leader of the CDB industry in Kentucky. And GenCanna has certainly given a black eye to the industry”.

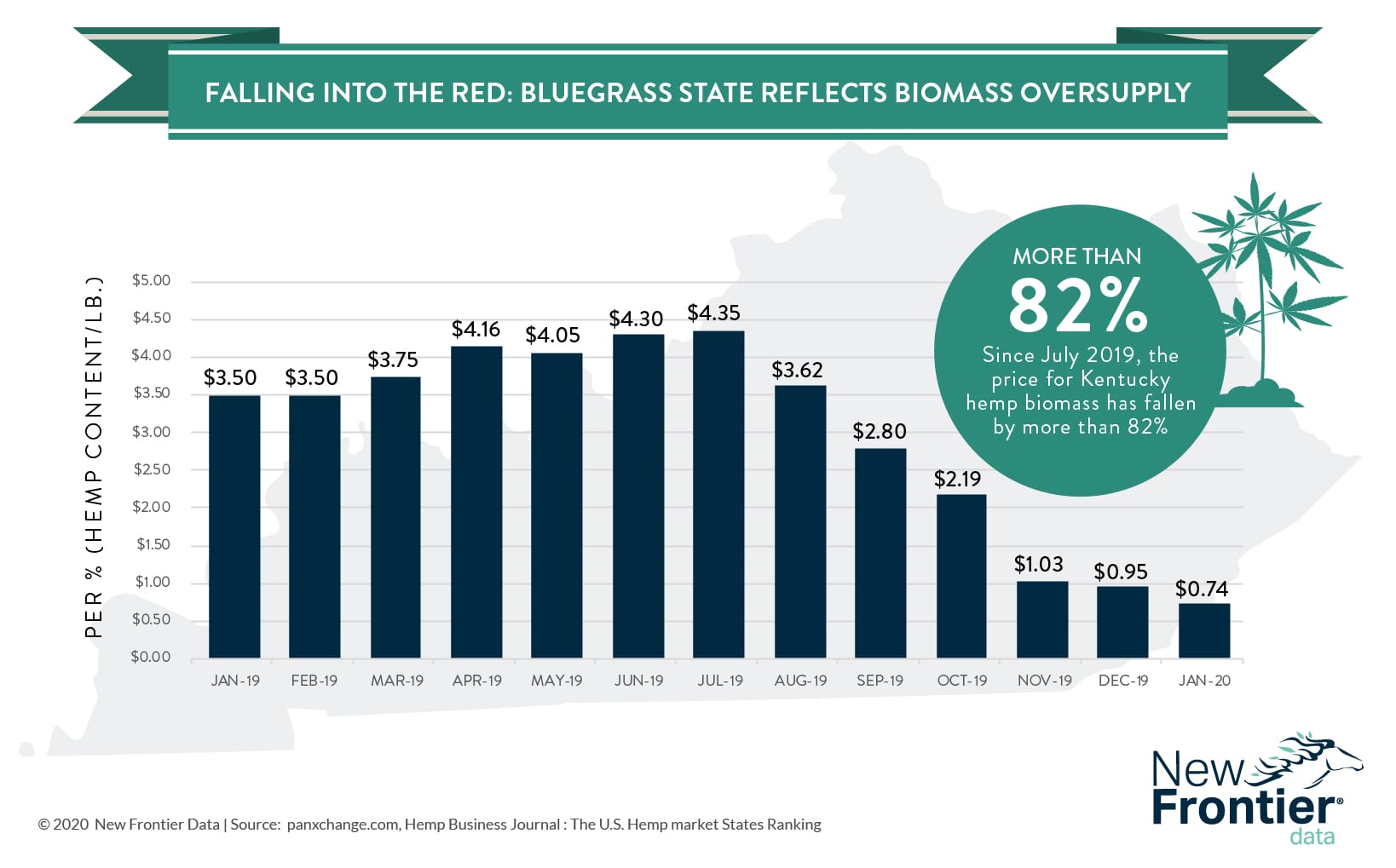

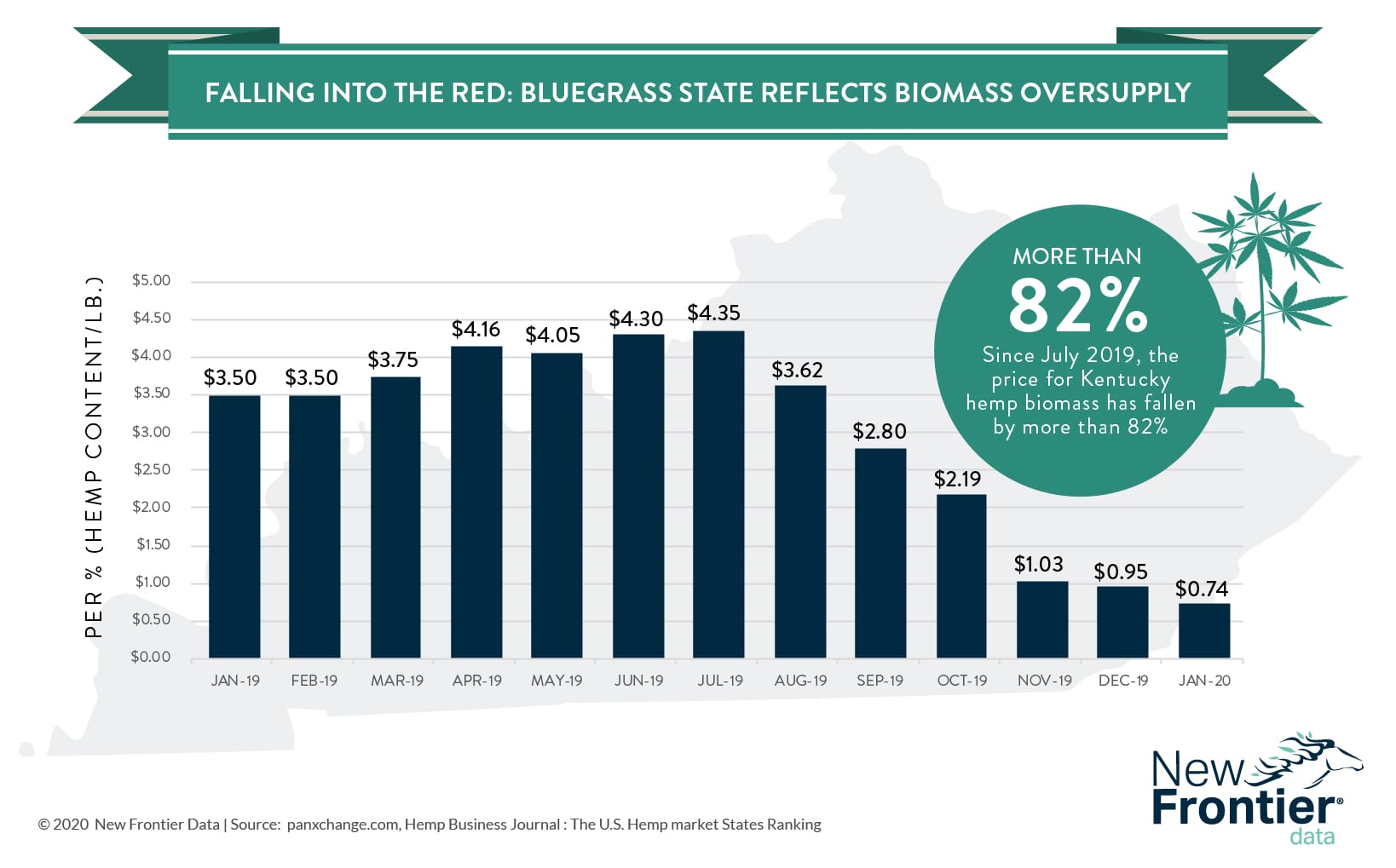

Large, vertically integrated operations like GenCanna’s are increasingly common in the CBD industry. Though vertical integration offers companies cost efficiencies and increased control over their supply chains, it also requires huge capital investments and makes it very difficult to sustain profitability and margins during periods of oversupply. In an uncertain and fast-changing market like CBD, this business model is coming under more and more scrutiny.

The news of GenCanna’s troubles comes on the heels of another high-profile bankruptcy in the sector. Among the largest U.S. processors of hemp fiber, Sunstrand LLC filed for Chapter 7 bankruptcy a month earlier. The company styled itself as a “sustainable materials manufacturer” which converted raw hemp fiber for applications including plastics, paper, and animal bedding. Though many hemp operators expect 2020 to be a big year for fiber, Sunstrand’s closure – and the lack of fiber-processing facilities nationwide – throws ominous shade on the industry.

The string of hemp-related bankruptcies mirrors difficulties in the marijuana industry, where several of the largest Canadian LPs (e.g., Aurora and Tilray) have laid off sizable percentages of their workforce in the face of lackluster financial performance. All of this points to a more challenging operating and investment climate throughout the cannabis world. According to New Frontier Data’s market tracker WeedEx, publicly traded cannabis companies are down nearly 20% since a peak in March 2019, as companies throughout the space struggle with uncertain regulations, processing and retail bottlenecks, and supply-chain shortages.

While discouraged, operators hope not to overreact. Such obstacles facing the industry can be surmounted in due time: Despite continued fluctuations, those invested for the long term may take solace that 2020 is also expected to bring more clarity from regulators, expanded capacity from processors, and increased investment in fiber production.