Illicit Cannabis Supply Output Still Dominates in the U.S.

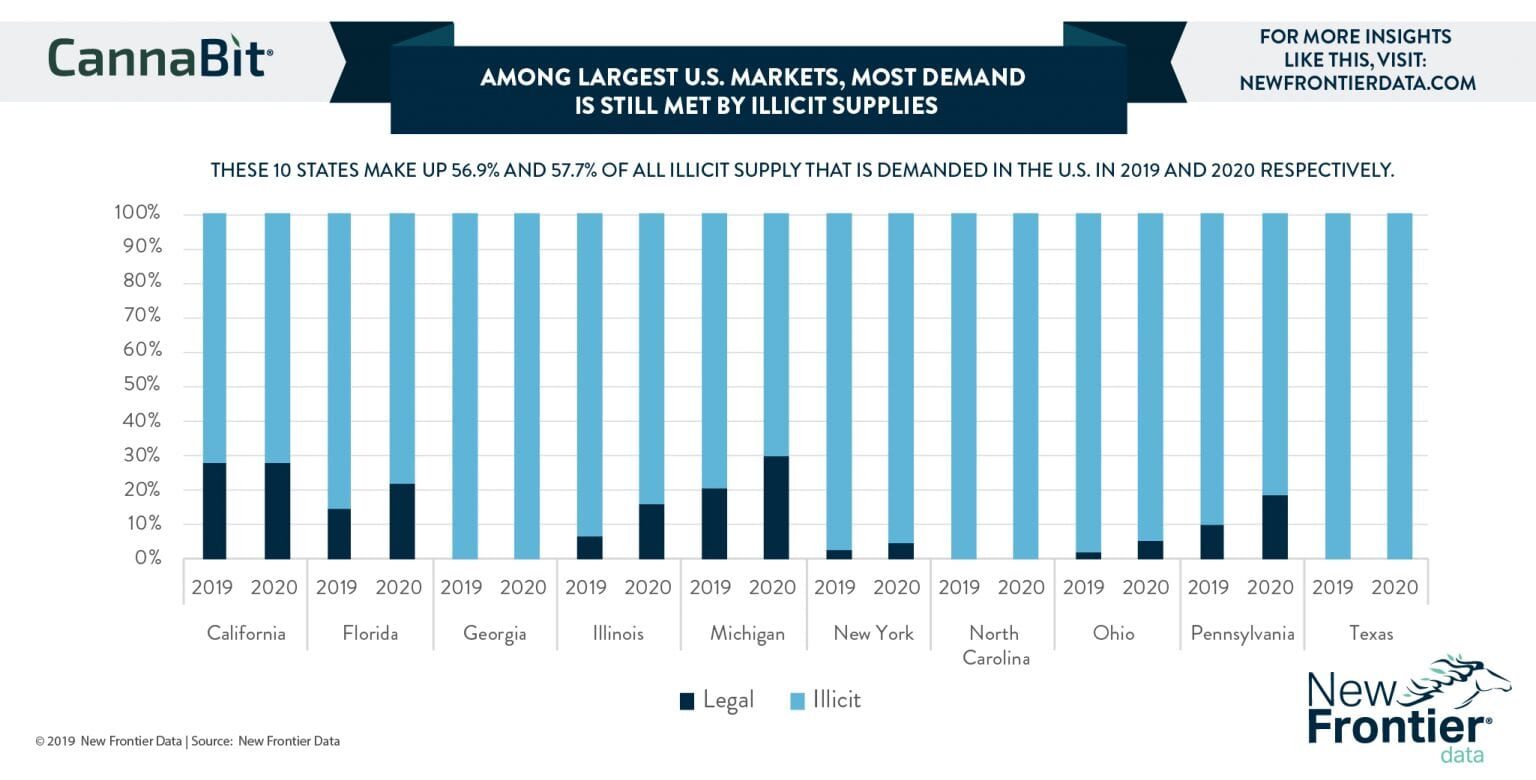

Among Largest U.S. Markets, Most Demand Is Still Met By Illicit Supplies

November 24, 2019

Most Cited Reasons For Use Among European CBD Consumers

December 1, 2019By Beau R Whitney, Senior Economist, New Frontier Data

In New Frontier Data’s The U.S. Cannabis Cultivation Report: 2019 Legal and Illicit Output by State, the estimated cultivation output in the U.S. for 2019 is forecasted to reach 29.8 million pounds, and expand to 34.4 million pounds by 2025. Of the 2019 output, 5.4 million pounds (18.2%) is legally cultivated. By 2025, the total legal output is expected to grow to 12.5 million pounds, or 36.3% of the total demand. The increase in output is mainly due to population growth and the deployment of newly legalized adult-use programs in Illinois, Massachusetts and Michigan as well as growth in Florida and California.

The cultivation report outlines not only legal cultivation estimates, but also illicit supply and demand. Given that 72% of all the 2019 cultivation in the U.S. has been from illicit growers, many stakeholders are closely scrutinizing the data.

Among states having the largest illicit demand, California, New York, Texas, Florida, and Illinois round out the top five by weight. Some of those are in the process of transitioning to an adult-use system (e.g., California and Illinois) while some are simply large markets that have limited access through medical-use consumers (e.g., New York and Florida). Texas is an outlier insofar as it is neither a medical nor adult-use state (its Compassionate Use Program, opened in 2018, allows people suffering from severe seizures to use low-THC medical cannabis while leaving most medical patients wanting), though it does have a significant population of 2.4 million cannabis users.

According to a 2018 survey by the Substance Abuse and Mental Health Services Administration (SAMHSA), among the top 10 states by largest illicit market supply, very few have access to legal cannabis and subsequently harbor large illicit cannabis industries.

Illicit suppliers represent an existential threat to legal operators. Illicit suppliers neither test their products, charge sales tax, nor burden themselves with compliance costs. Conversely, not only do legal suppliers need to be aware of their legal competitors, but also to compete against rivals in the illicit market.

Assessing the illicit supply is in some ways more important than tracking a legal one: By understanding the level of illicit activity, regulators can assess the effectiveness of their regulatory programs. Investors can examine the delta between legal and illicit support to determine the upside potential of the market(s) in which they are investing. Operators, meanwhile, can calculate the market share of production which they control, and better develop strategies to capture a greater share from their competitors. The illicit supply calculations contained in the cultivation report can provide critical data for a variety of audiences.

While the legal revenues are impressive (a projected $13.6 billion in 2019 revenues, growing to $29.7 billion in 2025), investors, operators, and regulators all need to keep a watchful eye on the illicit market, as that market is much more formidable and remains a key factor in the success of the deployment of any given legally regulated system.