Dispatch from the NoCo Hemp Expo: The Capital Conundrum

By Eric Singular, Director, Hemp Business Journal

Last week, stakeholders from the global hemp industry convened at the Gaylord Rockies Resort & Convention Center in Aurora, CO, for the 8th annual NoCo Hemp Expo. A resounding theme expressed during many of the event’s programs was the pressing challenge to secure hemp acreage with American farmers. The dearth of dedicated cultivators is due to record high prices for staple agricultural commodities (namely corn and soybeans, the latter reaching $17.10 per bushel last week), as each war, drought, and demand factor into increasing disruptions in the global food supply.

For fiber and grain processors, high agricultural commodity prices spell danger. To secure acreage that would otherwise be used for corn or soybeans, processors must be willing to offer premium forward contract prices for hemp grain and fiber, particularly in lieu of federal crop insurance protection for hemp acres. However, premium forward contracts are out of reach to any but a well-capitalized processor. Unfortunately, that is a rarity for most operators who, over the few years, have had to shell out large amounts of cash to purchase facilities and processing equipment. Most processors were penciling 2022 as their year to start generating revenue. What they had had not accounted for were massive rises in prices-per-bushel for each corn, wheat, and soybeans. (For more comprehensive and specific data and analysis, visit New Frontier Data’s online business intelligence portal Equio® to gain additional insights available within the U.S. Market Dashboard.)

Subsequently, their ability to provide cash up front to cover seed costs and grower contracts presents a conundrum: Where does a high-risk industry turn when it is in need of capital? Judging from NoCo attendees, there seems to be three primary avenues being explored.

Venture Capital

Gaining investors is straightforward enough. Earlier this year, rePlant Hemp Advisors LLC was launched by Geoff Whaling (also chairman of the board for the National Hemp Association) and opened the rePlant Hemp Impact Fund 1 for investments reportedly focusing on “bio-based innovation, a carbon-negative domestic supply chain, good green jobs, sustainable consumer products, and the verifiable sequestration of CO2”. By 2030, rePlant Hemp Advisors aim to infuse $500 million into the hemp space, the fund’s first close is set at $75 million as managed by Entoro Investments LLC, and subadvisors Clearbrook LLC, and Merida Capital Holdings LLC (full disclosure: Merida Capital Holdings is an advisor and investor for New Frontier Data).

That was welcome news to a host of U.S. hemp fiber processors and manufacturers who will undoubtedly make pitches to rePlant for engagement, though it would not mark Whaling’s first attempt to flood the domestic hemp industry with capital.

In March 2020, Whaling teamed with Bruce Linton and Tim Saunders to launch Collective Growth Corp., a special purpose acquisition firm (SPAC) seeking a targeted capital raise of $150 million-$175 million to purchase or invest in U.S. hemp companies active in the cannabinoid and fiber product markets. Nine months later, the SPAC had pivoted from hemp toward sensors and perception software for autonomous-driving vehicles. After evaluating non-cannabinoid hemp companies in North America, it became clear that none had the revenues and valuation to meet SPAC requirements.

USDA Partnerships for Climate-Smart Commodities

Another means is grant money. In February, the U.S. Department of Agriculture (USDA) announced the Partnerships for Climate-Smart Commodities program. USDA will provide for up to $1 billion in funding to support “climate-smart” agricultural markets and invest in American farmers, ranchers, and forest owners in rural and agricultural communities. USDA defines a climate-smart commodity as one produced using agricultural (i.e., farming, ranching, or forestry) practices which effectively reduce greenhouse gas emissions or sequester carbon.

In the Notice of Funding Opportunity announcement, USDA stipulated that proposals support production and marketing of such commodities through pilot projects that provide voluntary incentives for partnering producers and landowners (including early adopters) to:

a. implement climate-smart production practices, activities, and systems on working lands;

b. measure/quantify, monitor, and verify carbon and greenhouse gas (GHG) benefits associated with those practices; and

c. develop markets and promote the resulting climate-smart commodities.

One proposal can request up to $100 million over five years, with organizations submitting their own proposals encouraged to coordinate with other grant seekers to partner up per one other’s proposals. Proposals include meaningful involvement from small or historically underserved producers, consistent with preference to adhere to the Biden administration’s Justice40 Initiative.

Through numerous conversations with industry operators (particularly hemp-fiber processors) attending the NoCo Hemp Expo, it is evident that dozens of proposals will be submitted to USDA regarding sustainable applications for hemp. In particular, those companies pursuing funding opportunities will tout the crop’s ability to sequester CO2 both in soil through its cultivation using regenerative agriculture techniques, and in products by incorporating hemp fiber and hurd as raw materials.

A formidable case can be made for hemp as a climate-smart commodity. However, as a practical consideration the USDA has nevertheless rejected any animal feed studies from Europe and Australia that demonstrate safety and efficacy in hemp seed-derived ingredients for livestock. Given that the only peer-reviewed research on hemp’s ability to sequester carbon is from Europe and Australia, one may conclude that the USDA will push back against hemp proposals by arguing that U.S. universities have not verified the international research as they have with animal feed. Either way, the USDA is required to provide its grounds for why a proposal has been rejected.

The 2023 Farm Bill

Hemp industry operators with the longest institutional outlooks are setting their sights on the pending 2023 Farm Bill now being drafted. With the current legislation set to expire on Sept. 30, 2023, policymakers are already engaged in crafting the next federal omnibus bill to direct the nation’s primary agriculture and food policy legislation.

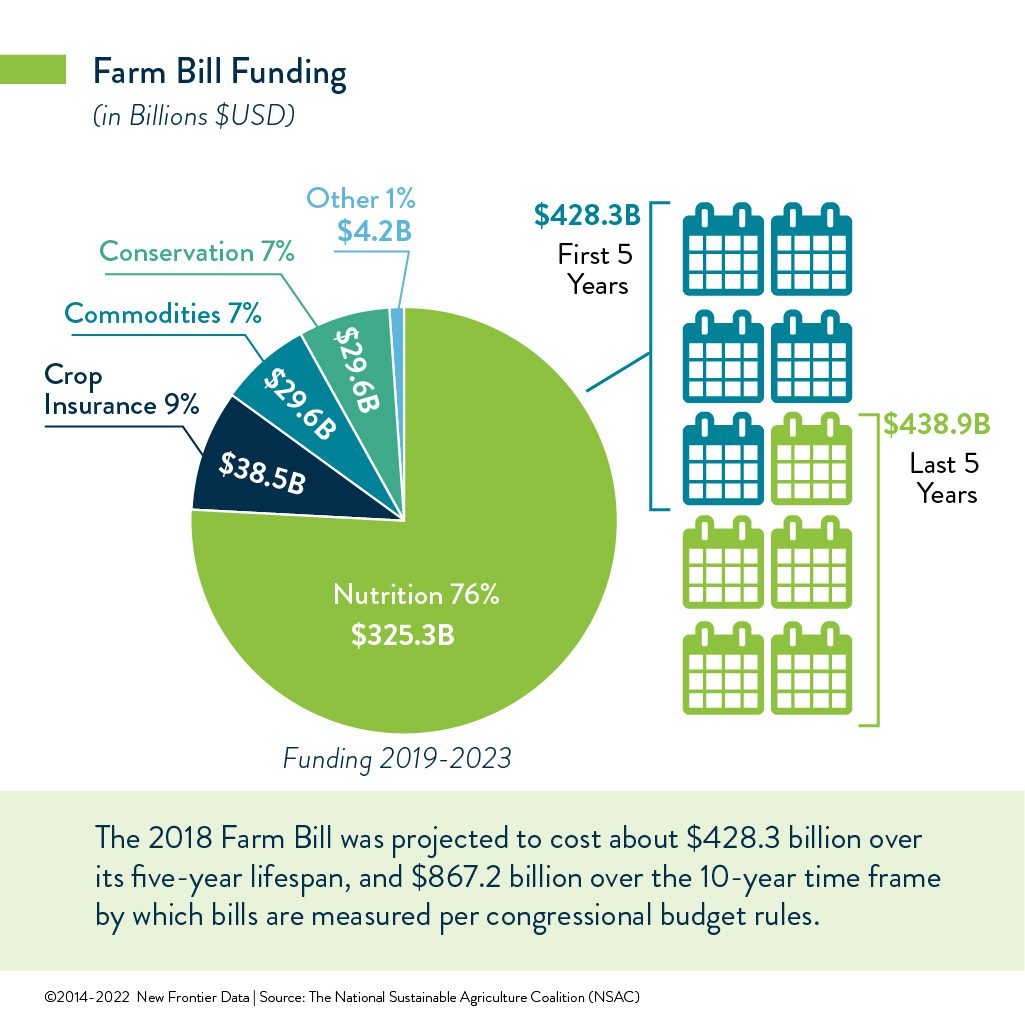

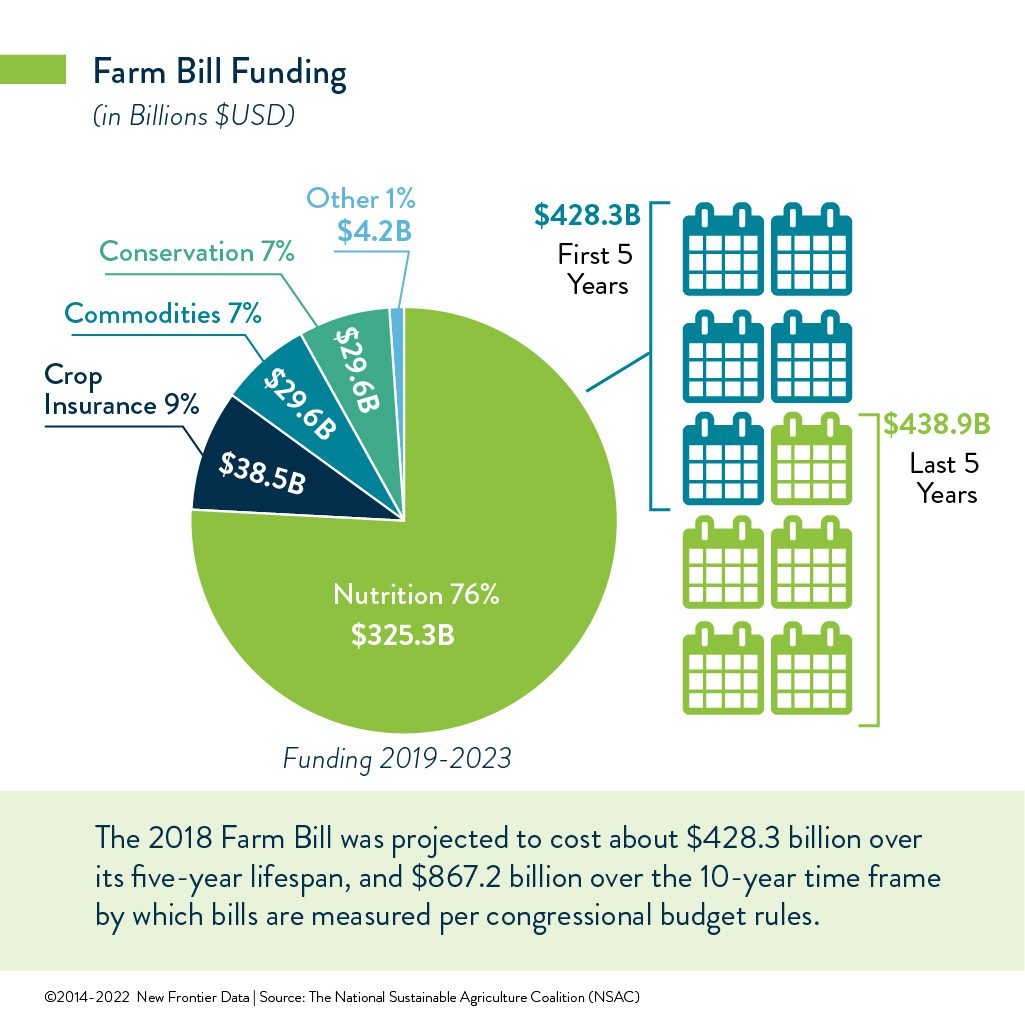

Unlike many authorization bills, the Farm Bill itself provides direct funding for many of its authorized programs, including those shepherding food assistance and natural resources. The currently active legislation, signed by President Trump in December 2018, authorized spending $428.3 billion over its five-year lifespan, and $867.2 billion over the 10-year period by which all bills are measured per congressional budget rules.

The National Association of State Departments of Agriculture (NASDA) plays a key role for shaping policy in the Farm Bill. Currently, NASDA’s hemp-focused recommendations concern amending the federal definition of hemp to increase the total THC concentration allowance from 0.3% to 1.0%, and expanding eligibility for the Specialty Crop Block Grant Program funding to hemp crops with horticultural uses through the dual designation of hemp as a specialty crop based on its intended growth and purpose.

NASDA is also advocating for increased investments in climate initiatives, which could provide ancillary funding to the domestic hemp industry similar to the Climate-Smart Commodities grant opportunity. It would include research and incentive programs for voluntary on-farm practices capable of reducing greenhouse gas emissions and increasing carbon sequestration.

Another initiative gaining attention at the expo was the Grain and Fiber Industrial Hemp- Exemption Framework. Its purpose is to remove the burden of THC testing for hemp farmers growing it for fiber or grain. Already, legislation is being drafted for inclusion to the upcoming Farm Bill. The next step is securing bipartisan support.

Besides regulatory policy, there are also creative ways to spur more end-uses for hemp as a food ingredient through the Farm Bill. The biggest funding allocation is nutrition assistance in the form of the Supplemental Nutrition Assistance Program (SNAP). It is conceivable that given hemp’s robust nutritional profile, it could find a foothold in the SNAP program (as well as in school lunches, since many kids are eligible for free meals if their household participates in SNAP).

Markets Matter

Ultimately, without markets, capital can only float the industry for so long. Long-term growth will be wholly dependent on wider adoption of hemp as a plant-based food ingredient and renewable material. U.S. retail sales of plant-based foods grew 6.2% in 2021, bringing the total market value to an all-time high of $7.4 billion.

On paper, hemp should command a decent chunk of the booming market, but at present it represents a minuscule fraction. While it is encouraging that PepsiCo’s latest drink from Rockstar Energy is infused with hemp seed oil, without a flurry of supply-chain contracts from Big Food for domestic hemp grain ingredients, the U.S. hemp market will remain a limited niche. For lenders and investors, hemp is very much still a high-risk sector.

Capital will flow in parallel with the opening of markets. Otherwise, the industry risks another black eye with the investment community, which must be keenly avoided.