USDA’s National Hemp Report Is Feds’ First Look at U.S. Production

By Eric Singular, Director, Hemp Business Journal

A new report released by the United States Department of Agriculture (USDA)’s National Agricultural Statistics Service (NASS) represents the feds’ first in-depth look at the U.S. hemp market since the 2018 Farm Bill.

Based on survey information collected throughout the fall, the National Hemp Report shares feedback from more than 13,000 producers nationwide to quantify the value and acreage of domestic hemp production. Up to now, U.S. hemp acreage was projected through patchwork estimates by advocacy groups like Vote Hemp using data from state agriculture departments and planting reports. Beginning last October, the Hemp Acreage and Production Survey was sent to furnish regulatory agencies with a hemp production benchmark to inform governmental policies. The findings will help regulators set allocations of grant funding, along with price assessments for each of the USDA’s Risk Management Agency (RMA)’s Whole-Farm Revenue Protection, Multiple Peril Crop Insurance (MPCI) coverage, and Farm Service Agency’s Noninsured Crop Disaster Assistance Program. It should likewise provide key market insights to producers, state governments, processors, and other industry stakeholders.

Measuring Crop Yields by Category

Data collected about indoor and outdoor hemp production were categorized by floral, fiber, grain, and seed yields to examine the U.S. market by the crop end-use (e.g., “grain” refers to hemp produced for food-grade human consumption, whereas “seed” refers to certified planting seed produced for further hemp production).

According to NASS, 2021’s total U.S. planted area for industrial hemp was 54,152 acres (i.e., about twice the area of New York’s Manhattan Island). Among more than 54,000 planted acres, a reported 16,000 acres were harvested for smokable flower and cannabinoid extraction, with another 12,700 for fiber, 8,255 for grain, and 3,515 for seed.

A primary goal of the NASS survey was to assess the national average yield per acre and price per pound of harvested hemp material being sold for varying end uses. As seen in years past, significant variability exists between licensed, planted, and harvested acreage, respectively. Crop failure due to extreme drought was a critical factor contributing to a 20,672-acre discrepancy between planted and harvested acreage in 2021. The RMA reports that U.S. hemp growers last year insured 12,189 acres under 59 policies to protect $10.9 million in liabilities, suggesting the critical need for establishing a baseline for federal crop insurance.

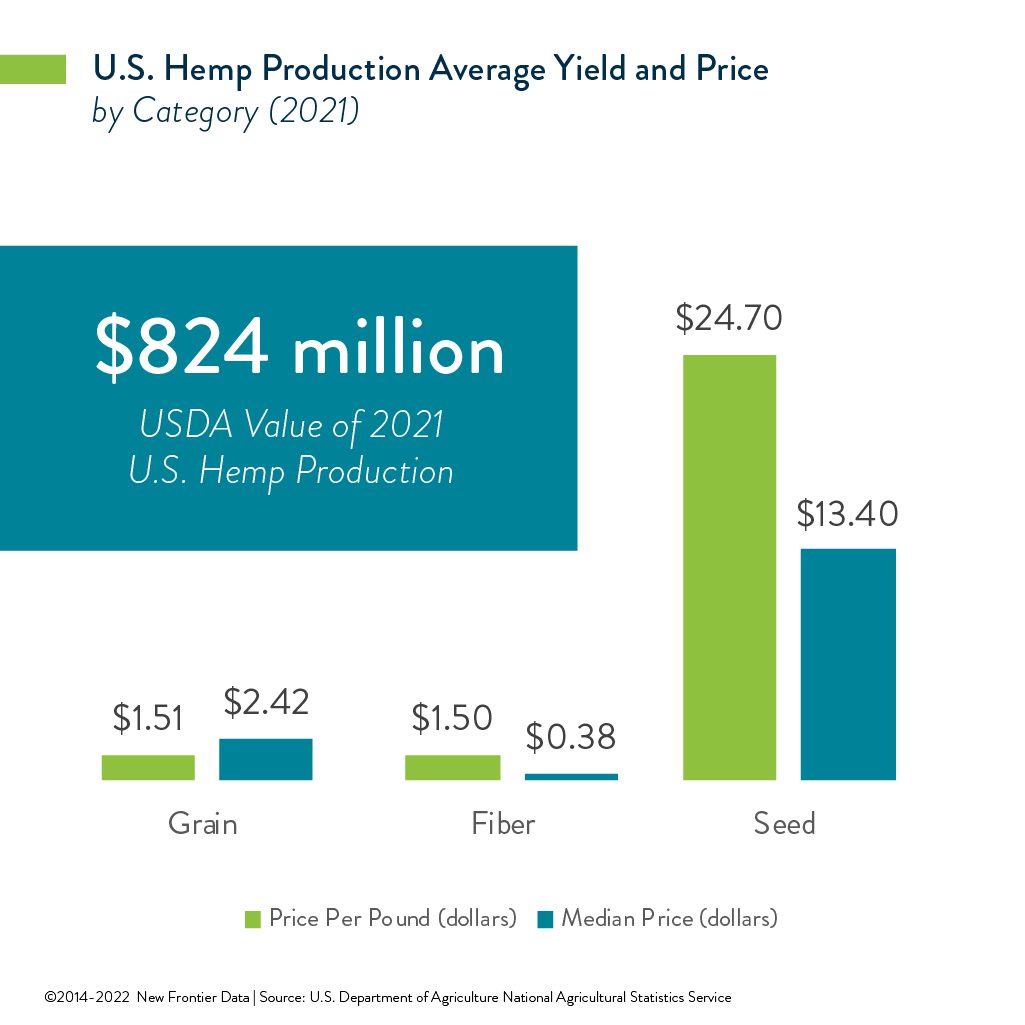

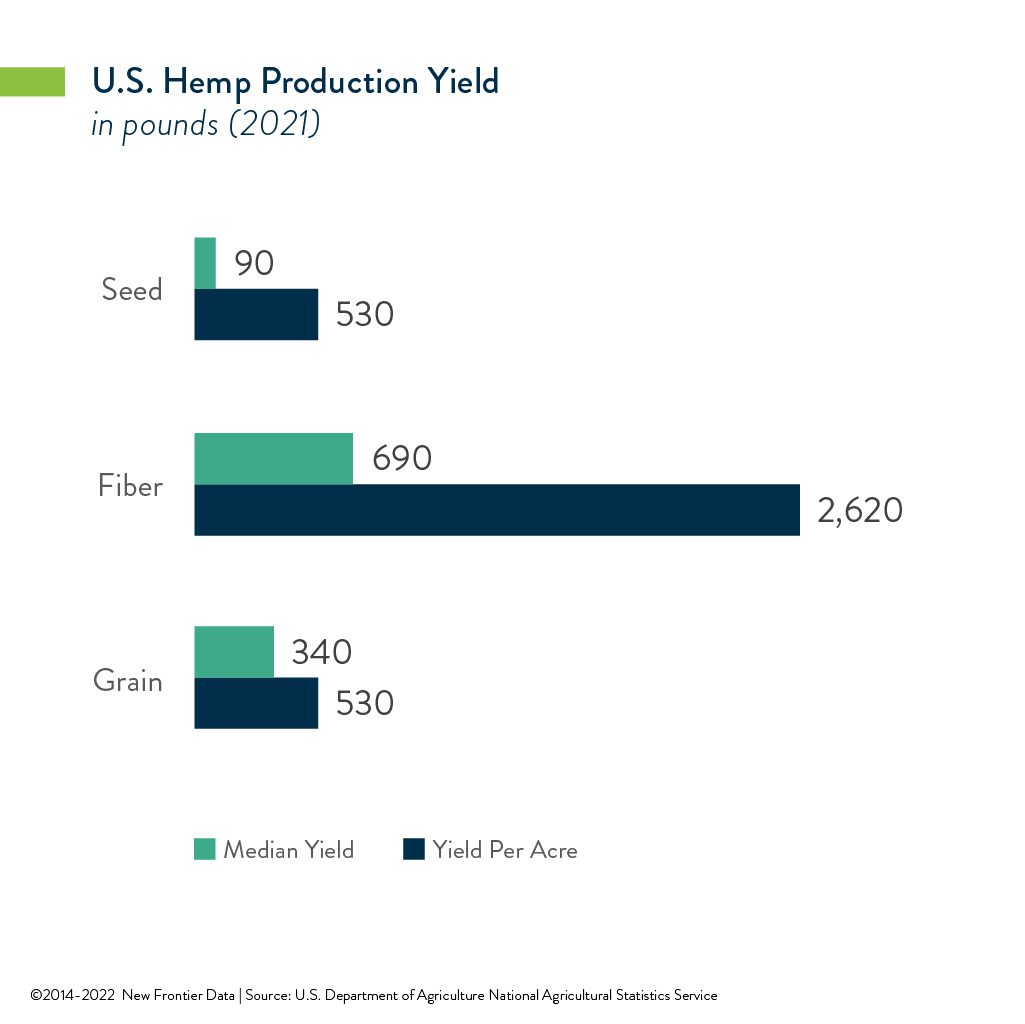

The average 2021 U.S. yield for outdoor smokable flower and cannabinoid hemp production was estimated at 1,235 pounds per acre, for a national total of 19.7 million pounds (15.7 million pounds sold). The value was totaled at $623 million. The average yield for grain production was estimated at 530 pounds per acre, for a national total of 4.37 million pounds (3.96 million pounds sold). The value was totaled at $5.99 million. The average fiber production yield was estimated at 2,620 pounds per acre, with a national total of 33.2 million pounds (27.6 million pounds sold) worth $41.4 million. The estimated average yield for seed production was 530 pounds per acre, for a total of 1.86 million pounds (1.68 million pounds sold) worth $41.5 million nationwide. The total U.S. yield for outdoor hemp production was worth $712 million, with indoor U.S. hemp production reaching $112 million.

Which States Fared Best?

Among individual states, Colorado led the nation in outdoor hemp production (with 10,100 acres planted), followed by Montana (7,900), and both Texas and Oklahoma (tied at 2,800 acres apiece). Montana led in acres harvested (4,500), followed by Colorado (3,100) and Minnesota (2,300). California led the nation’s indoor production at 3.9 million square feet, followed by Colorado (2 million square feet), and Oregon (1.7 million square feet).

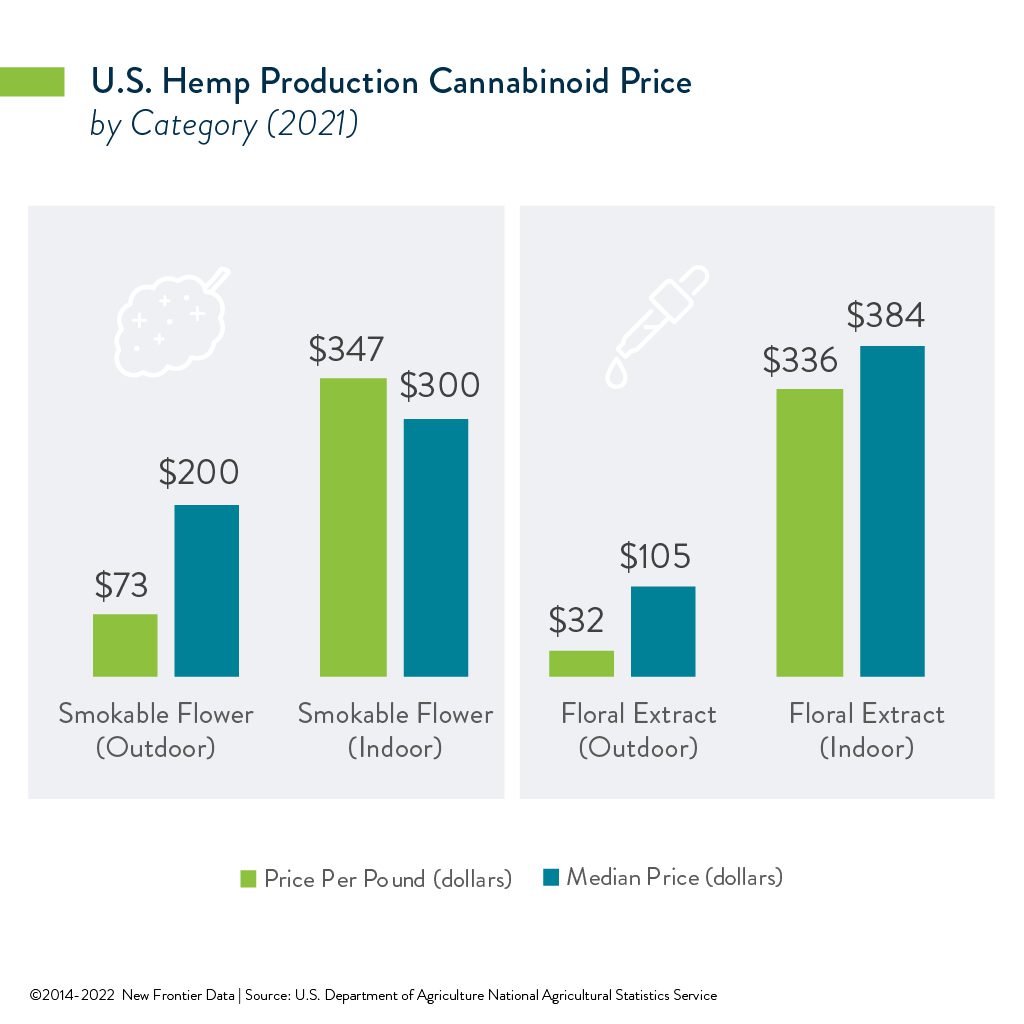

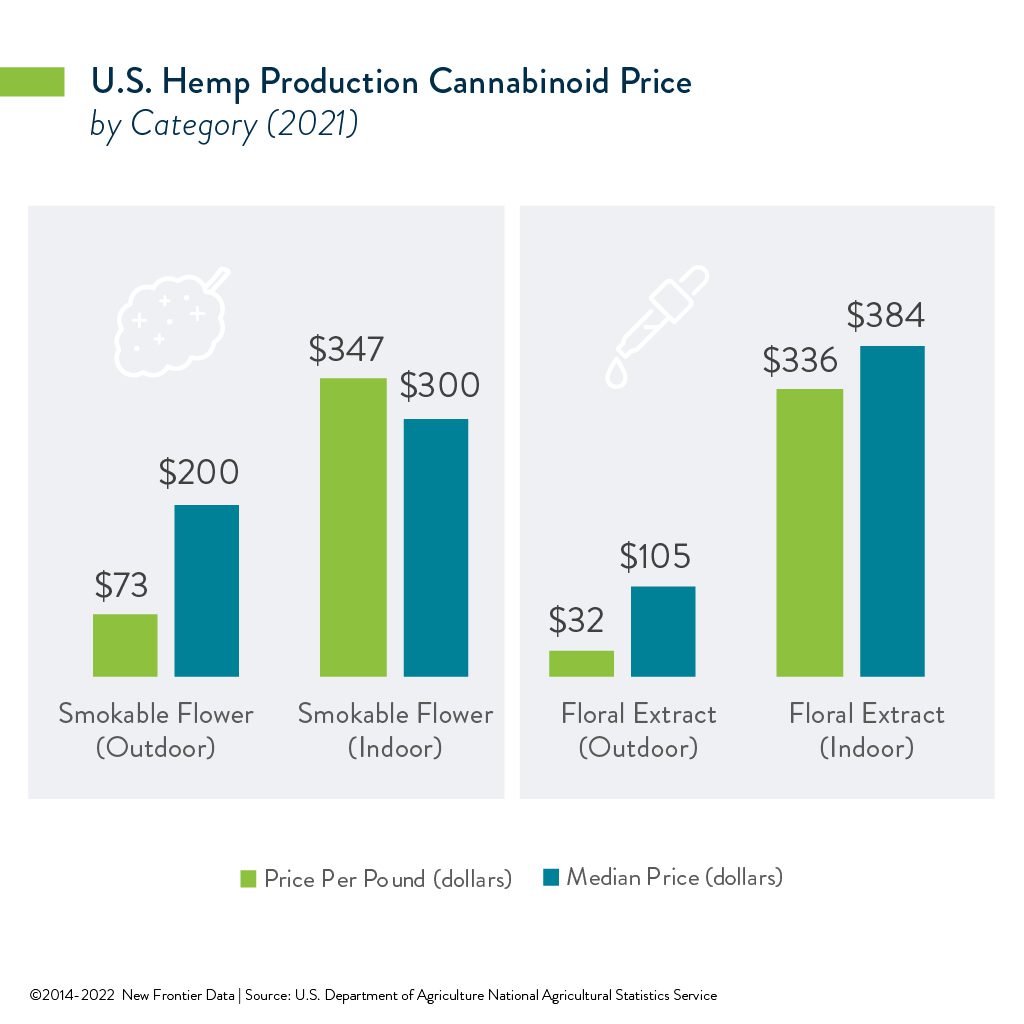

Notably, both the reported prices per pound and the median prices for most categories were significantly higher than anticipated. The average price per pound for grain was reported at $2.42. New Frontier Data found that the 2021 market was closer to $0.65-$0.85 per pound for conventional grain, and $1.15-$1.50 per pound for organic.

Interestingly, while Hemp Benchmarks assessed the 2021 annual average price for smokable hemp flower at $265 per pound, the National Hemp Report pegged it at $347 per pound. One possible explanation for the discrepancy is whether survey respondents reported higher prices so as to skew the benchmarking for crop insurance more favorably. It’s also worth noting that USDA did not differentiate between crops grown for biomass for cannabinoid extraction and those grown for smokable flower. This certainly skews the pricing data for the floral category as smokable flower commands a much higher premium than biomass.

In 2021, floral hemp production was insurable under both the Nursery Commodity Insurance

program and the Nursery Value Select pilot crop insurance program. There is also an MPCI pilot insurance program to provide Actual Production History coverage for eligible industrial hemp producers in 24 states, though access to federal crop insurance is still extremely limited.

This year, hemp producers need a contract for the purchase of their hemp while meeting all applicable state, tribal, and federal regulations to receive insurance. As in 2021, crop insurance does not cover any loss due to exceeding the allowable THC threshold of 0.3 percent.

The Outlook for 2022 and Beyond

Last summer the National Industrial Hemp Council, a U.S. trade organization, released a report which estimated that the value of domestic hemp prediction will surpass $10 billion by 2025. Given how the National Hemp Report pegged the value of U.S. hemp production at $824 million in 2022, that projection would mark a 1113.6% increase within three years’ time. Meanwhile, the report projected that grain production would rise to 65.8% of total acreage, with fiber accounting for 31.4%, reducing cannabinoid production to only 2.8% by 2030.

Given all of the regional fiber and grain processors which have become operational in the past 12 months, a significant increase in U.S. hemp acreage is due in 2022, particularly for seed, grain, and fiber. Yet, as agricultural commodities and fertilizer prices are skyrocketing, competition for acreage becomes increasingly challenging.

Many U.S. hemp processors will be challenged this year to find regional growers willing to contract for hemp production while price competition for staple agricultural crops like corn, wheat, and soybeans is so high.

New Frontier Data will be closely analyzing the status and forecasting the near-term growth of the domestic hemp market in the forthcoming U.S. Hemp Report, due this spring.