Confusion and Unsubstantiated Claims Are Still Surrounding CBD Sales

By William Sumner, Hemp Business Journal Contributor

When the 2018 Farm Bill was signed into law last year, the Hemp Business Journal (HBJ) had predicted that mass-market retailers would quickly see clear to begin carrying topical products containing hemp-based CBD.

In March, the pharmacy retail chain CVS announced it would start carrying CBD products in over 800 stores throughout 10 U.S. states. In an interview with CNBC’s Jim Cramer, CVS CEO Larry Merlo said the decision to stock CBD products was prompted by increased customer demand, and that the company would wade slowly into the market.

Not to be outdone, rival Walgreens announced last month that it would start selling CBD products in over 1,500 stores among nine U.S. states. For the moment (pending more FDA guidance), both companies are avoiding selling CBD-based supplements and food additives, opting instead for topical products such as creams, ointments, and sprays.

The decision to sell topical CBD products instead of supplements has less to do with market demand and more to do with an unclear regulatory path for products containing CBD. For now, the U.S. Food and Drug Administration (FDA) is revising its policies about CBD, and grappling with how to regulate it while protecting consumers from retailers’ selling unsubstantiated ingestible products claiming CBD benefits.

Though CVS and Walgreens try to skirt the FDA by selling products containing “full spectrum hemp oil,” which some retailers use as coded language for CBD oil, both companies have decided it better to wade into the market more conservatively, limiting themselves to selling only topical products.

Such approaches seem prudent given the lack of clarity about where the FDA will come down for enforcement. Speaking before a House Appropriations subcommittee, outgoing FDA commissioner Scott Gottlieb said that while the FDA believes CBD to offer therapeutic value, there is no straightforward process for regulating the substance.

To better understand the issue, the FDA recently announced the creation of a “high-level internal agency working group” to recommend policy. A public hearing on CBD has been scheduled for May 31. In addition to taking written public comments, the FDA has asked hemp industry stakeholders to share their experiences, challenges, and any information about the safety of CBD products.

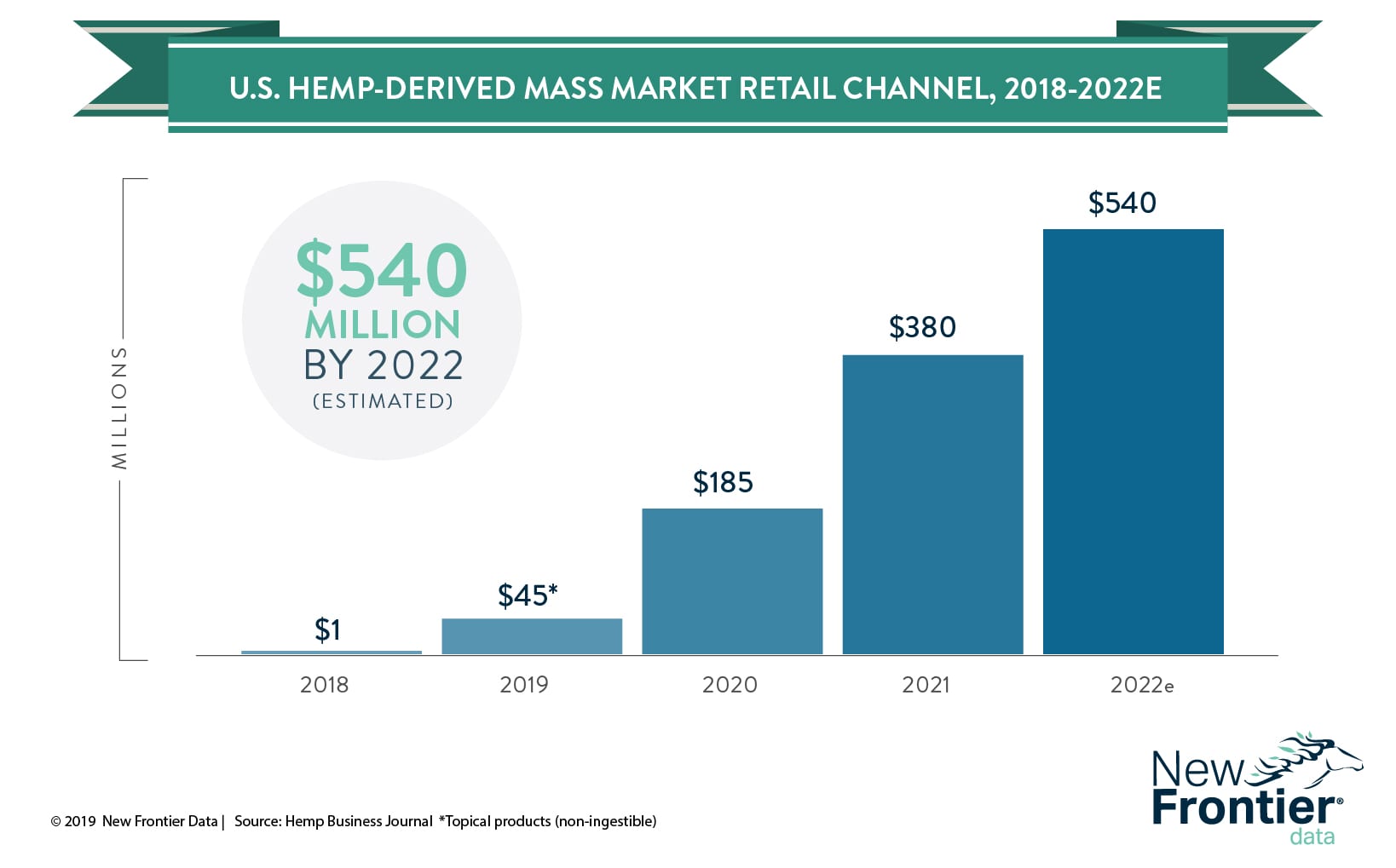

So where does this leave the hemp-based CBD market? Much depends on the FDA’s guidance. Consumers and retailers alike may be heavily interested in exploring the market, but until the FDA issues clear and unambiguous guidance on the legality of CBD supplements and additives, the market will continue to develop without explosive mass market growth. HBJ is tracking mass market sales to understand, analyze, and improve total CBD market forecasts. As regulations from the FDA clear up, and hemp-derived CBD products are treated as dietary supplements (non-isolate-containing products), HBJ expects other mass-market retailers to enter the market, including Sprouts, Natural Grocers, Walmart, Target and Whole Foods/Amazon. The hemp-derived CBD mass-market channel is estimated to grow from humble beginnings this year, to $540 million in sales by 2022.

William Sumner

William Sumner is a writer for the hemp and cannabis industry. Hailing from Panama City, Florida, William covers various topics such as hemp legislation, investment, and business. William’s writing has appeared in publications such as Green Market Report, Civilized, and MJINews. You can follow William on Twitter: @W_Sumner.