New Frontier Data’s Analysts Offer Predictions for the Year Ahead

By Oliver Bennett, Special Contributor to New Frontier Data

Last year was dominated by COVID-19, and it seems that 2021 will be similarly afflicted by the virus. Yet while the pandemic has caused devastating losses, both human and economic, it has also yielded unexpected dividends for the cannabis industry and consumers.

“Many parts of the economy have been crushed, but by virtually every metric 2020 was a banner year for our industry,” noted John Kagia, chief knowledge officer for New Frontier Data. “In terms of both public attitudes to cannabis as a therapeutic application, and as a business and investment opportunity, it has changed.”

Beyond having been deemed “essential business” during other commercial shutdowns, economic indices should favour various cannabis sectors with good footing as they move into 2021, Kagia added. “Government revenues will be needed, so they will likely try to capitalise on this fast-moving environment. And with the rise of Canada’s adult use market, and the UN rescheduling cannabis from Schedule 4, there is a strong tailwind as we go into the new year. As a result, there will be a lot of investor interest.”

Last November’s U.S. presidential election has also helped spur optimism – which could favourably impact the European market. “President Biden’s agenda will see North American capital being invested in R&D in Europe,” Kagia explained. “There will be an infusion into this space, and with a European THC market that remains immature, this capital will go a long way to ensure future growth.” Biden’s new administration will also likely prioritise climate change-related opportunities – another factor that could impact the U.S. and EU cannabis markets.

As New Frontier Data’s senior managing editor J.J. McCoy noted, the U.K.’s Brexit (the country fully left the European Union on 1 January) will also have an obvious effect across Europe. “The impact of Brexit and what it will mean for the EU will be a big feature of the year,” he says. “There will also be ripple effects from proposed Israeli cannabis legalisation, due to happen in 2021.”

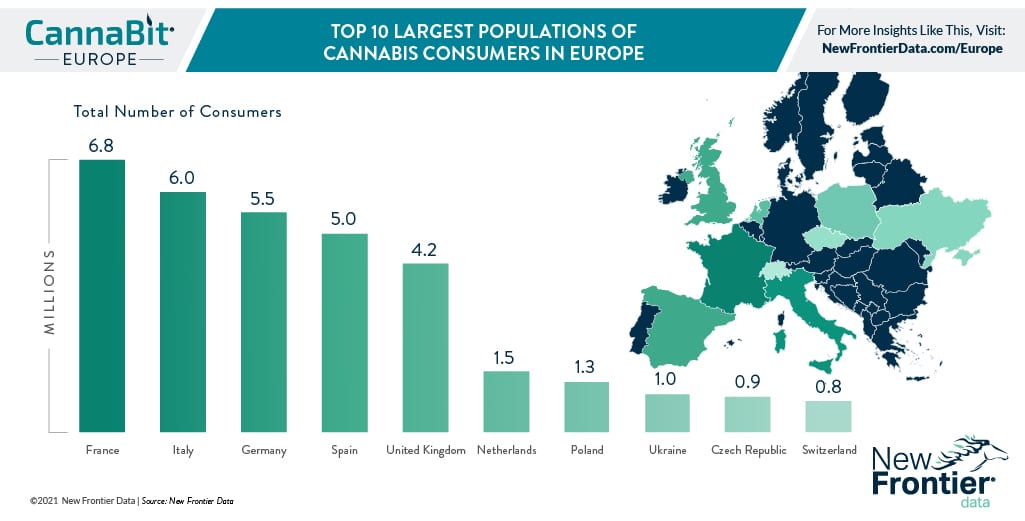

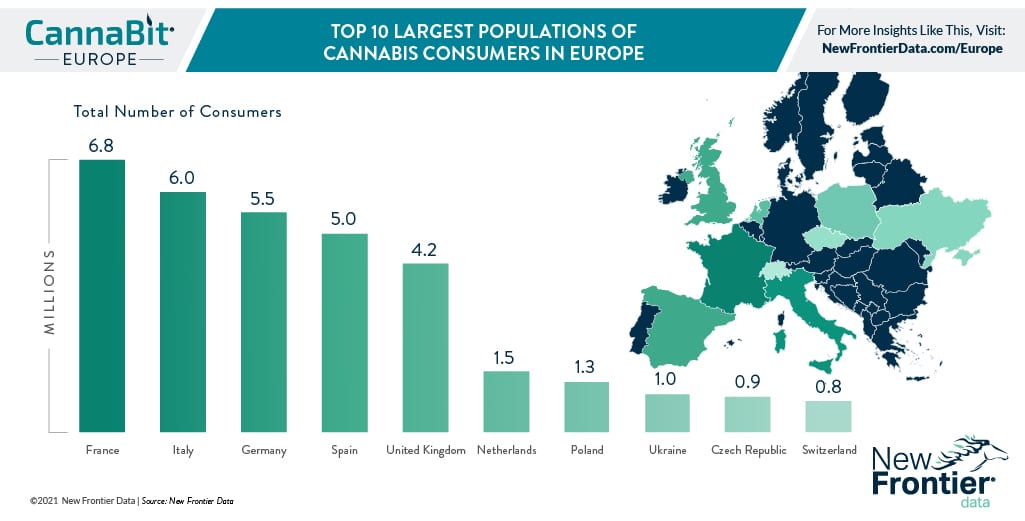

As the European market grows both within the EU and in those countries outside of the federation (e.g., the mature markets of Norway and Switzerland, as well as the U.K.), there is likely to be a growth of import/export activity, including increasing imports from developing-world countries.

“The year will see some countries get a leg up in terms of getting their products into Europe,” said Kacey Morrissey, New Frontier Data’s senior director of industry analytics. “For example, Australian producers are getting product into German pharmacies. There are now 68 countries with legal medical cannabis in some form or another, and for most it is specified oils from specific countries. I would expect some European countries with small early programmes to expand their lists – and we should watch more nascent markets. It will be important to see where they will be importing their oil from, to watch their sales and see who will be their key importers. New markets will be getting legs, and the top exporters of 2021 won’t be the same as in 2020.”

New and developing markets could include India, McCoy concurred, particularly regarding the U.K., which has a historic relationship with the country, and is seeking trade partners from outside the EU.

Watching European markets evolve together in 2021 will be key. Kagia identified a “regional contagion effect”, whereby countries that have not legalised will see the beneficial effects in a neighbouring country which legalised a program two or three years ago, and now enjoy operational markets.

The effects of the KanaVape case in France, where at the end of last year the Court of Justice of the European Union (CJEU) ruled that a CBD product was not narcotic, will continue to have effects on the industry, said Dr. Molly McCann, Ed.D., New Frontier Data’s director of industry analytics. “In the case of CBD, the novel food category might change in the mind of consumers.” More generally the logjam around novel food applications remain, but the U.K.’s moving forward and granting novel food status to CBD might help to shift the EU’s stance.

Kagia added that obstacles remain: “CBD has survived an existential crisis, but major challenges remain with the novel food categorisation,” he said. “There is going to be a need for consumer education, and work needs to be done to allay consumer concerns. The position in Europe has not been as clear as in the U.S., where they have mostly been positive stories. Legal wrangling and regulatory contortions have clouded consumer judgment in Europe.”

Overcoming such negative perceptions will take more work this year and, as McCann adds, the scenario might have the effect of shutting down smaller operators and enabling the continuation of the grey market.

Meantime, there could be increasing action in the various CBD sub-sectors, however, providing that consumer education takes place. As Josh Adams, New Frontier Data industry analyst, explained, “It could be bad public relations for CBD, as its perception has been marginally tainted. But it could be interesting to see if those segments within CBD – such as wellness and pet food – start to do more education and position their brands in 2021.”

Hemp is a sector that has traditionally been stronger in Europe than in North America, as it should continue to be. “The big question on the industrial side is that there is a big push to form partnerships with governments and work towards decarbonisation in line with the new European Green Deal,” noted Trevor Yahn-Grode, data analyst for New Frontier Data. “People are expecting a lot of action on climate change in 2021, including investment in decarbonised technology. The position of the European Industrial Hemp Association (EIHA) is that it can play a big role in that effort, aligned with government help.”

Accordingly, Yahn-Grode added, new applications for hemp and bio-based research are coming from SSUCHY, a joint project agency which is making big strides in newer applications from car parks to construction materials. “The research barriers have been lifted and there’s a lot of research and innovation breaking through.”

Despite a problematic lack of convergence in Europe – which is likely to continue – Kagia believed it might have the benefit of seeing others do trial runs. “In the U.S., the ‘patchwork nation’ model has worked pretty well,” he said. “It has allowed for a lot of innovation and experimentation with factors such as retail distribution models, and given the market a chance to assess what works best. From there, a convergence of policy and business can be drawn from best practises, and later adopters will not make the same mistakes.”

So it is that cautious optimism is in the air. But the COVID-19 scenario will likely provide a constraint to economic activity. As McCoy put it, “At present, normalcy is unlikely by the summer, and disruptions could be extending throughout 2021. That uncertainty will continue to guide the conversation.”