A Packed Cannabis Convention Underscores the Industry’s Need for Strategic Data, Partnerships

Dispensaries Love Company: Know Your Customers to Grow Your Customers

November 15, 2022

Beauty May Be Skin Deep, But CBD Skincare Market Looks to Grow 8x by 2029

November 29, 2022By J.J. McCoy, Senior Managing Editor, New Frontier Data

Right after the annual MJ Biz Convention put an unofficial bow on the year’s end before the holiday season, New York state regulators on Monday approved the Empire State’s first dispensaries to sell adult-use cannabis.

Permits were granted to nearly three dozen businesses slated to serve consumers in Manhattan, the Bronx, Queens, and Staten Island. The rest of the state will need to wait a while longer after a federal judge in Albany blocked the state’s Office of Cannabis Management from approving dispensaries in Brooklyn and several cities upstate — including Buffalo, Rochester, and Syracuse — pending ongoing litigation impacting up to 63 of the 150 possible business licenses (the Office of Cannabis Management’s board still plans to approve applications for up to 25 nonprofit licenses this month).

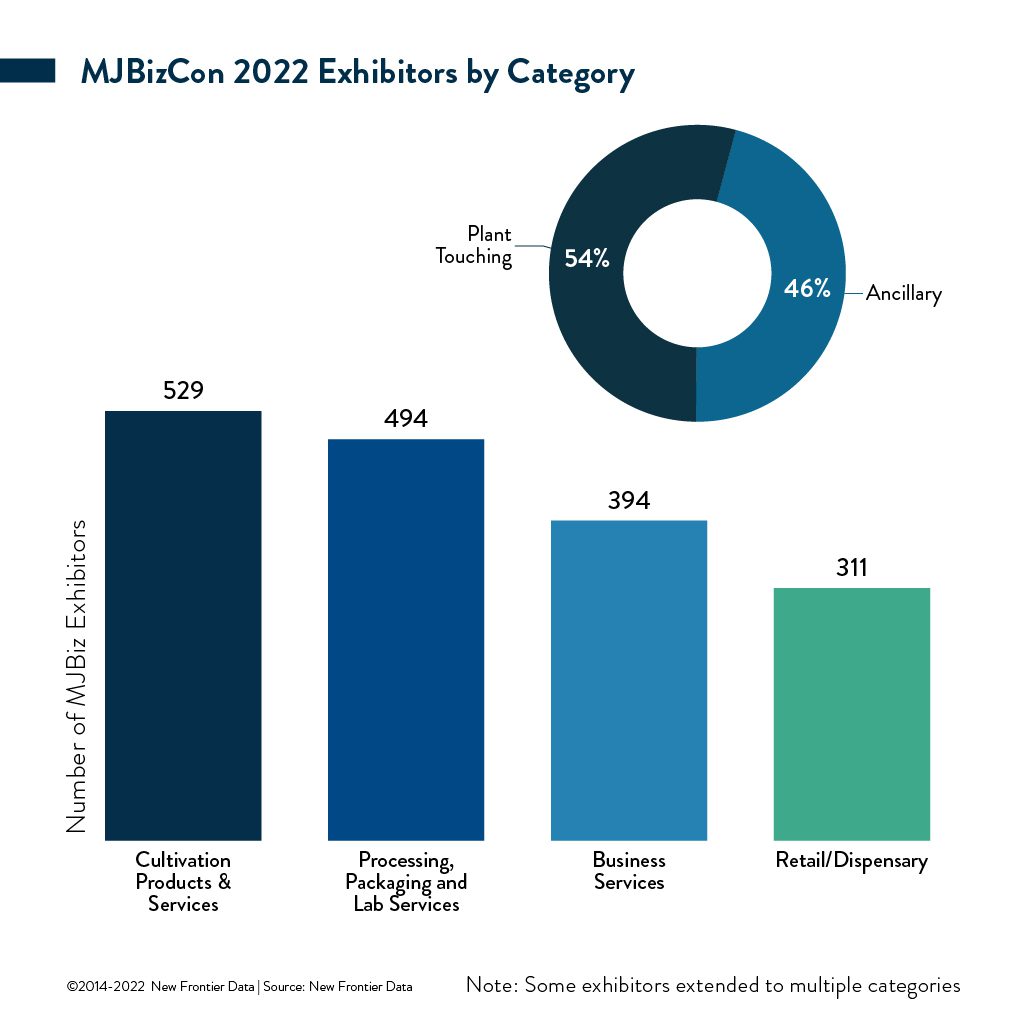

In Las Vegas for the MJ Biz Convention last week, more than 1,300 exhibitors filled up the Convention Center’s South Hall over two floors. The first edition of the event hosted by its new owners, Emerald Company, featured several side forums, including programs focused on psychedelics and. Attendance numbers have not been divulged, but the consensus among attendees is that the event drew a much larger crowd than last year. Four distinctly segmented pavilions featured exhibitors in:

- Cultivation Products & Services featured seeds and clones to fertigation, irrigation, nutrients, facility design, greenhouse components and lighting to grow pure, beautiful flowers.

- Processing, Packaging & Lab Services presented distillation, extraction, flavors, automation, packaging, or testing and lab equipment.

- Retail & Dispensary included top brands for high-THC flower and infused products, CBD, and even paraphernalia.

- Business Services presented critical products and services for all aspects of cannabis businesses, including cannabis-specific point of sale and inventory control software, and the latest offerings in technology, security, HR and staffing, marketing, consulting, banking, private equity and investing, accounting, real estate, insurance, or government and industry associations.

Looking ahead, most businesses and investors intent on crafting true product innovation and branding are anticipating federal deregulation across markets where cannabis sales will happen on various platforms, with a critical premium placed on differentiation within branding. Operators are reportedly relying on strategies based on economies of scale and vertical integration with captive retail.

A general surplus of cannabis among state markets is putting a premium on producers’ balancing supply and demand while factoring in the lifecycle of plants. Meanwhile, retail sales and operational planning tied to forecasting demand are designed to buy time to adjust supply chains to that demand.

Other issues begging for solutions in 2023 include heavy taxation, market fragmentation, and rampant illicit markets.

Cannabis has gone mainstream, and the plant appeals to a wide demographic spectrum with different needs, desires, and interests. Strategic partnerships seek to bridge cannabis and culture, with lifestyle companies overlapping the same core values, consumer bases, aesthetics, and brand cultures as their cannabis suppliers.

According to New Frontier Data’s Chief Knowledge Officer Dr. Amanda Reiman, Ph.D., MSW, it’s more vital than ever that canna-businesses get their messaging out to their target audiences to separate themselves from the crowd.

“It’s not just brands and retailers that can benefit from consumer data,” she explains. “The ancillary cannabis business space is crowded with companies trying to make business easier for plant-touching companies. Payment processors, hardware manufacturers, facility builders, and clean-air providers have the goals of supporting those who grow, process, and sell the plant.”

Though such services are primarily B2B, that doesn’t mean that any companies should shy away from consumer data. Understanding the motivations for consumer behavior across the supply chain can help ancillary businesses better understand the needs of their clients and reduce the costs of R&D by knowing the habits and desires of the end user.

“Companies that make vape hardware should know who vaping consumers are, how they act at the dispensary, and what it is they want out of a vaping experience,” Reiman reminds. “Those who do build-outs for dispensaries need to understand what drives consumers to visit a certain dispensary, and what keeps them coming back. Takeaway: Just because your business does not touch the plant, doesn’t mean that it doesn’t need to understand the motivations of the consumers who do.”

It’s crucial for any cannabis business to understand consumers’ purchasing behaviors, particularly by identifying product and experience preferences. A recent webinar “Intentional Cannabis Consumption”, featured Reiman in conversation with Jointly’s CEO and Co-Founder David Kooi, and Sara Payan, Public Education Officer at The Apothecarium in San Francisco, about findings in New Frontier Data’s recent cannabis consumers series of reports.

The industry experts considered how cannabis producers are targeting consumers looking for specific outcomes: Intentional consumption is the process of selecting cannabis products based on specific goals. What are the most common goals for cannabis consumers and which products are most effective at meeting these goals? As the cannabis industry evolves, emerging products are targeting consumers looking for specific outcomes.

The recorded webinar is available on Equio®, our cannabis business intelligence platform. Download a complimentary copy of the most recent consumer report. Interested in accessing Part I of our Cannabis Consumers in America report series? Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.