Will 2022 Spark Europe’s New Continental Convergence for Cannabis?

By Oliver Bennett, Special Contributor to New Frontier Data

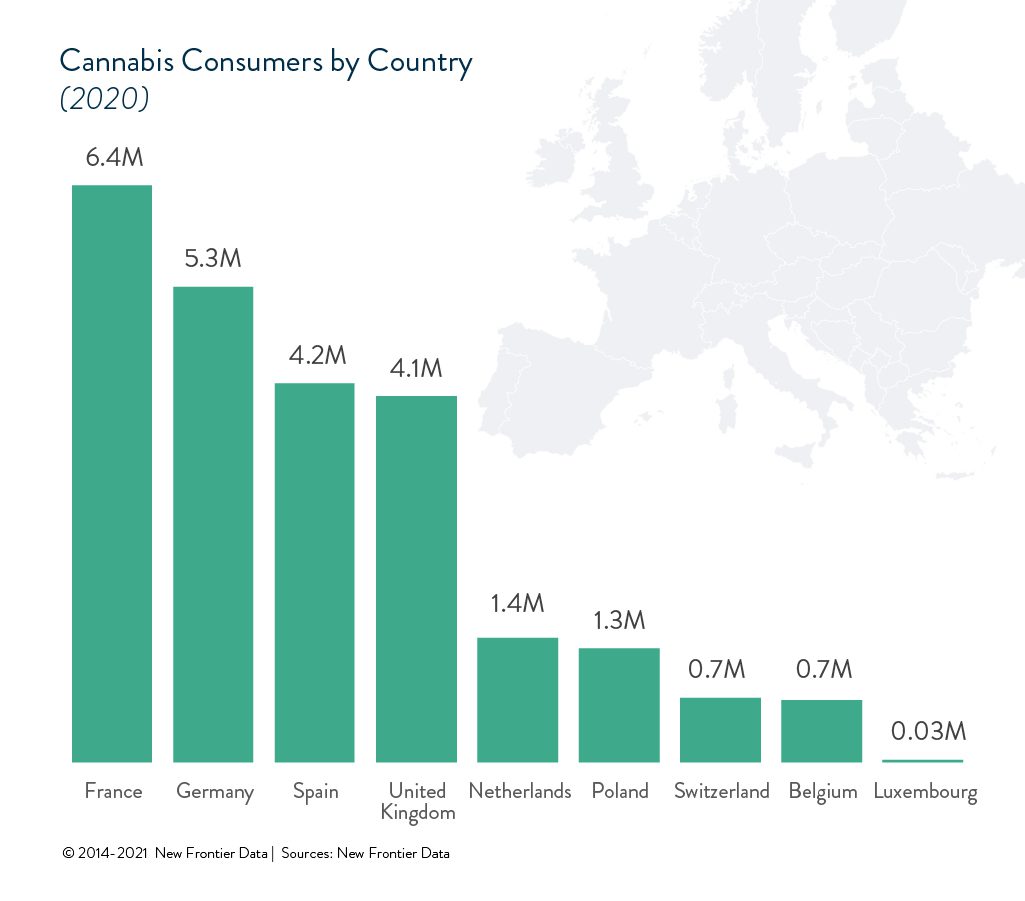

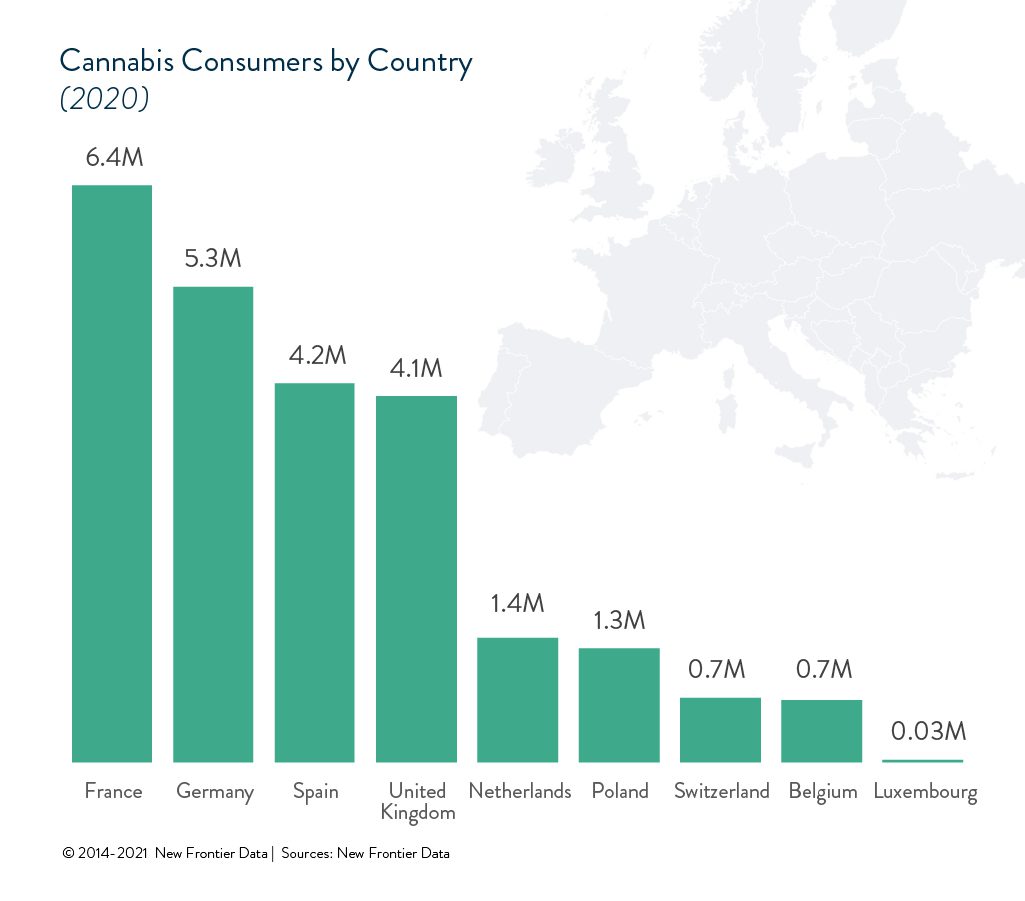

The consensus thinking on the continent is that Europe’s cannabis market is powering apace toward prosperity. Much is expected within the industry for 2022, including both Malta’s and Germany’s legalising adult-use markets. Curaleaf International CEO Antonio Costanzo expects more European countries to allow the use of recreational cannabis within the next four years, and speculation abounds about the next country to enter the mix.

That said, a lack of policy convergence or national harmonisation about legal cannabis has held the European industry back, and continues to hamstring progress.

Though Europe looms as a honeypot for cannabis investment, its legal framework remains fragmented in all areas of the sector: from medical cannabis, to CBD, to nascent adult-use markets. Along with disparate positions per each nation’s legislation, the prospective industry suffers from a confluence of societal variables, including a residual stigma to the drug which feeds into difficulties about banking, supply chains, patient access, inconsistent GP/MD training and prescription practices – not to mention political factors including the electoral cycle and relative strengths of national cannabis lobbies against adversarial opponents.

Though the establishment of a medical program has proven utility as the basis for national legalisation, a lack of any harmonised regulatory framework has long been noted. Among European Union (EU) member nations, national legislation has always trumped either an EU or European Medicines Agency framework, resulting in a patchwork of laws across the continent rather than EU-wide parity. Take-up times, too, have been markedly different. Ireland did not pass legislation until 2019, while the Netherlands had in 2003. The EU Good Manufacturing Practice (GMP) certification gives some structure to the industry, but even that has stirred some confusion with different national interpretations and some overlap between the EU’s GMP and Good Agricultural and Collection Practice (GACP) protocols. There is a lack of consistency about which qualifying conditions that medical cannabis is expected to treat across different health services, with but one pan-European approval by the European Medicines Agency for GW Pharma’s Epidiolex for two forms of epilepsy: Dravet syndrome and Lennox-Gastaut syndrome. The Novel Foods regulation also continues to confound CBD producers and retailers from country to country.

The question as Germany moves in fits and spurts toward adult-use legalisation is about what is to come of the rest of Europe – and will greater continental convergence result?

“Switzerland is in an interesting position,” says Frankfurt-based cannabis consultant Margeurite Arnold. “It’s outside the EU, and is likely to influence Germany. My guess is that the German model won’t look like Holland, but is probably going to look more like Switzerland, with pharmacies being a first test market.”

The mountainous country announced in October that it would legalize cannabis through a three-year pilot project starting this year in Zurich, as industry eyes intently watch its progress.

Despite having the highest per-capita level of users Europe, France has never openly embraced it. That may be changing, however, as there are signs of a societal thaw ahead of its presidential election this spring. France’s Constitutional Council recently ruled CBD as neither addictive nor harmful, overturning previous rulings and bringing it more in line with the rest of Europe. Moreover, French lawmakers discussed a cannabis legalisation bill proposed by the left-wing France Unbowed Party (LFI) and the Green Party hitting back at a rule banning the sale of CBD flower.

Portugal is also worth watching: By offering lower costs than in northern Europe, it has become a key foothold for U.S. and Canadian medical cannabis companies (e.g., Tilray, Curaleaf, Casa Verde Capital, and Aurora) to position themselves across the pond. As if to demonstrate the lack of coherence in Europe, however, it still has not regulated its cannabis market, and there are draft bills pending for personal possession, consumption, and cultivation.

Luxembourg was set to legalize adult-use cannabis last October, but has not yet moved to do so; it is expected to become law this year, and could join Malta as small outliers prompting more widespread agendas across the continent.

An Italian referendum to decriminalize cannabis cultivation and decriminalise possession also seem likely this year, as Prime Minister Mario Draghi has said that the government would not hinder the public’s choice. Spain has already decriminalized cannabis, though it failed to approve a bill to legalize it for recreational use. Should it push forward to do so, it could conceivably join Italy and Germany to form a troika of European cannabis titans and help shape regulatory harmonisation.

There are also rumbling among other, less high-profile states. In January, the Polish Parliament heard three draft laws leaning toward cannabis reform laws, one of which went forward to enable research by the Minister of Agriculture to cultivate hemp with more than 0.3% THC for the medical cannabis industry. Though no action is expected from it, the discussions have been well received in a country where doctors as of last September had issued 28,076 prescriptions to 9,261 patients through one of Europe’s largest medical cannabis markets.

Cannabis advocates often look at legalisation as a three-part process extending from decriminalization to medical legalization before full adult-use legalisation. Thus, optimism exists heading toward June’s Cannabis Europa London conference in the U.K. to encourage rapid adoption of new regulatory frameworks across Europe.