Dispensaries Love Company: Know Your Customers to Grow Your Customers

For Dispensaries: Know Your Customers to Grow Your Customers

November 9, 2022

A Packed Cannabis Convention Underscores the Industry’s Need for Strategic Data, Partnerships

November 22, 2022By Noah Tomares, Senior Research Analyst, New Frontier Data

The legal cannabis industry is no one-size-fits-all proposition, but to consumers the purchasing process can often seem pretty standardized, if not stale. Understanding consumers’ expectations and preferences for visiting a dispensary is essential both for the brands hoping to connect with new consumers and for those dispensaries aiming to cultivate a positive environment — whether for seasoned consumers or the uninitiated canna-curious.

New Frontier Data’s latest report offers indispensable information to dispensary operators about who their customers are, what they consume, and how to keep them coming back.

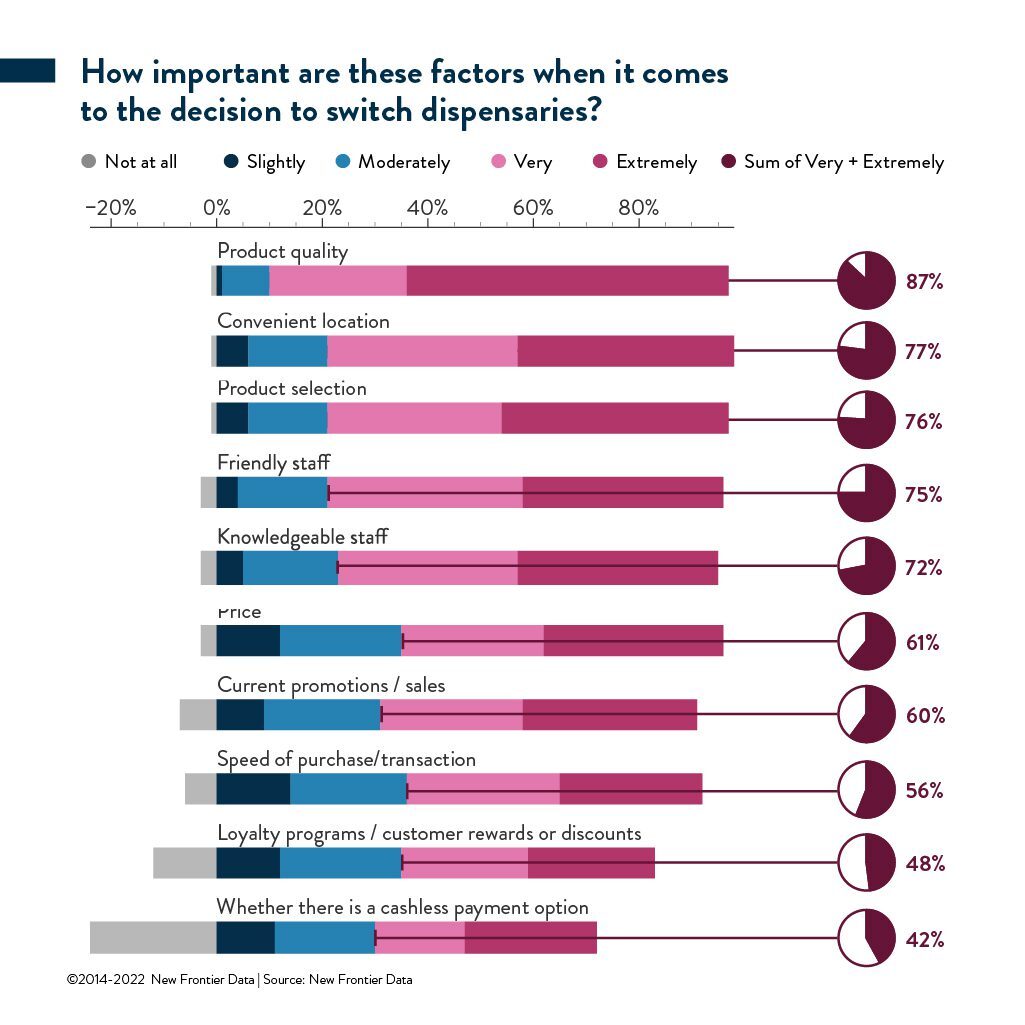

Drawing from insights gleaned from our latest consumer survey, a new report titled The Dispensary Experience: Cannabis Consumer Attitudes, Preferences, and Opinions details how local customers make their purchasing decisions, and how brand loyalty impacts those decisions. Cannabis consumers choose a favored dispensary based on familiarity, convenience, and product offerings. Though sales and other promotions can encourage consumers to visit a new retail outlet, the value of an initial positive dispensary experience cannot be understated.

“As we have all seen, the consumer spend throughout the market has declined, making understanding the consumer more important than ever,” said Gary Allen, New Frontier Data’s CEO. “While the spend is reducing, retail operators need to find more consumers, bring those consumers into their stores, and give them the products they are looking for.”

Among U.S. consumers today, more than a third (34%) report a brick-and-mortar store being their primary source; in legalized adult-use markets, closer to half (43%) do. Most (58%) of those customers typically spend between $50-$200 per purchase, while two-thirds (66%) report spending up to $200 monthly.

The vast majority of these consumers claim to only purchase from licensed dispensaries. None of these consumers claimed to exclusively purchase from unlicensed sources. Notably, while use of licensed sources was common among this consumer population, those who favored edibles were more likely to report only purchasing from licensed sources (86%) than were those who favor flower (73%).

Retailers need to ask themselves what they are doing to deserve, draw, and redouble their customers’ patronage. The Dispensary Experience offers evidence, experiences, and advice to realize their continued success.

Dispensary consumers primarily enjoy flower products: As the market matures and consumers become more intentional with their consumption, we expect value-added products to gain market share.

While strain is often a poor indicator of the effect a product will have, it is still a powerful tool for many consumers when it comes to making purchasing decisions: Brands that can deliberately promote the quality of their flower products and the effect that flower will have on consumers will be well positioned to capitalize on new consumers and those seeking an effective barometer of quality.

Consumers are more likely to purchase an unfamiliar strain from a familiar brand than vice versa: The same holds true for value-added products. Brands which can clearly and succinctly communicate their value proposition to consumers will likely engender greater loyalty than those merely advertising specific strains or flavors.

Most consumers check out a menu before shopping, and familiarity is the top reason for choosing to go to the same store: However, promotions and deals are the factor that can get someone to try out a new place.

The value which budtenders add to a shopper’s experience at a dispensary—especially for new consumers unfamiliar with value-added products—is quintessential to fostering repeat business: Consumers overwhelmingly reported that their experience with budtenders have been positive, and 39% of respondents said that they would actively seek out the budtender whom they met on a previous visit.

Who uses brick-and-mortar dispensaries? How can cannabis retailers best encourage foot traffic, and what’s vital to know about how customers’ purchasing decisions are made? Strategies for attracting new consumers are important, but the key to a dispensary’s long-term success is keeping those that it’s got.

In a related webinar, New Frontier Data’s Chief Knowledge Officer Dr. Amanda Reiman, Ph.D., MSW, discussed ways to promote customer retention along with principles for developing consumer loyalty. She was joined by Christine De la Rosa, CEO & Co-Founder of The People’s Ecosystem, in exploring the characteristics and habits of consumers who purchase from dispensaries, what keeps them coming back, and how to maintain their loyalty.

Check out the complete video library on Equio®, our cannabis business intelligence platform. Download a complimentary copy of the report. Purchase an Equio® subscription to gain access to New Frontier Data’s entire library of Analyst Reports, and our five dashboards of interactive data widgets connecting you to the best-in-class retail, consumer, and market intelligence.